Is the Market Rebound Premature?

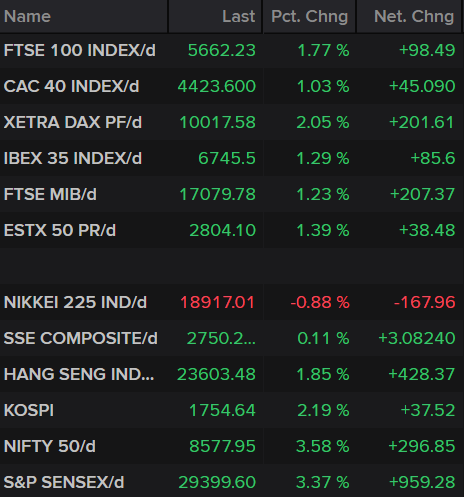

It’s been an incredibly turbulent month for financial markets but the last week has given investors much to be optimistic about, with stocks in positive territory again on Tuesday.

Source – Thomson Reuters Eikon

It’s still early days and I am not at all convinced we’ve bottomed yet but five positive days in six is definitely encouraging. Investors will no doubt just be relieved that the incredible levels of volatility appear to be behind us. This at least provides the foundations for a sustainable rebound even if we see another test of the lows in the near-term.

We will start seeing more encouraging headlines over the coming weeks which will do the rebound no harm whatsoever. On Monday, we had Johnson & Johnson announcing a potential vaccine and Abbott Laboratories launching a rapid testing kit, while in the UK, we were told that there are early signs of the virus spread slowing across Europe.

It’s still early days but more of these kinds of headlines will appear over the coming weeks which will give investors cause for optimism, particularly at these levels. The question will be whether it will be enough to offset the dreadful daily coronavirus statistics and then the flow of woeful economic figures and company failures. The bad news is unfortunately going to keep coming for some time.

We’re also still not even close to peak coronavirus in the US which has already reported more cases than any other country – albeit likely due to more testing than China and others – and will sadly likely see a huge spike in the number of deaths, meaning further lockdown measures will likely follow. Huge challenges still lie ahead.

Oil remains vulnerable despite small bounce

Oil prices are bouncing this morning but, let’s face it, a 5% rally in WTI is nothing to get excited about. At just above $21, we’re still at extremely low levels and the situation doesn’t give us cause for optimism. The only real bullish case is that prices are so low they can’t drop much further. Talk of negative prices is purely theoretical at this point but the fact that anyone is talking about this highlights just how desperate the situation has become.

Neither Russia or Saudi Arabia are giving any indication that they’re willing to budge in this price war which means that prices are likely to stay low until US shale starts to shut down or fail. The rig numbers from the last couple of weeks point to signs of the former starting but output is still near record levels for now. If that significantly falls, oil prices may stabilize a little but given how much the others have ramped up production by, there’s still likely to be a massive oversupply problem until they cut as well.

WTI Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold slips as risk appetite improves

Trying to make sense of gold’s movements hasn’t been easy recently but we are seeing signs of its normal relationship with the wider market being re-established. The yellow metal has battled countering forces of improving sentiment and a softening dollar this last week which may explain its relative stability compared with the rest of the market.

This morning, we have stock market gains and a slightly stronger dollar which has pushed gold into the red although it still remains above $1,600. I wonder whether another thing keeping gold elevated is the belief that stock market lows will be tested again but perhaps without the levels of volatility that we saw before. The next few days could be very interesting.

Gold Daily Chart

Bitcoin enjoys risk rebound

Bitcoin has bounced back from Monday’s lows, in a similar manner to other risk assets in the market. Having failed repeatedly at $7,000 previously though, it still faces a huge challenge breaking through that level. It’s easy to get carried away with the rebound we’ve seen recently but I feel it’s too early to celebrate. Should risk appetite turn, bitcoin could get hit hard again and perhaps this is what traders are wary of.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.