Markets pare tariff-related losses

European equity markets are paring tariff-related losses at the end of the week, with indices around half a percent higher, while US futures look pretty flat ahead of the open on Wall Street and the closely watched jobs report.

Trade wars have once again proven a distraction for investors this week, one that started with a suggestion that the US and China were ready to engage in discussions but quickly turned sour again, as it was reported that the Trump administration is now proposing a 25% tariff on $200 billion of imports, up from 10%. This apparent escalation, intended to put further pressure on the world’s second largest economy, has instead only added fuel to the fire prompting China to respond with threats of retaliatory measures. Naturally, investors have become more risk averse in response.

The PBoC giveth the PBoC taketh

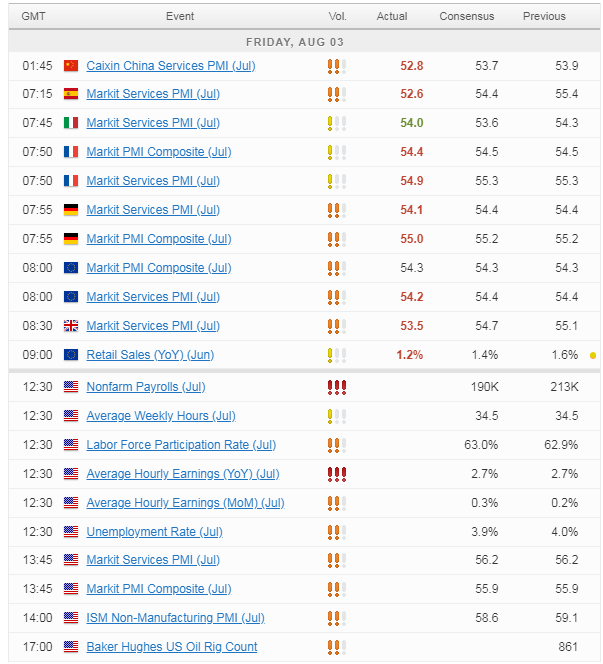

Another strong month of US job gains expected

Attention now turns to the US jobs report which is widely regarded as the most important economic release each month. The US has continued to create jobs at an extremely impressive rate despite unemployment being around the lowest it’s been in decades. While this, along with only modest wage growth, has triggered questions about just how much slack there really is in the economy – with a tight labour market typically being associated with higher wages – it is still impressive none-the-less and another strong month of employment gains is expected for July.

Around 190,000 jobs are believed to have been created last month, although after the ADP release on Wednesday – which does have a tendency to be a little off – even this may prove to be a little on the low side. As ever, investors will be more focused on wages because only once these start to grow will people consider the market to be tight, which could make the Federal Reserve a little nervous as it continues to raise interest rates at a steady pace.

Sterling steady after weaker PMI reading

The UK services sector experienced a somewhat mixed month in July with the index that represents more than three quarters of the economy slipping to 53.5 from 55.1 in June. The unusually warm weather and world cup fever that some thought would boost the sector – and in the case of bars and restaurants it did – was actually a hindrance for others and reduced footfall creating even more challenges for the high street.

There was also evidence of hiring difficulties, both due to a lack of skilled workers – something Bank of England policy makers clearly strongly considered when deciding to raise rates yesterday – and companies being reluctant to invest due to Brexit uncertainty. This has all created a rather uncertain and challenging environment for the sector and therefore the economy that is weighing on output and is likely to continue in the months ahead.

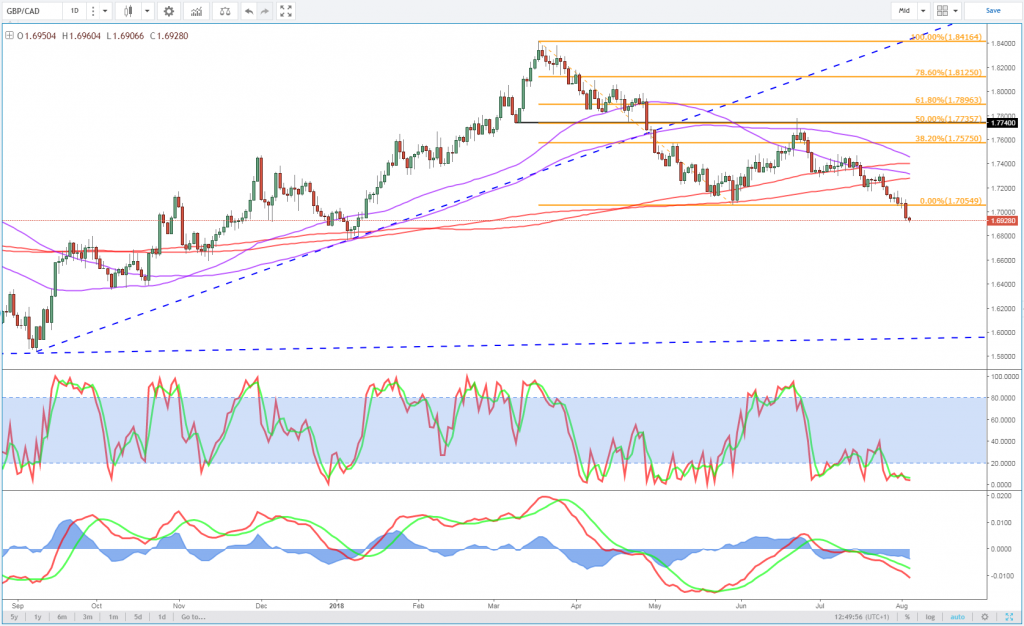

The pound broadly shrugged off the weaker number though, with it having already fallen heavily yesterday following the dovish hike from the central bank. Once again, it dropped below 1.30 against the dollar but appears to be finding some support around those levels. It has been less resilient against other currencies, such as the Canadian dollar, where it dipped below 1.70 for the first time since the start of the year.

GBPCAD Daily Chart

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.