Will economic data derail the Federal Reserve’s plans to hike? What impact will the Presidential Election play?

The US jobs report is widely regarded as the most important monthly economic reports that we get from the worlds’ largest economy and as such, it often gets a lot of attention and has the potential to generate some of the most volatile responses in the markets.

In what has already been quite a volatile market environment in recent weeks driven by multiple factors – Brexit, OPEC deals, the Fed and the US election to name a few – Friday’s jobs report is arguably the most important that we’ve had in a long time.

While it seems every jobs report is built up to be the most important and a Fed hike is constantly just around the corner, there is something different about this one. The Fed continues to hint at a rate hike this year and only yesterday claimed “the case for an increase in the federal funds rate has continued to strengthen” but wanted to wait for “further evidence of continued progress toward its objectives”. With only two jobs reports to go until the December meeting, today’s release could offer evidence of such continued progress or strengthen the case for waiting a little longer.

XAU/USD – Gold Choppy Ahead of Nonfarm Payrolls Next

And what about next week’s Presidential election? With the polls so close once again, could tomorrow’s figures sway any of the remaining undecided voters?

But with unemployment already at 5%, a level close to what the Fed deems full employment, and job creation well above what is needed to absorb any additional supply coming into the labour market, what are the key indicators we should be watching?

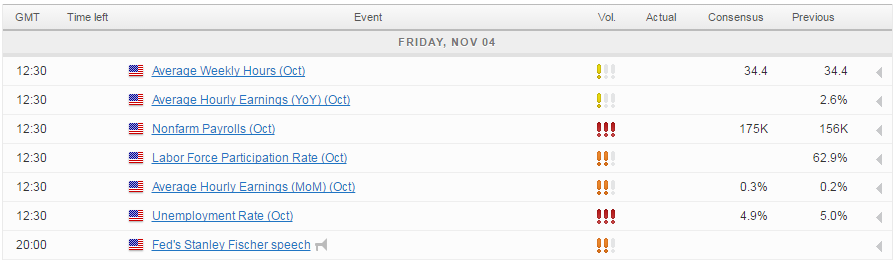

The headline grabbers and those that the markets will typically react first to continue to be the non-farm payrolls number and then the unemployment rate. Ultimately, these are the first indicators that tell us the economy is strong and it still has momentum. Market expectations ahead of tomorrow’s release is for an NFP reading of 175,000 and unemployment to fall back to 4.9%.

Source – OANDA MarketPulse Economic Calendar

That said, job creation and unemployment has been strong for some time now and yet the Fed has still only raised interest rates once in the last decade. Standing in the way has been the other side of the Fed’s mandate, inflation, which has been below target every month bar five since the financial crisis eight years ago.

While the core PCE price index has been on the rise since the middle of last year, it still remains at 1.7%, slightly shy of the Fed’s 2% target and policy makers want to see evidence that it hit this in the future. There are a number of indicators that could help determine this, one of the most important of which is believed to be wage growth. Higher wages allow consumers to spend more and could therefore deliver sustainably higher inflation. The problem is this has also been lacking in recent years, although this has been gradually improving. Should we see wages grow at an annual rate of 2.6% again, or faster, it would certainly support the case for another rate hike next month.

Sterling Spikes on UK Court Brexit Ruling

As would an increase in the participation rate, which may ultimately drive the unemployment rate higher, but is a sign of a healthier labour market. If people are returning it’s because jobs are being created and there is confidence in the economy to function properly. In this case, a rising unemployment rate is a good problem to have, although it’s even better if jobs are being created a rate that covers the additional people joining the labour force.

The US dollar has had a torrid week, falling in four of the last five sessions in response to the Hillary Clinton email investigation and Donald Trump’s resurgence in the polls. Still, while the dollar has plummeted, Fed rate hike expectations for December remain above 70%. It will be interesting to see whether that remains the case on 9 November.

Source – CME Group FedWatch Tool

For more analysis on the US dollar, check out our NFP video.