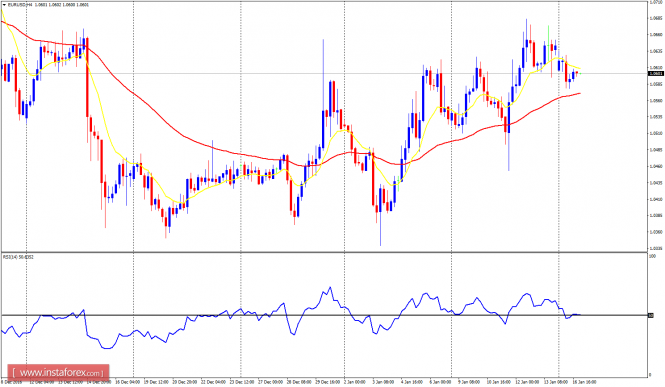

EUR/USD: This pair is in

a bullish mode, and because of the current Bullish Confirmation Pattern on the

4-hour chart, it is possible that price would continue going upwards this week,

reaching the resistance lines at 1.0650 and 1.0700 soon. The resistance line at

1.0650 was tested last week, and it may be tested again this week.

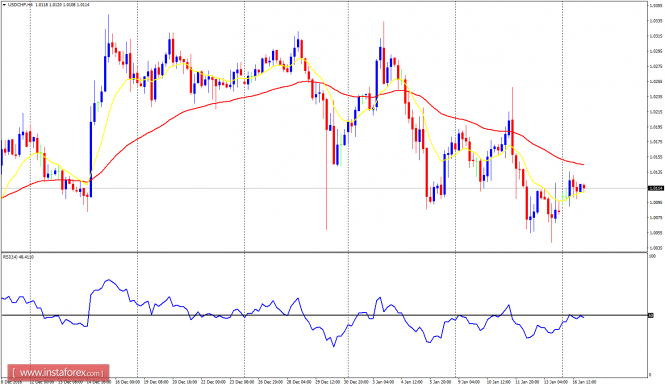

USD/CHF: The USD/CHF

pair went downwards seriously last week, resulting in a Bearish Confirmation Pattern

in the market. Price hit the low of 1.0042, and it could still go further than that. Although the market is quite choppy, a further

downwards movement is anticipated and the support level 1.0000 could tested

this week.

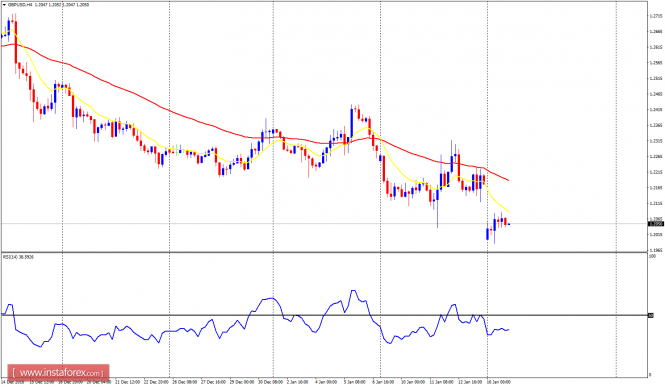

GBP/USD: This GBP/USD pair opened with a gap-down this week

and later moved sideways on Monday. The bias remains bearish and a further

downward movement is anticipated this week, for price may reach the accumulation

territories at 1.1950 and 1.1900 this week, but that would require a strong

selling pressure.

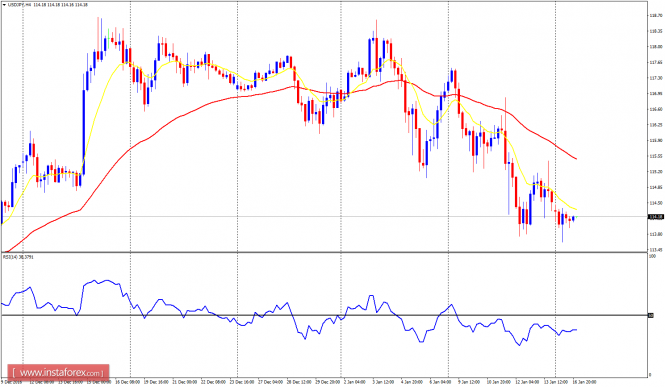

USD/JPY: This currency

trading instrument did not move significantly yesterday – though a bearish

signal has already formed on it. The current sideways movement may continue for

some time (or days) but a breakout would happen soon, which would most probably

be in favor of the bears.

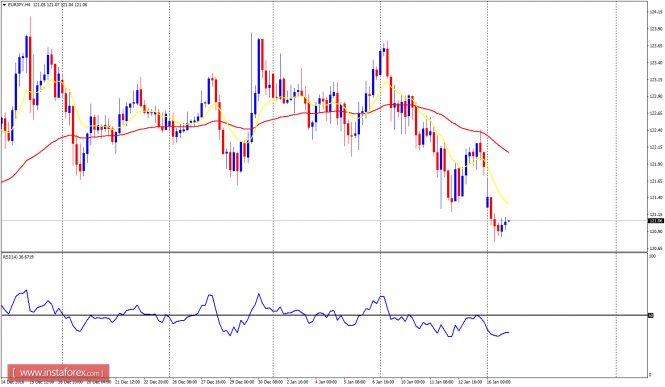

EUR/JPY: The EUR/JPY pair also

gapped down at the beginning of this trading week. The outlook on the market

has turned bearish since last week, and as price trended further downwards on

Monday, the bearish outlook has been strengthened further. The next targets are

the demand zones at 120.50 and 120.00; to be attained soon.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 17, 2017 appeared first on forex-analytics.press.