Trump $500 billion Chinese tariffs threat weighs on sentiment

Equity markets are trading slightly in the red at the start of the week, a reflection of the slightly risk averse tone stemming from the prospect of the trade conflict escalating in the coming months.

US President Donald Trump has continued to double down on threats against China, warning he is willing to impose tariffs on all goods imports which equates to around $500 billion. While this isn’t the first time he’s suggested this, it does seem he is becoming increasingly frustrated with the process and that he is not getting the results he expected when he first started down this path.

Unless the two countries find a solution in the next couple of months, the next $200 billion of 10% tariffs that were revealed recently will likely be imposed which could be met with similar measures on the US, if previous actions and rhetoric are anything to go by. While the market rally has stalled this year, with trade being a major contributor, they have shown a certain resilience, something that may not last once tariffs start to take their toll on the economy, with price increases for consumers sure to have an impact.

DAX under pressure after Trump threatens currency war

Earnings eyed but trade could once again be key

This week is likely to see focus remain on trade, with Trump not one to take a back seat and remove himself from the spotlight. Earnings season could provide a welcome distraction from the political theatre of trade wars but even here it’s going to feature as tariffs will have an impact on the outlooks of a number of companies and investors will be keen to hear their views. Around a third of S&P 500 companies report on the second quarter, including three of the four FANG stocks which will typically attract plenty of attention.

There are also a number of other events to focus on this week including the ECB meeting on Thursday – although this may be more of a low key affair with the central bank having already laid out plans for the next year. Theresa May will also meet with her cabinet on Monday for their final meeting before the summer recess, in which the Brexit white paper may be discussed, given the widespread opposition to it and apparent rejection of aspects of it by the European Union chief negotiator Michel Barnier. Needless to say, with only months to go until exit day, negotiations are not progressing as hoped.

Trade and currency wars a market threat

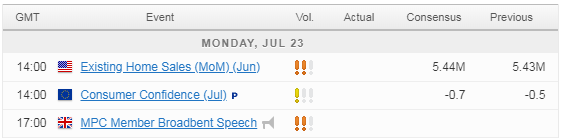

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.