Submitted by Lance Roberts via RealInvestmentAdvice.com,

Negative Revisions Coming

Despite mainstream economists hopes that somehow “this time will be different,” the ongoing massaging of economic data through seasonal adjustments to obtain better headlines did not translate into actual prosperity. Of course, “reality” is a cruel mistress and despite ongoing hopes and overstatements, “fantasy” eventually gives way.

The chart below shows the S&P 500 index with recessions and when the National Bureau of Economic Research dated the start of the recession.

There are three lessons that should be learned from this:

- The economic “number” reported today will not be the same when it is revised in the future.

- The trend and deviation of the data are far more important than the number itself.

- “Record” highs and lows are records for a reason as they denote historical turning points in the data.

The last two-quarters of economic growth have been less than exciting, to say the least. However, these rather dismal quarters of growth come at a time when oil prices and gasoline prices have plummeted AND amidst one of the warmest winters in 65-plus years.

Why is that important? Because falling oil and gas prices and warm weather are effective “tax credits” to consumers as they spend less on gasoline, heating oil and electricity. Combined, these “savings” account for more than $200 billion in additional spending power for the consumer. So, personal consumption expenditures should be rising, right?

What’s going on here? The chart below shows the relationship between real, inflation-adjusted, PCE, GDP, Wages and Employment. The correlation is no accident.

Economic cycles are only sustainable for as long as excesses are being built. The natural law of reversions, while they can be suspended by artificial interventions, can not be repealed.

More importantly, while there is currently “no sign of recession,” what is going on with the main driver of economic growth – the consumer?

The chart below shows the real problem. Since the financial crisis, the average American has not seen much of a recovery. Wages have remained stagnant, real employment has been subdued and the actual cost of living (when accounting for insurance, college, and taxes) has risen rather sharply. The net effect has been a struggle to maintain the current standard of living which can be seen by the surge in credit as a percentage of the economy.

To put this into perspective, we can look back throughout history and see that substantial increases in consumer debt to GDP have occurred coincident with recessionary drags in the economy.

“No sign of recession? Are you sure about that?”

Furthermore, the recent decline in rates likely suggests a much weaker economic environment than is currently expected. The last time that rates were this low, and potentially heading lower, was during the economic slowdown in 2012 which bordered on a recession. The difference is that in 2012 the Federal Reserve was in extreme accommodation mode, profits were growing and multiples were expanding. That is not the case today.

In July, the BEA will negatively revise the economic data going back over the last eleven years.

“During 2012 and 2013, when the U.S. economy had what some have referred to as a micro-recession, the overstatement of real GDP growth ballooned to about $275 billion. Despite over $100 billion in revisions to real GDP growth in 2014 and 2015, the overstatement continued to grow to $324 billion, or 2 percent of GDP.”

Importantly, these aren’t the only forthcoming revisions. The extremely warm winter weather is currently wrecking havoc with the seasonal adjustments being applied to the economic data. This makes every report from employment, retail sales, and manufacturing appear more robust than they would be otherwise. However, as the seasonal trends turn more normal we are likely going to see further negative adjustments in future revisions.

Here is my point. While my call of a forthcoming “recession” may seem far-fetched based on today’s economic data points, it should be remembered that no one was calling for a recession in early 2000 or 2007 either.

The takeaway of all this is the risk to equities may be higher than currently expected. If rates, economic data trends, and valuation reversions are sending the correct message, the forthcoming negative revisions to the underlying data will derail the current bullish thesis of a profits recovery in the making.

Share Buybacks & Balance Sheet Rot

Chris Martenson via Peak Prosperity wrote early this year:

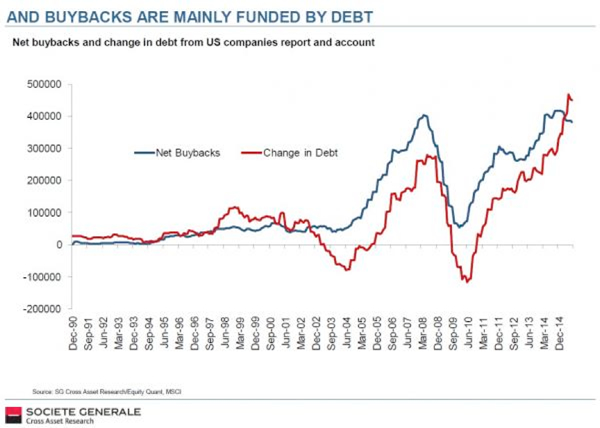

“Corporate debt is a hot topic this year. Before the 2008–09 calamity, U.S. non-financial corporate debt teetered at $2.6 trillion dollars. It is now $5.8 trillion. The reported $2 trillion of corporate “cash on the balance sheet” constitutes only 30–35% of the corporate debt. So much for that meme. The high-yield debt placed in peril by the collapse of commodities is putting serious pressure on the high-yield (junk) bond indices. GM and Chrysler are way out on the subprime yield curve; a recession would be poorly timed, which is precisely why it will arrive soon. Auto loans are pushed out 67 months. Liquidity in the market is faltering—a sell-off could get ugly.”

“So what’s all this debt being used to fund? Share buybacks, of course. More is spent on share buybacks than on capital expenditures (Capex). Companies are making corn dogs from their seed corn. The record buying spree is twice that of the early months of 2014.

Citi analysts noted that ‘if leverage is going up today because it’s funding tomorrow’s growth that might not be a bad thing. Unfortunately, that’s not what’s going on.’ Companies reaching for returns on their cash have found another overpriced investment on which to squander their shareholders’ value—other companies’ bonds. The sellers of these corporate bonds are reputed to be using the proceeds to . . . wait for it . . . buy back shares of their companies! This is financial engineering that would make Escher proud.”

Why is this important? Because it is the ongoing rot of corporate balance sheets and obfuscation of earnings that are a potential trap for investors. Yesterday, the problem got even worse following the release of the “stress tests” which immediately led to a stock buyback, dividend boosting, frenzy in a sector already plagued by low net interest margins – the banks.

- JPMorgan: $10.6 billion

- Citi: $8.6 billion

- Bank of America: $5 billion

- Goldman Sachs: Will buy back stock, but did not release the amount.

- State Street: $1.4 billion

- Ally Financial: $700 million

- American Express: $3.3 billion

- BB&T: $640 million

- Capital One: $2.5 billion

- Discover Financial: $1.95 billion

- PNC Bank: $2.0 billion

- SunTrust: $960 million

- Northern Trust: $275 million

- Regions Financial: $640 million

- KeyBank: $350 million

Just as a reminder, In 2007, S&P 500 firms allocated more than one-third of their cash to buybacks just before the S&P 500 plunged by 56%.

According to FactSet:

“Companies in the S&P 500 spent $166.3 billion on share buybacks during the first quarter, which marked a new post-recession high. Since 2005, only Q3 2007 produced a larger amount of buybacks ($178.5 billion). Dollar-value buybacks in Q1 represented a 15.1% increase in spending from the year-ago quarter, and a 15.6% jump from Q4. This breakout in the first quarter of the year comes amid somewhat of a stabilization period for buybacks since the middle of 2014. With that said, buyback spending still remained at very high levels for the index during this period.”

There are many layers to this magical onion. If Eugene Fama was correct, an efficient market would reduce the P/E ratios to account for the rot contained in the balance sheet. Leveraged share buybacks are a zero-sum game (like stock splits).

As Chris concluded:

“With almost a third of the ‘buying pressure’ in the S&P coming from share buybacks, however, markets are not very efficient. Let’s take this notion to the limit. Imagine you borrow enough to buy up almost all the shares. The last share represents ownership in a company whose assets are entirely offset by debt. The P/E ratio of that share will head to zero in the limit. So who owns the company? The creditors! Yes indeedy, leveraged share buybacks constitute a sale of the company to creditors. It’s an LBO. Long before the LBO is complete, however, corporate debts that soared with century-low interest rates will lead to an 80-car pileup. Shale companies are being forced to re-issue shares—the reverse of a share buyback—at fire sale prices to cover their debt payments. A bond crisis will force an analogous deleveraging across the broader equity markets. The flawed TINA—There Is No Alternative—equity model will morph into TINWA—There Is No Worse Alternative. But until then, you just keep buying shares because insiders are buying, and they know what’s best.“

BRE-LIEF Rally

Just a quick update to Tuesday’s discussion on the market.

“We can benefit from the alignment of policies. What I mean by alignment is a shared diagnosis of the root causes of the challenges that affect us all; and a shared commitment to found our domestic policies on that diagnosis.” – Mario Draghi at the ECB Forum in Sintra, Portugal.

As I noted, the belief that Central Banks can “heal all ills,” quickly drove buyers back into the markets following the brief two-day rout on the heels of the “Brexit” vote. However, there are two things to note about the recent rally as notated in the chart below:

The first is that volume has declined during each day of the rally. While both days were 90% up days in terms of positive stock performance, the negative divergence in volume is concerning.

Secondly, the rally in the market is currently retesting the 50-day moving average which is currently acting as resistance. The market must reclaim the short-term moving average if another attempt at 2100 is going to be made.

The biggest concerns, however, remain at price momentum remains weak and with both price and volume oscillators currently on “sell signals,” the risk of a failed rally is currently high.

The rally on Tuesday and Wednesday was not unexpected. With the markets oversold on a short-term basis, end of the quarter portfolio “window dressing” at hand, and soothing comments from Central Banks, the rally off of critical support at 2000 was certainly viable.

The question now becomes sustainability. As we head into the depths of the summer months, all eyes should begin to focus once again on the month of August. The potential of a rather severe market rout in August and September from a technical perspective is extremely high. Despite the rhetoric, the best thing that investors can likely do this summer is to continue operating at reduced risk levels in portfolios.

Just some things to think about.

The post Bad Earnings, Balance Sheet Rot, & The “Brelief” Rally appeared first on crude-oil.top.