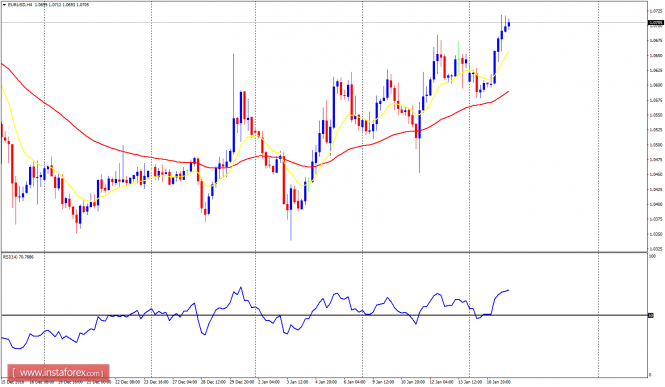

EUR/USD: Just as it was predicted

at the beginning of this week, the EUR/USD has continued its upward journey,

now targeting the resistance lines at 1.0750, 1.0800 and 1.0850. These are

essentially the targets for this week, and they would be attained as bulls push

price further and further northwards.

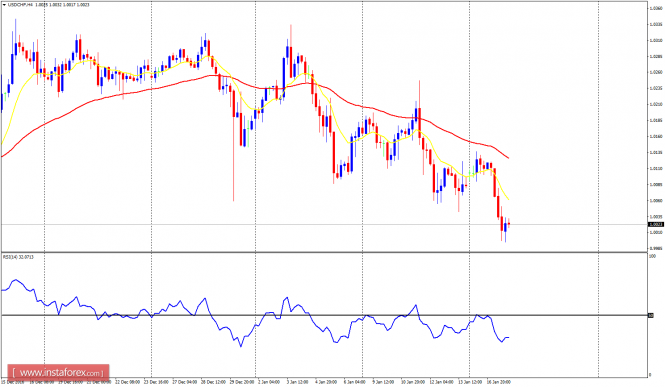

USD/CHF: As it was expected,

the USD/CHF has continued its downward journey, now targeting the support

levels at 1.0000 (+0.9950 and 0.9900). These are essentially the targets for

this week, and they would be attained as bears push price further and further

southwards. However, the psychological level at 1.0000 has appeared to be something

price could not breach permanently to the downside. Price needs to go below it,

staying below it, in order for the threat to the current bearish movement to

disappear.

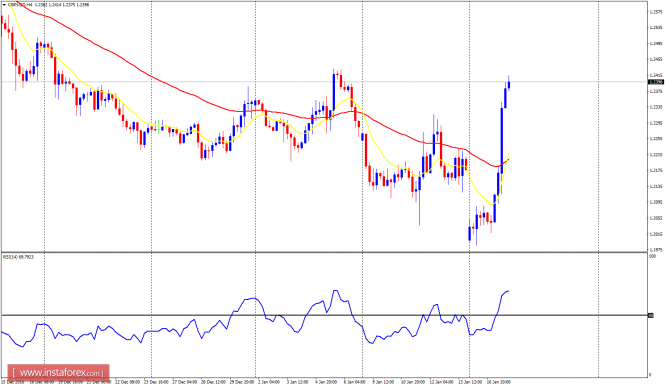

GBP/USD: The GBP/USD shot upwards significantly,

following the gap-down that occurred at the beginning of this week. The 400-pip

rally was so strong that it overturned the bearish bias in the market (especially

in the short-term). The rally is supposed to continue today as price targets

the distribution territories at 1.2400, 1.2450 and 1.2500.

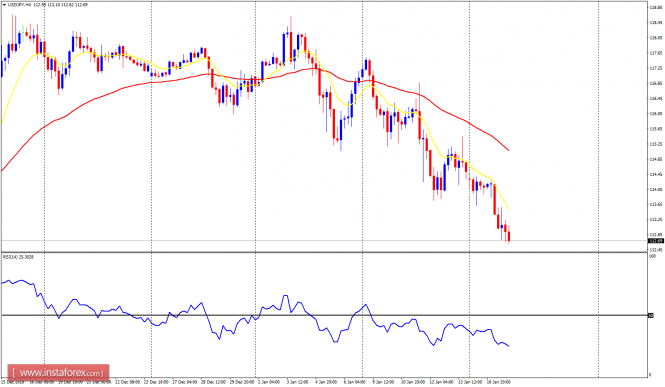

USD/JPY: This currency

trading instrument has now gone downwards by 160 pips this week – to underline the

“sell” signal that started last week. There is a Bearish Confirmation Pattern

in the chart and further bearish movement is anticipated this week.

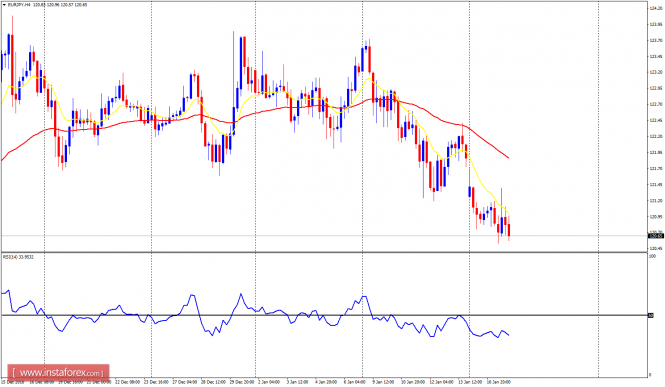

EUR/JPY: This cross pair

is in a bearish mode. EUR may be strong versus another currencies but it is

weak versus JPY. The EMA 11 is below the EMA 56 and the RSI period 14 is below

the level 50. Price is now below the supply zone at 121.00, targeting the

demand zone at 120.50. The demand zone is expected to be breached.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 18, 2017 appeared first on forex-analytics.press.