Investors encouraged by Trump/Juncker meeting

Equity markets are trading slightly in the red in what has been a slow start to an otherwise very busy week in financial markets.

Stock markets have been gradually rising in recent weeks, making their way back to the record high levels they achieved earlier in the year before the numerous trade conflicts involving the US heated up. The apparent progress made at the White House last week between Donald Trump and Jean-Claude Juncker has eased some concerns for now but the threats generally remain.

Earnings season has delivered a positive distraction for investors, with companies once again reporting stellar quarterly results aided by the obvious benefit of tax cuts. We’ll get results from another 144 S&P 500 companies this week as US corporates look to continue the positive momentum of earnings season so far and potentially propel the index to a new high.

DAX ticks lower, German CPI next

BoE seen raising rates while Fed and BoJ also meet

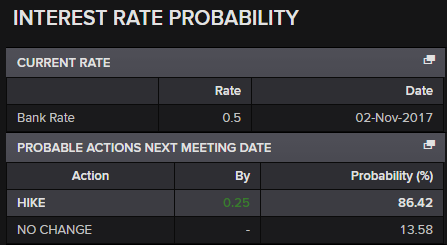

There’s also a number of central bank meetings this week, the most notable of the lot probably being the Bank of England with investors widely expecting a rate hike, taking the benchmark rate above 0.5% for the first time since early 2009. A rate hike is now 86% priced in which could trigger a lot of volatility if policy makers once again hold off, as they did back in May.

BoE Interest Rate Probability

Source – Thomson Reuters Eikon

The Federal Reserve and Bank of Japan will also hold meetings this week although these events may be less eventful, with neither seen adjusting policy this month. The Fed is also on a very clear tightening path and with the economy performing in line with expectations and the trade conflicts not yet biting, I don’t expect there to be any change in the central bank’s stance.

G7 FX moves look to central banks for direction

There has been speculation that the BoJ may look to slightly remove accommodation by increasing the yield it will allow the 10-year to reach, although I’m not sure that will come this week. Investors appear to be testing the BoJ’s resolve, with the yield having hit its highest level since February last year. Should the central bank reject the speculation, I would expect this to quickly reverse course.

This week also sees the release of the US jobs report which is widely regarded to be the most important economic report of the month and is typically a trigger for market volatility.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.