By EconMatters

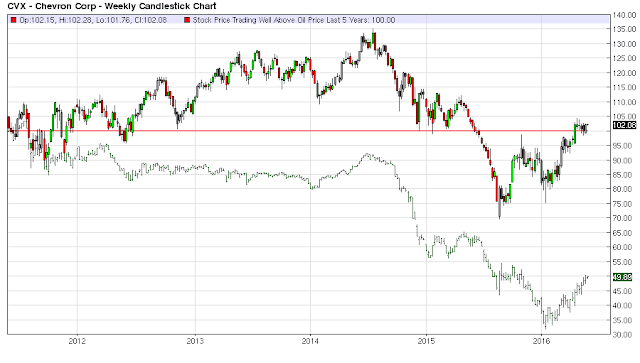

When reviewing the financial metrics of CVX, this stock is overpriced relative to the fundamentals of the company. CVX should Conservatively Retest $88 before year end. With over $42 Billion in Debt, a $50 oil price, and a 4% dividend this company is mismanaging capital right now trying to prop up the stock in the short term versus prudent fiscal management for the long term. This stock is a short on any pops into year end. Even with $60 oil this stock is overpriced as costs in the oil services sector are only going to go up from here! There are a lot of overpriced stocks right now, but CVX is one of the most offensive in our opinion.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The post Chevron is the Poster Child for an Overpriced Market (Video) appeared first on crude-oil.top.