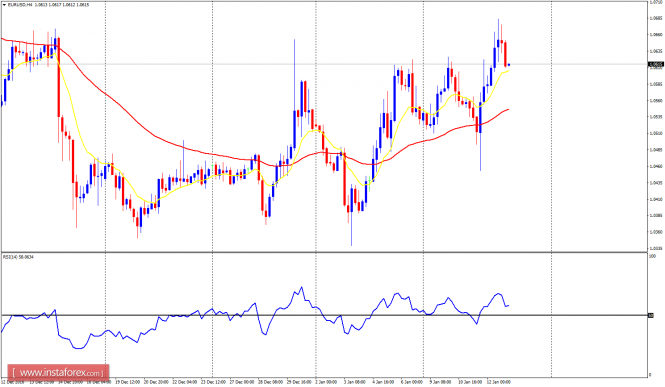

EUR/USD: The EUR/USD pair has

gone significantly upwards, and the bias has turned into bullish (due to the

weakness of USD). Price is supposed to go further upwards in the next several days,

and as long as the support lines at 1.0600 and 1.0500 are not breached to the

downside, the bullish outlook would be logical.

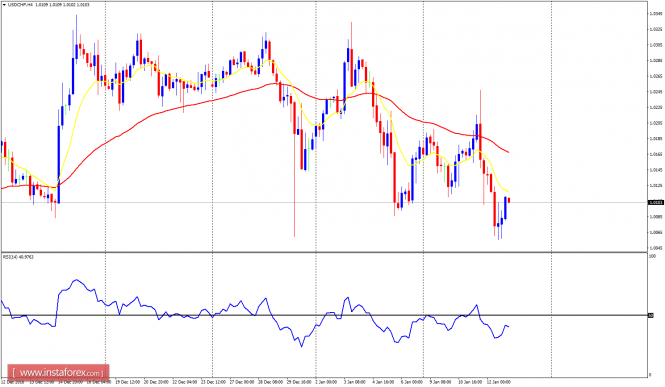

USD/CHF: This market has

gone downwards – as a result of the weakness in USD. There is already a “sell”

signal in the market, as price has dropped from the weekly high of 1.0247. It

is important to know that price is still recently above the psychological level

at 1.0000; and once it is breached to the downside. The bias would turn

completely bearish.

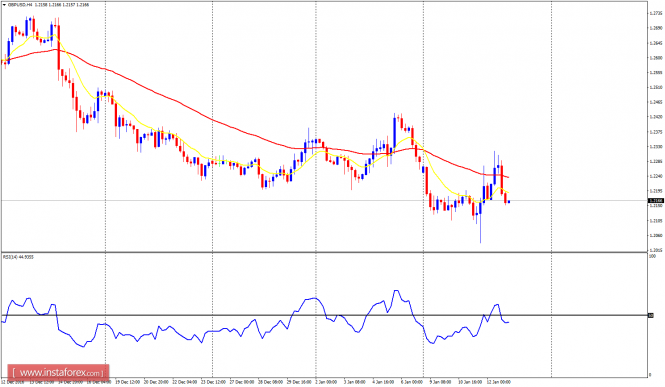

GBP/USD: This market is quite choppy. The recent

bullish attempts have been foiled, and the current price action has revealed intent

to push price lower. The EMA 11 is already below the EMA 56, and the RSI period

14 is below the level 50. The

accumulation territories at 1.2100 and 1.2000 could be tested soon.

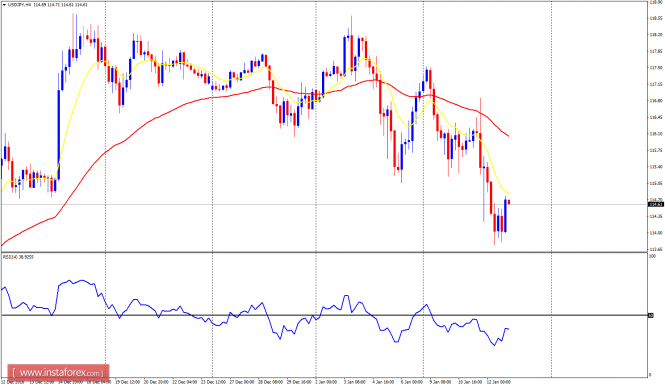

USD/JPY: The USD/JPY pair has

gone down significantly. The bearish movement started gradually at the

beginning of this week, and it has really become serious. The EMA 11 is below

the EMA 56, and the RSI period 14 has gone below the level 50. It is possible

for price to go further and further downwards today or next week.

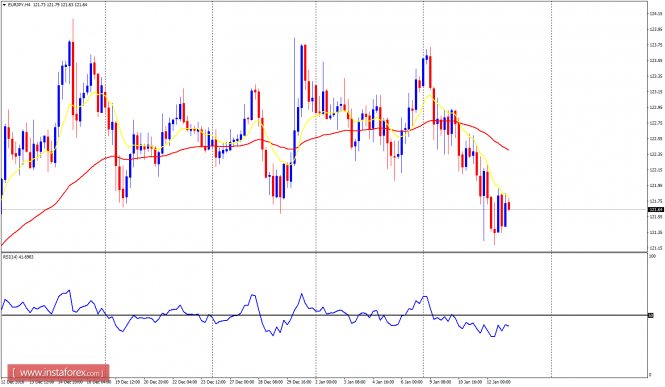

EUR/JPY: The EUR/JPY pair is

now in a clear bearish trend. Price has gone down by 230 pips this week, and

the upwards bounce that is currently happening is shallow. A further bearish

movement is anticipated, which may take price towards the demand zones at

121.00, 120.50, and 120.00.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 13, 2017 appeared first on forex-analytics.press.