Monday April 8: Five things the markets are talking about

Global equities have opened slightly lower overnight as the market takes stock of last week’s rally, following progress in U.S-China trade talks and a strong U.S employment figure Friday, while conflict in Libya is sending oil prices higher.

Markets rallied last week as President Trump met Chinese officials in Washington, claiming progress in the continuing trade negotiations, while NFP data showed that U.S job growth rebounded last month.

Oil prices have jumped as fighting intensified near Tripoli this weekend, while in the U.K, investors are waiting on Brussels to decide on an extension to the Brexit deadline – at the end of the year or even in 2020 – while PM May seeks to cooperate with the Labor Party.

In the week ahead, the U.S. economy will see fresh data on inflation and consumer sentiment, while the Fed will release its March meeting minutes. The minutes should offer more detail on how officials judged the U.S economy and the prospect of either rate increases or cuts later this year.

Both U.S Treasuries and the dollar are trading steady after President Trump increased his rhetoric on the Fed to sustain growth.

Across the pond, there is the ECB decision mid-week. Last month policy makers made a clear dovish move, pushing back on its guidance regarding raising interest rates, announcing an upcoming new lending program for banks (TLTRO), and cutting forecasts. Nevertheless, Draghi is expected to provide an update about their economic situation.

Also, mid-week, all EU leaders, including U.K PM Theresa May, will convene at a special summit to discuss what to do with Brexit, just two days before the updated official exit date of April 12.

On tap: GBP GDP & manufacturing product, ECB monetary policy statement, USD CPI & FOMC meeting minutes (Apr 10).

1. Stocks mixed results

In Japan, the Nikkei ended lower overnight as the market remains cautious ahead of the corporate earnings season, although better than expected NFP data is limiting the downside for now. The index finished -0.21% lower, while the broader Topix dropped -0.4%.

Down-under, Aussie stocks found support by gains in mining and healthcare firms. The S&P/ASX 200 index closed up +0.65%, recouping some of -0.8% losses on Friday. In S. Korea, the Kospi index closed out virtually unchanged, up +0.04% from the previous session.

In China, stocks ended lower overnight amid profit-taking following last week’s strong gains, and as the market remained concerned over progress in China-U.S trade talks. The Shanghai Composite index was down -0.05%, while China’s blue-chip CSI300 index was down -0.12%.

In Hong Kong, stocks ended firmer overnight, closing at a nine-month high as a jump in U.S payrolls and hints of more stimulus in China supported investor sentiment, while high oil prices lifted energy stocks. At the close of trade, the Hang Seng index was up +0.47%, while the Hang Seng China Enterprises index rose +0.87%.

In Europe, regional bourses trade lower following recent strength, in line with mixed Asian Indices and lower U.S Index futures.

U.S stocks are set to open in the ‘red’ (-0.15%).

Indices: Stoxx600 -0.24% at 387.30, FTSE % at #, DAX -0.41% at 11,960.99, CAC-40 -0.14% at 5,468.38, IBEX-35 -0.72% at 9,442.20, FTSE MIB -0.20% at 21,715.50, SMI -0.19% at 9,523.00, S&P 500 Futures -0.15%

2. Oil jumps to new highs on U.S sanctions, OPEC cuts and Libya fighting

Oil prices have rallied to a new five-month high overnight, driven by OPEC+ supply cuts, U.S sanctions against Iran and Venezuela, fighting in Libya as well as strong U.S jobs data.

Brent futures are at +$70.62 per barrel, up +28c, or +0.4% from Friday’s close, while U.S West Texas Intermediate (WTI) crude are up +30c, or +0.5%, at +$63.39 per barrel.

Note: Brent and WTI both hit their highest since November at +$70.76 and +$63.48 a barrel overnight.

Oil ‘bulls’ are finding support from Friday’s better than expected U.S payrolls report and OPEC+ commitment to withhold around +1.2M bpd of supply this year. However, this morning’s kick higher has come mostly from an escalation of fighting in Libya which is threatening further supply disruption.

Nevertheless, oil bears are taking solace from the possibility that Russia maybe a reluctant participant in its agreement with OPEC to withhold output, and it may increase production if the deal is not extended before it expires on July 1 and from the fact that in the U.S, crude production reached a global record +12.2M bpd last month.

Note: Russian oil output reached a national record high of +11.16M bpd last year.

Ahead of the U.S open, gold prices have rallied to a one-week high overnight as the ‘big’ dollar slipped a tad after data Friday showed that U.S wage growth slowed last month, while the markets waits for the Fed’s minutes mid-week. Spot gold has gained +0.4% to +$1,296.87 per ounce, while U.S gold futures are also up +0.4% at +$1,301 an ounce.

3. JGB’s gain on risk aversion

Japanese government bond prices have rallied broadly overnight as risk aversion amid a decline in equities supported debt, while a regular debt-purchasing operation conducted by the Bank of Japan (BoJ) gave further support to the market.

The five-year JGB yield fell -1 bps point to -0.170%, while the 10-year yield dropped -1.5% to -0.050%. The 30-year yield declined -1 bps to +0.535%.

Note: Longer-dated JGB’s benefited as the BoJ offered to buy +$2B worth of 10- to 40-year bonds.

Stateside, President Trump has called again for the Fed to loosen monetary policy, this time going so far as to say the central bank “should return to the aggressive measures it undertook during the financial crisis.” He also indicated that the Fed should also start expanding the central bank’s balance sheet.

Elsewhere, the yield on 10-year Treasuries dipped less than -1 bps to +2.49%, while in Germany, the 10-year Bund yield declined -1 bps to +0.00%. In the U.K, the 10-year Gilt yield has decreased less than -1 bps to +1.114%.

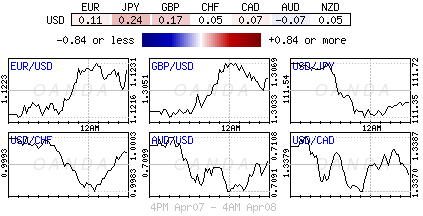

4. Dollar looking for directional help

It’s a quiet start to a key week for Europe as EU leaders meet mid-week to discuss the Brexit situation. Also, there is the ECB rate announcement and FOMC minutes due this Wednesday.

EUR/USD (€1.1237) is steady with the focus on the ECB decision. The market is not expecting the central bank to reveal any more details regarding the third round of targeted longer-term refinancing operations (TLTRO-3).

Sterling (£1.3055) will be looking to whether PM Theresa May can reach an agreement with Labor opposition leader Jeremy Corbyn, for now the currency remains stable. If she could secure an agreement, she would then be expected to head to Brussels to obtain a Brexit deal which may get her a majority in the House of Commons. Until this happens, the danger of a ‘no deal’ happening remains valid.

Elsewhere, the yen has climbed +0.3% to ¥111.45, the biggest increase in more than a fortnight.

5. Eurozone investor morale rises on China hopes

Data this morning showed that Investor morale in the eurozone improved this month to hit its highest level in five-months, supported by signs of an upswing in China.

The Sentix research group said its investor sentiment index for the eurozone rallied to -0.3 from -2.2 in March. The market was expecting a reading of -2.1.

Digging deeper, a sub-index of expectations improved for the third consecutive month, reaching -4.3. However, the current situation weakened for the eighth month in a row, slumping to 3.8, its weakest level since February 2015.

“The economic situation in the eurozone remains fragile,” said Sentix, but “with expectations rising, the momentum of the decline is slowing.”