By the SRSrocco Report,

According to the figures in the 2016 World Silver Survey, Americans now lead the world in physical silver investment. This is quite an interesting change as India has been the number one market for silver bar demand in the past.

For example, Indians purchased more than 100 million oz (Moz) of silver bar in 2008 of the approximate world total of 125 Moz. However, silver bar demand is only one segment of total global physical silver investment. There is also Official Coin demand.

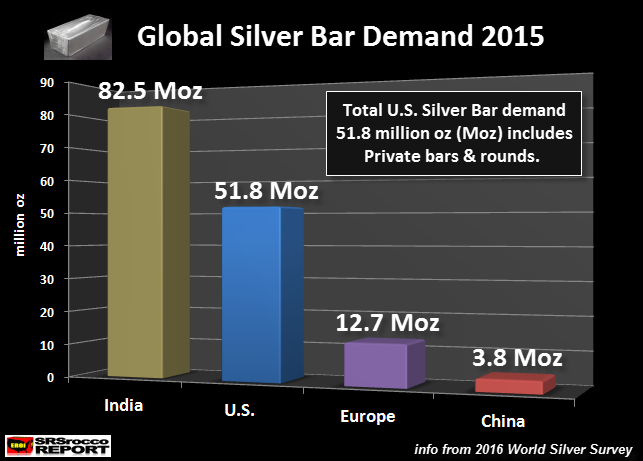

If we look at the data for 2015, India continues to rank as the largest source of silver bar investment int he world:

India purchased 82.5 Moz of silver bar in 2015 while the U.S. ranked second with 51.8 Moz, Europe came in third with 12.7 Moz and China placed last at 3.8 Moz. (2016 World Silver Survey, pg. 22 & 23).

The United States experienced a huge increase in silver bar demand in 2015 due to the inclusion of “Private rounds and bars” now in the data. So, all private silver bar and rounds sold are lumped into the Silver Bar category.

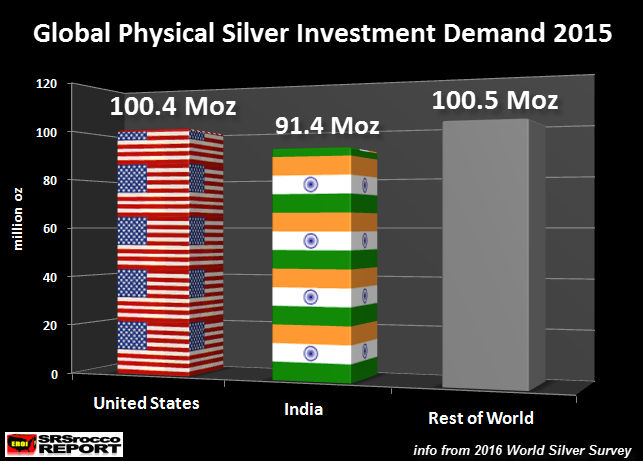

Even though India ranked first place when it comes to silver bar demand, if we include Official Coin sales, the U.S. is now the global leader of physical silver investment:

In 2015, the U.S. Mint sold 48.6 Moz of Official Silver coins while India ranked fifth at 8.9 Moz. If we add silver bar demand to these figures, the U.S. was the leader at 100.4 Moz while India came in second at 91.4 Moz. (2016 World Silver Survey, pg. 25). The rest of the world accounted for the remaining 100.5 Moz of the total 292.3 Moz of Silver Bar & Coin demand.

I could not break down Silver Bar & Coin demand in the ‘Rest of World” category because there isn’t enough data. The World Silver Survey’s do a much better job than the CPM Group’s Silver Yearbook in reporting silver investment figures. However, they only publish the amount of Silver Coins sold by each of the Official mints, not the actual demand.

There is no way of knowing how many U.S. Silver Eagles end up in foreign hands, or how many Canadian Maples or Australian Kangaroos are purchased by Americans. The data is not that accurate. However, I do believe Indians purchased the overwhelming majority of their own Official Silver coins.

Furthermore, the Silver Bar & Coin demand of 100.4 Moz for the United States may be quite conservative. Why? Because, Americans buy a heck of a lot more foreign Official Silver Coins to more than make up for the amount of U.S. Silver Eagles exported abroad. We must remember, Americans don’t have to pay a vat tax when they buy silver.

What is also interesting about the data is that China ranked fourth behind Europe in silver bar demand. Even if we assume that the Chinese purchased all of their Official Silver coin sales of 10.7 Moz in 2015, their total Silver Bar & Coin demand would only be 14.5 Moz. While the Chinese are the biggest buyers of gold in the world, silver still hasn’t caught on as it has in the U.S. or India.

Lastly, according to the data from the 2016 World Silver Survey, Indians purchase their silver bar as a short-term investment vehicle by taking advantage of lower prices or to profit from any differences in the spot or futures market. However, the majority of Americans purchase their silver for a long term BUY & HOLD strategy.

Which means as the Chinese consume most of the gold in the world, Americans are now the biggest silver investors.

Please check out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page.

Check back for new articles and updates at the SRSrocco Report.

The post Americans Are Now The Top Silver Investors In The World appeared first on crude-oil.top.