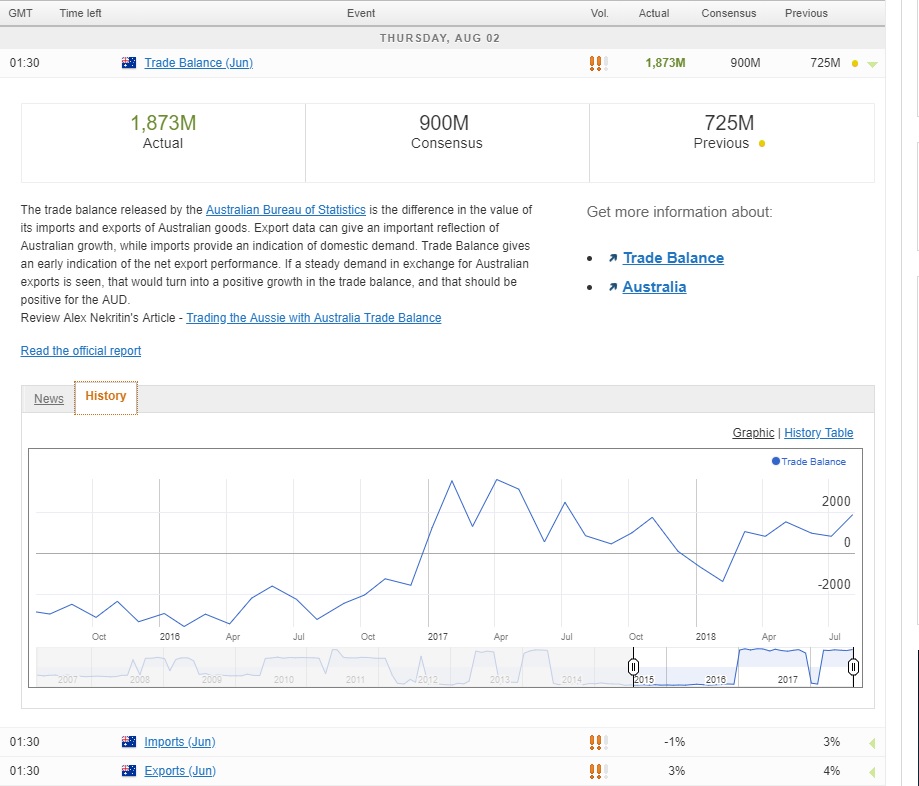

Reduced imports the major factor

Today’s release of Australia’s trade data for June saw the trade surplus widening dramatically to A$1.87 billion from a revised A$725 million the previous month. That is the largest surplus in more than a year. A hefty decrease in imports was the reason for the jump, while exports growth slowed from 4% in May to 3%. The implication that slower imports could be a harbinger of slower economic activity going forward weighed on the Aussie dollar after the release. The initial knee jerk reaction to the headline was for a higher Aussie, rising as high as 0.7411, but once it became clear that the import side of the equation was the major influence, the pair reversed track and is now down 0.16% on the day at 0.7392.

Australia Trade Balance

First Bank of England rate hike in nine months?

The Bank of Japan, Reserve Bank of India and Federal Reserve meetings are now all history and it is the time of the Bank of England to be in the spotlight in what could be one of the more interesting meetings. The majority of economists expect the Bank to deliver a 25 bps hike taking the benchmark rate to 0.75%, which would be the highest since March 2009. The Bank had signaled it was inclined to hike rates in May but that idea was abandoned as data took a turn for the worse. Since then, the data per se has not been particularly impressive and inflation still appears to be on a downward trajectory. Hence there is still an outside chance that the Bank could do nothing, with would be detrimental for sterling.

BoE Super Thursday to live up to its name

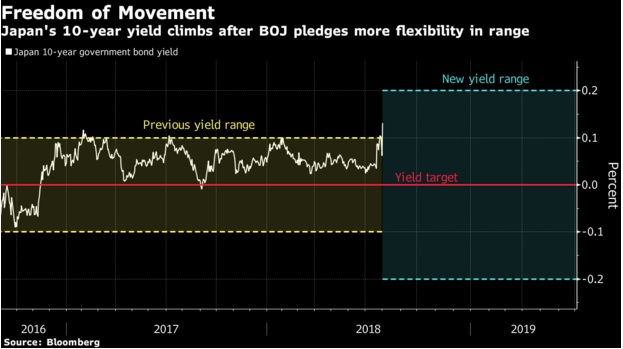

Japan yields advance

After the Bank of Japan announced on Tuesday it was widening the target band for 10-year yields, sure enough the yield has climbed to its highest level since February 2017. In a speech earlier today, BOJ Deputy Governor Amamiya commented that the Bank would buy JGBs “promptly” if yields rise rapidly though does not expect yields to ratchet up. He reiterated that it is appropriate to maintain powerful monetary easing and would not loosen the grip on easing just because reaching the inflation target is delayed. However, he admitted that prices have continued to show relative weakness recently.

10-Year JGB Yield

ISM Employment Index rises

In the run up to tomorrow’s key release of US nonfarm payrolls for July, the employment component of the ISM purchasing managers index rose to 56.5 from 56.0 with 13 out of the 18 manufacturing industries surveyed reporting employment growth. This could imply the tomorrow’s number could be on the buoyant side, with the latest survey suggesting payrolls dipped to 195,000 from 213,000 in June. The unemployment rate is also expected to ease back to 3.9% after last month’s surprise jump to 4.0%. Growth in average hourly earnings is seen accelerating to +0.3% m/m from +0.2%.

You can access the full MarketPulse data calendar here: https://www.marketpulse.com/economic-events/