Five Star and Lega Reopen Discussions on Forming Government

US futures are paring losses ahead of the open on Wednesday, similar to the moves we’re seeing in Europe as political uncertainty in Italy continues to act as a drag on risk appetite.

It looked as though we were headed for fresh elections as early as July, with negotiations between Five Star Movement and Lega having failed after President Sergio Mattarella vetoed their choice of Finance Minister. Carlo Cottarelli – a former IMF economist – was tasked with forming a temporary government until further elections are called, ideally next year, but that appears to have failed before it got started.

While early elections will arguably be very beneficial to the populist parties, who will cite the rejection of its choice of Finance Minister as evidence of Brussels interference and an abuse of the democratic will of the people, it seems one last attempt to form a government is being discussed. The parties seem unwilling to hold an election in July and have no desire to wait until next year.

If a government can be formed that receives the stamp of approval from Mattarella and is therefore seen as not posing a threat to Italy’s place in the eurozone, then this will come as a relief to markets in the near-term. Longer-term risks remain though and both parties will likely use recent events as a platform to drum up opposition to the euro with the end goal of holding its own referendum, something eurozone leaders will understandably fear after the UK result in 2016.

DAX Recovers as German Consumer Spending Jumps

BoC Decision and US Data Eyed

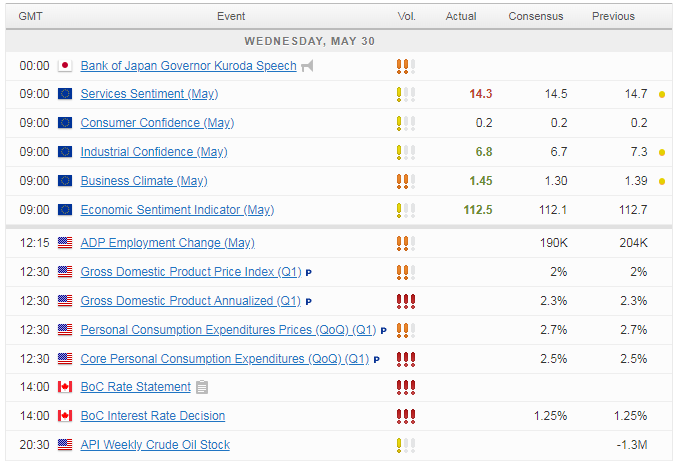

While the situation in Italy will likely continue to be a driver of market sentiment, there are plenty of data releases that will be of interest to traders today as well as an interest rate decision from the Bank of Canada. While the central bank is not expected to hike interest rates at the meeting, at least one more is priced in for this year and possibly a second so the statement that accompanies the decision will be monitored closely.

We’ll get an early look at US employment in May today, with ADP releases its estimate ahead of the official jobs report on Friday. While this is typically not entirely reliable as an estimate of the non-farm payrolls figure, it could give us some insight into whether markets are well positioned or not. We’ll also get a revised GDP reading for the US for the second quarter, which is expected to be unchanged at 2.3% on an annualised basis.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.