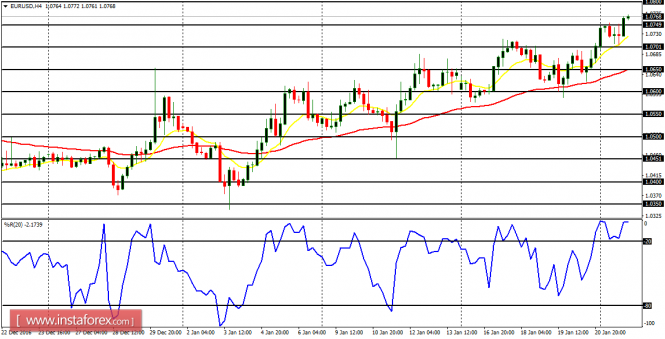

EUR/USD: There is a bullish

signal on the EUR/USD pair, and just as it was forecasted earlier this week, price

is expected to go further northwards. The market moved up beyond the support

line at 1.0750 yesterday, targeting the resistance lines at 1.0800, 1.0850, and

1.0850. This bullishness would be sensible as long as price does not go below

the support line at 1.0600.

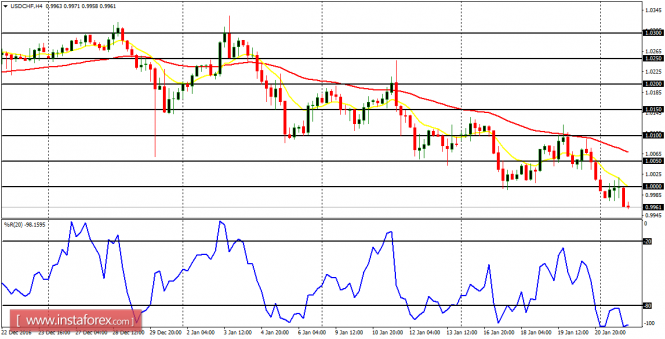

USD/CHF: There is a

bearish signal on the USD/CHF pair, and just as it was forecasted earlier this week,

price is expected to go further southwards. The market moved up below the resistance

line at 1.0000, targeting the support lines at 0.9950, 0.9900, and 0.9850. This

bearishness would be sensible as long as price not go above the resistance line

at 1.0000. The resistance line at 1.0000 is particularly important because it

would not be easy to be broken to the upside, and so, the current bearishness

is expected to hold out longer.

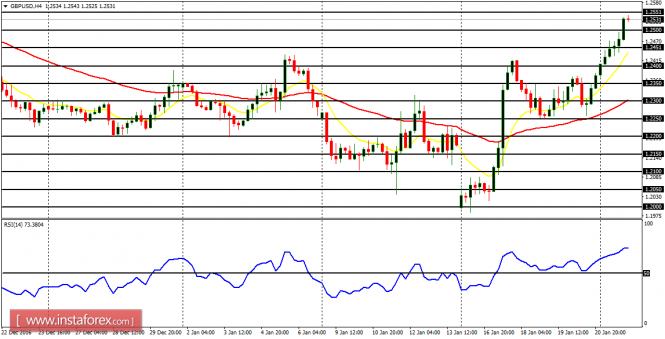

GBP/USD: The GBP/USD pair moved upwards by 170 pips

yesterday, to continue the bullish signal that was started last week. There is

a Bullish Confirmation Pattern and price may later reach the distribution

territories at 1.2550, 1.2600, and 1.2650.

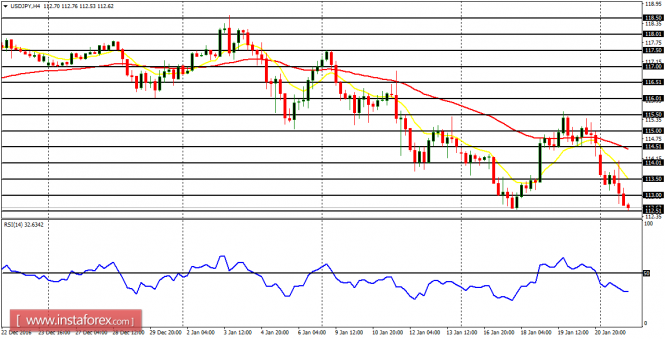

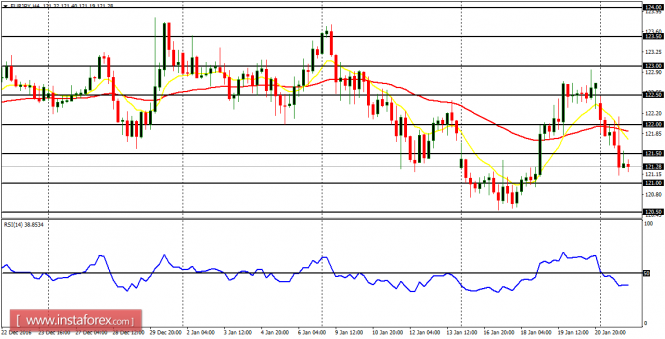

USD/JPY: What happened

yesterday showed that the rally that happened last Thursday and Friday was an

opportunity to sell short at better prices. Price went south on Monday,

underlining the recent bearish trend in the market. Further downwards movement

is expected for the rest of this week.

EUR/JPY: The movement on

this currency cross is now quite similar to the movement on the USD/JPY pair. There

is a Bearish Confirmation Pattern here, and a further bearish movement is

possible as price targets the demand zones at 121.00 (the first target), 120.50,

and 120.00.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 24, 2017 appeared first on forex-analytics.press.