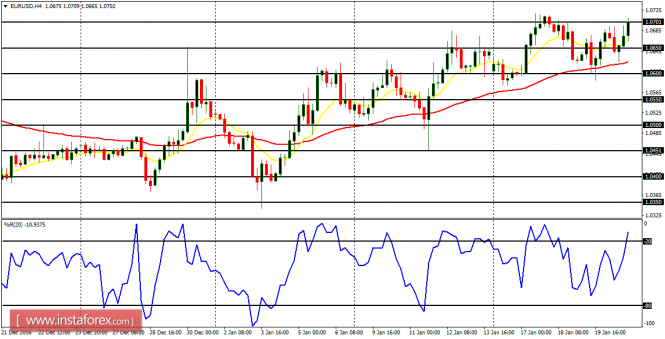

EUR/USD: The EUR/USD was

able to maintain its bullishness last week. There is a Bullish Confirmation

Pattern in the 4-hour chart, and price is currently testing the resistance line

at 1.0700. The resistance line would be broken to the upside this week as price

targets another resistance lines at 1.0750 and 1.0800.

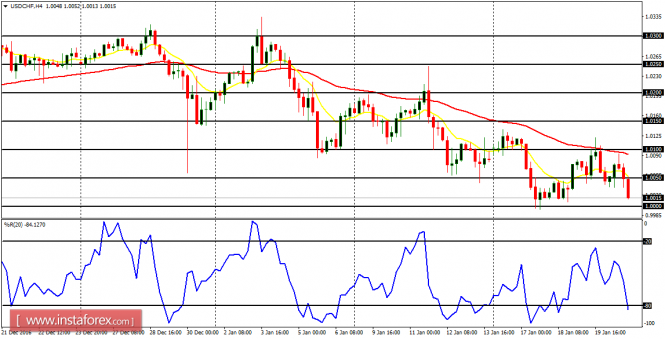

USD/CHF: The USD/CHF was

able to maintain its bearishness last week. There is a Bearish Confirmation

Pattern in the 4-hour chart, and price is currently below the resistance level

at 1.0050. The great psychological level at 1.0000 is still a formidable threat

to the current bearish outlook, and price should be able to break it to the

downside this week, so that the bearish movement can continue.

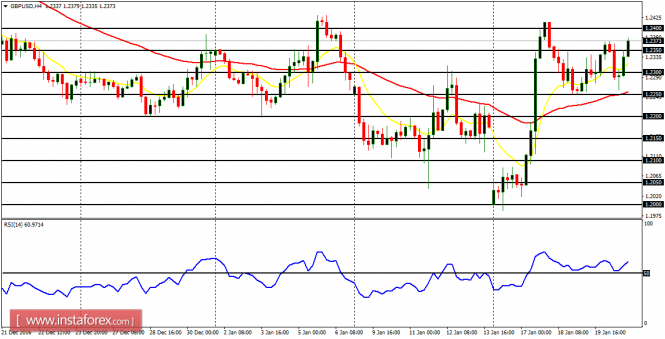

GBP/USD: The Cable rallied last week and consolidated till

the end of the week, remaining volatile throughout the week. Things have turned

bullish in the short-term, and it is anticipated that price would go upwards by

at least, 200 pips this week. Therefore the distribution territories at 1.2400,

and 1.2450 and 1.2500.

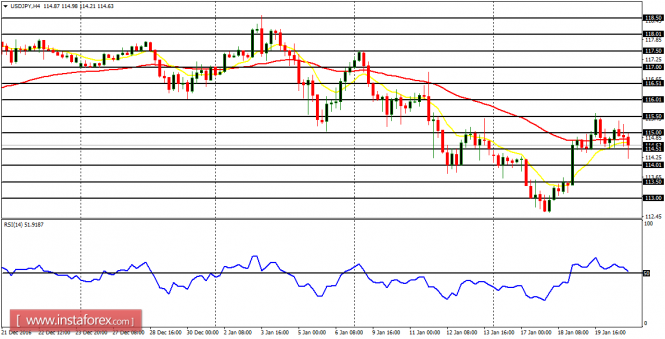

USD/JPY: There are

conflicting signals in the USD/JPY 4-hour chart. The outlook on the market is

bearish, but right now, there is a kind of hesitation in the market. This week,

price could go seriously upwards or further downwards to emphasize the recent

bearish outlook. Whatever would happen, this week would tell.

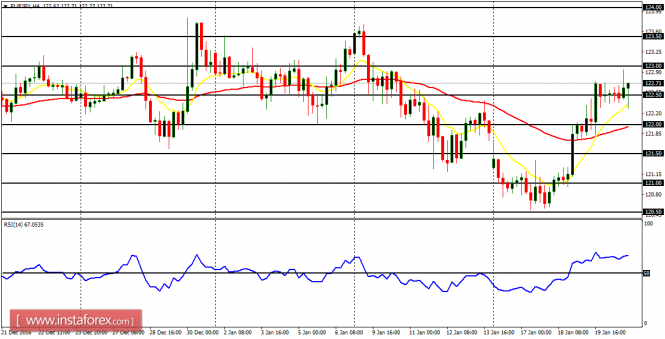

EUR/JPY: There is a

“buy” signal in this market. Price has gone upwards – mainly because the EUR is

strong. Since movements of JPY pairs would be determined by whatever happens to

other currencies, this market would continue to go upwards as long as EUR is

strong. The Supply zones at 123.00, 123.50 and 124.00 could be reached.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 23, 2017 appeared first on forex-analytics.press.