Markets in the red as Fed holds off on policy change

It would appear we’re going to end an otherwise positive week on a negative note, with equity markets around the globe in the red following the Fed decision on Thursday.

The Fed is not for turning, not yet at least. It was always a bit of a long shot that the central bank would choose a meeting that did not produce new economic projections or be followed by a press conference to change course, even a little, unless things had got especially bad. The recovery in the markets last week will have provided enough comfort to convince them it was not necessary and a decision can be made in December.

That’s not stopped traders from being disappointed though, with some hoping the central bank would soften their hawkish views and bring some calm to the markets. I don’t think this is going to trigger another sell-off like the one that followed Jerome Powell’s comments last month but then again, I don’t think anyone thought they would either.

European Open – Stocks lower on hawkish Fed

UK growth stalls in September

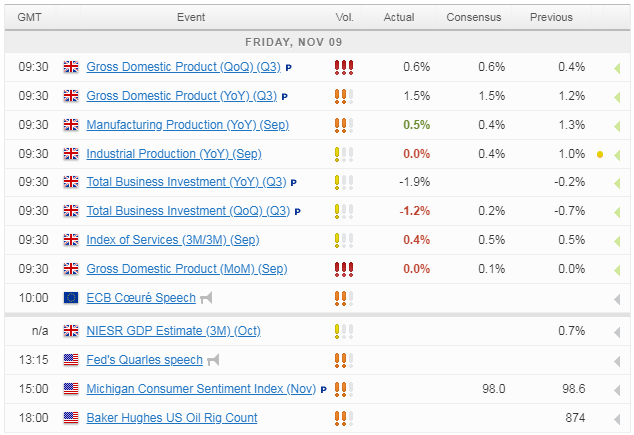

This morning’s UK data did little to shift traders attention away from the infinitely more important matter of Brexit, partly because in the grand scheme of things it’s borderline irrelevant and partly because the numbers were broadly in line with expectations.

An early summer economic boost from the double whammy of great weather – by our standards – and World Cup fever was unfortunately, but predictably, unsustainable. Still, flat growth in September was still enough to secure the strongest quarterly growth since the end of 2016, at 0.6%.

EUR/USD – Euro dips on hawkish Fed statement

Brexit deal brings weekend risk for GBP

Business investment was a drag on growth in the quarter though, dropping 1.2% on a quarterly basis – the most since 2015 – and 1.9% on an annual basis, the most since the end of 2016. While the link to Brexit in all of the above data is clear for all to see, the positive from this is that this could provide a tailwind for the economy if a good Brexit deal is secured.

News on this could come at any time, with both sides apparently desperate to find an agreement in time for a special EU summit later this month, which would conveniently free up the holiday period. I remain optimistic that a technical fudge will be found but obviously this takes time which makes it difficult to predict when. This naturally creates additional risk for the pound, particularly over the weekend and also if a deal does somehow collapse.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.