It’s been an interesting start to trading on Wednesday but attention will now shift to the U.S. where we await the latest interest rate decision and statement from the Federal Reserve, as well as more earnings reports from more than 10% of S&P 500 companies.

Barring any major shocks, which we’ve already had more than our fair share of so far this year, the Fed is widely expected to leave interest rates unchanged again this month, all but ending any hope of the two rate hikes in 2016 that it has previously alluded to. While Brexit may not impact the U.S. in the same way that is will the U.K. and eurozone, the Fed will likely want evidence of this before pursuing higher rates and being forced to backtrack in the event of an adverse effect on the economy.

Central Banks to Dictate Next Market Move

The economic data from the U.S. has performed quite well as of late, with the latest jobs report in particular bouncing back strongly from a weak showing in May. Had the U.K. not voted to leave the E.U. last month, the Fed may well have been very tempted to raise rates this month and markets would more than likely have priced it in a lot more, making the job of the central bank much easier. As it is, given the potential risks associated with Brexit and a market that is not prepared for such a move, I see very little chance that the Fed will opt to act this month.

This means the statement is probably much more important than the decision itself, with investors wanting insight into the latest consensus view within the Fed and whether further rate hikes this year are likely. I think that the Fed will likely stand by its desire to raise rates again this year, while highlighting the increased risk environment due to Brexit, which would probably suggest that it has again fallen back in line with the market and point to one hike in December.

EUR/USD – Euro in Holding Pattern as Fed Statement Looms

The problem we have with just getting the statement on its own is that the smallest changes in the wording can prompt some quite significant moves in the markets. With investors still reluctant to accept a hike this year, there is a good chance that any sign of dovishness from the Fed will once again convince the market that there will be no hikes again this year, with the implied probability of a hike in December having only just climbed back above 50% since the Brexit vote.

Source – CME Group FedWatch Tool

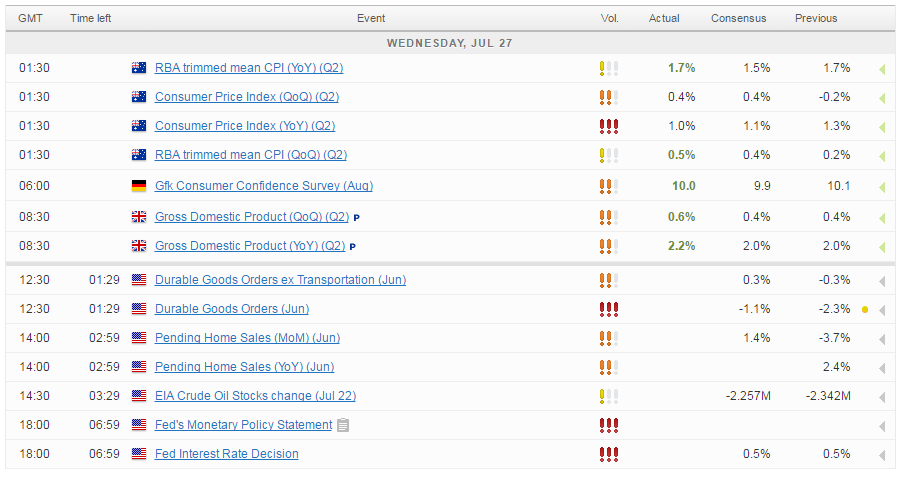

For a look at all of today’s economic events, check out our economic calendar.