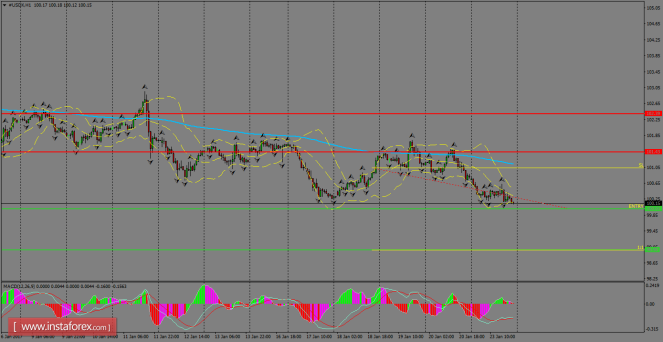

The index once again is looking to trade lower as it’s challenging

the support level of 100.00. If we see a breakout lower around that

area, we can expect another decline towards 98.98. The dynamic

resistance offered by the 200 SMA at H1 chart remains intact and as

long as USDX continues to trade below that moving average, a

consolidation below the 100.00 handle for the short-term is likely to

happen.

H1 chart’s resistance

levels: 101.43 / 102.39

H1 chart’s support levels:

100.01 / 98.98

Trading recommendations for today:

Based on the H1 chart, place

sell (short)

orders only if the USD Index

breaks with

a bearish

candlestick;

the support

level is at

100.01,

take profit is at

98.98

and stop loss is at 101.03.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of USDX for January 24, 2017 appeared first on forex-analytics.press.