Cocoa, The World’s Best Performing Commodity

$NIB, $CHOC

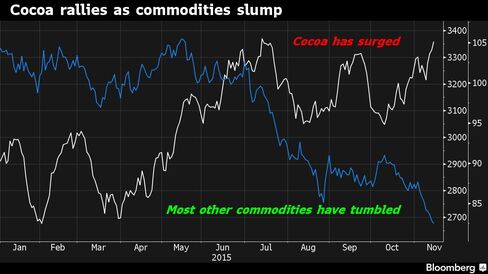

In a year that has so far spelled disaster for commodities from Crude Oil to Coffee, Cocoa stands out the best performer of all.

United Cacao Ltd. and KKO International SA are among those investing in plantations as production shortfalls boost prices. United Cacao, a Peruvian grower, is expanding in the country by planting 3,250 hectares (8,030 acres). KKO, which went public in Brussels last month, is working on farms spanning an initial 3,500 hectares in Ivory Coast, the world’s biggest supplier.

While the industry has historically been dominated by millions of small farmers in Africa, some companies are looking to industrialize Cocoa growing after prices soared almost 50% since Y 2012 and Asia’s rising middle class demands more Chocolate.

This year’s El Nino weather pattern is pushing prices even higher by threatening to reduce output from Ecuador to Indonesia, just as most raw materials like Crude Oil dive on surplus supply.

Cocoa is up 15% this year at $3,371 tonne in New York Tuesday reaching the highest in more than a year. Among the 24 raw materials tracked by the S&P GSCI index, nothing has done better than Cocoa this year.

Supplies will fall short of demand by 150,000 tonnes in the season started last month, according to Olam International Ltd., the world’s 3rd-biggest bean processor. The International Cocoa Organization estimates last season’s deficit at 15,000 tonnes.

United Cacao plans to produce about 10,000 tonnes in Peru annually at its peak in MY 2021-22, Mr. Melka said. KKO, which also trades in Paris (PA:ALKKO), is targeting 15,000 tonnes by 2022, the company said.

Large companies are still cautious about investing in the sector partly because Cocoa crops take a long time to develop and are prone to disease. About 40% of all the Cocoa produced annually is lost to pests and disease, according to the ICCO.

There are also the risks of doing business in countries like Sierra Leone, where Agriterra Ltd. had to reconsider its 3,200 hectares of Cocoa plantations after last year’s Ebola outbreak.

United Cacao is investing in plantations in Peru because the climate is good for growing Cocoa, there’s freehold land available and the country has stable taxes and fiscal policy, Mr. Melka said. He called Peru the lowest-cost producer. The company is also extending financing to local growers to plant Cocoa on another 3,250 hectares by Y 2020, and then it would purchase the beans.

Ivory Coast is an attractive bet for KKO because farmers are getting more for their crop under a government system that sets a price based on forward sales. The system, started in Y 2012, has seen prices increase annually. The nation sells as much as 80% of the crop before it is harvested.

Cocoa farms in West Africa, which account for about 70% of global supplies, have been threatened by higher returns in other crops such as Palm Oil and Rubber. In Asia, large corporate-style plantations, especially in Malaysia, disappeared in the 1980’s due to competition with Palm Oil.

“Historically, this was a corporate-type business,” Mr. Melka said, referring to Cocoa plantations in Asia. “Corporate capital got out of it and it really fell in the domain of the small farmers, now predominantly in Africa.” Corporate capital is “coming back to it because the returns are there to justify that investment,” he said.

| HeffX-LTN Analysis for NIB: | Overall | Short | Intermediate | Long |

| Bullish (0.37) | Very Bullish (0.58) | Bullish (0.29) | Neutral (0.22) |

Stay tuned…

HeffX-LTN

Paul Ebeling

The post Cocoa, The World’s Best Performing Commodity appeared first on Live Trading News.