US and China trade spat heats up

We’re seeing a slightly risk averse tone in financial markets at the start of the week after the trade spat between the US and China ramped up over the weekend.

Both countries have laid out plans to impose tariffs on one another on 6 July which is making investors a little uncomfortable, more so due to the potential for the situation to escalate further than the tariffs themselves. The question now is how much pain both sides will be willing to inflict on the other – and themselves in the process – before coming to an agreement that removes tariffs and eases investor concerns.

It’s possible that with the US economy doing so well and President Donald Trump last week securing a significant victory following his meeting with North Korean leader Kim Jong Un, he may be willing to use some of this political credit he’s earned and make the necessary economic sacrifice in order to force China into concessions. That’s certainly the impression he’s giving.

Mario Draghi, the master of the dark art of central bank communiqué

Stocks in the red but FTSE outperforms on weaker GBP

While we’re only seeing moderate risk aversion in the markets at the moment, it is enough to drag European stocks markets down with French and German indices off between 0.5% and 1%. The FTSE is holding up ok although this is being aided by the weaker pound which supports the large number of external looking companies in the index.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Traditional safe havens are naturally doing well this morning with Gold up a couple of dollars and the yen in the green against the dollar euro and pound.

EUR/USD – Euro trading sideways, ECB forum next

OPEC meeting and central bank speeches eyed this week

Oil remains well of its highs as traders look ahead to the OPEC meeting later in the week with the cartel likely to discuss reducing or even ending its coordinated output cut which was imposed in an attempt to bring inventories back in line with the five-year average which has been successful. An increase in production from the OPEC nations and others including Russia involved in the deal will be welcomed by Trump who has recently been berating them for pushing prices higher, despite the fact that part of this has been driven by US sanctions on Iran.

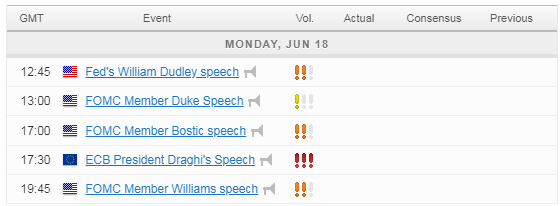

It’s going to be a quiet day on the data side but we will hear from a number of prominent central bankers which is very much going to be the theme of this week. Incoming Bank of New York Fed President John Williams will be speaking later on in the day, as will his colleague Raphael Bostic. We’ll also hear from ECB President Mario Draghi who’s due to appear on a number of occasions this week.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.