Saudi in the spotlight as lies start to unravel

Investors may not be feeling particularly comfortable yet but we are seeing some welcome stability in the markets on Tuesday, with Europe posting small gains following a mixed session in Asia overnight. US futures are also pointing a little higher which will provide some comfort following a number of rather explosive sessions.

As ever, politics is driving everything right now and while a trade spat between the US and China has gone quiet, it’s been Saudi Arabia in the spotlight following the disappearance and alleged murder of journalist Jamal Khashoggi. Brexit is never far from the headlines as the UK and EU continue efforts to resolving the Northern Ireland backstop – without much success – while Italy offers another headache from within after it submitted its first populist budget that put it on a collision course with Brussels as it breaks its fiscal rules.

Oil eases as Trump takes heat out of situation

Oil prices have continued to edge lower on Tuesday, as Trump appeared to take some of the heat out of the Saudi situation following a phone call with King Salman. Trump appeared reassured by the conversation after the King denied any knowledge of what happened, which suggests he’ll be in no rush to impose sanctions or other measures against the country.

WTI and Brent Crude Daily Charts

OANDA fxTrade Advanced Charting Platform

While it later emerged that Saudi Arabia was willing to admit that Khashoggi was unintentionally killed during an interrogation, having previously claimed he left via the back door, traders don’t appear to believe that this will influence Trump’s response to the situation with the American President clearly very reluctant to enter into a tit-for-tat with a key middle eastern ally.

Saudi Arabia has a number of options at its disposal for responding to US sanctions, including causing severe disruption in the oil market if it suddenly reduced output in what is already a tight market. Prices have already risen to levels not seen in four years and if the Saudi’s decide to use this as a weapon, it could cause prices to soar which would be very damaging for the global economy. There is a hope that the self-harming nature of such a move would deter such action.

Commodities Weekly: Gold at 2-1/2 month high as safe haven status reborn

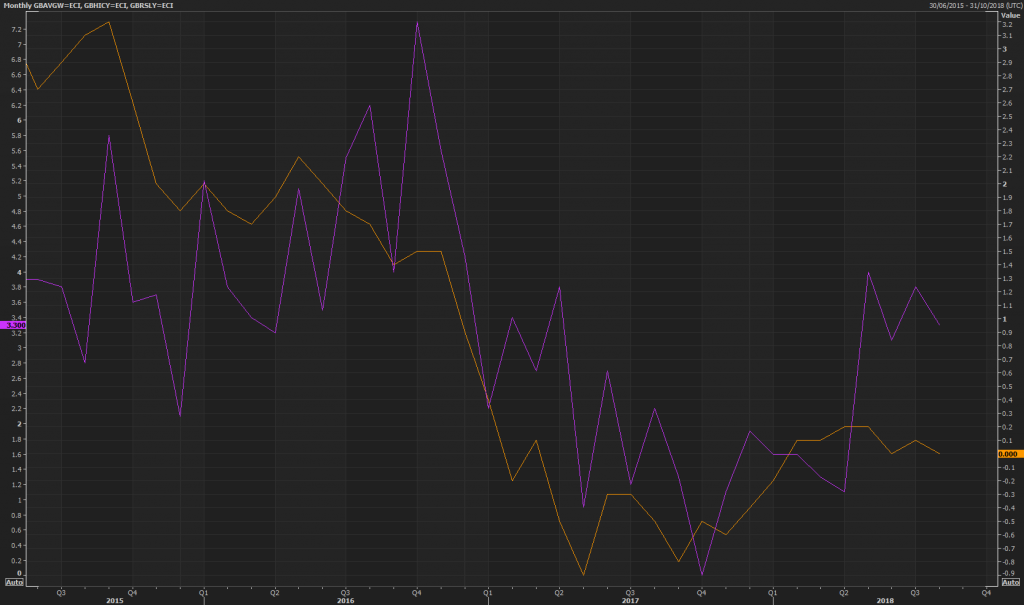

UK wage growth accelerates in August

The UK labour market data this morning provided some positive news among the constant flow of tedious rhetoric regarding to the stalled Brexit negotiations. Despite the low growth environment the country finds itself in due to the uncertainty around the negotiations, unemployment remained at a 43-year low in August while wage growth exceeded expectations, rising 2.7% or 3.1% when bonuses are stripped out.

UK Real Wage Growth

Source – Thomson Reuters Eikon

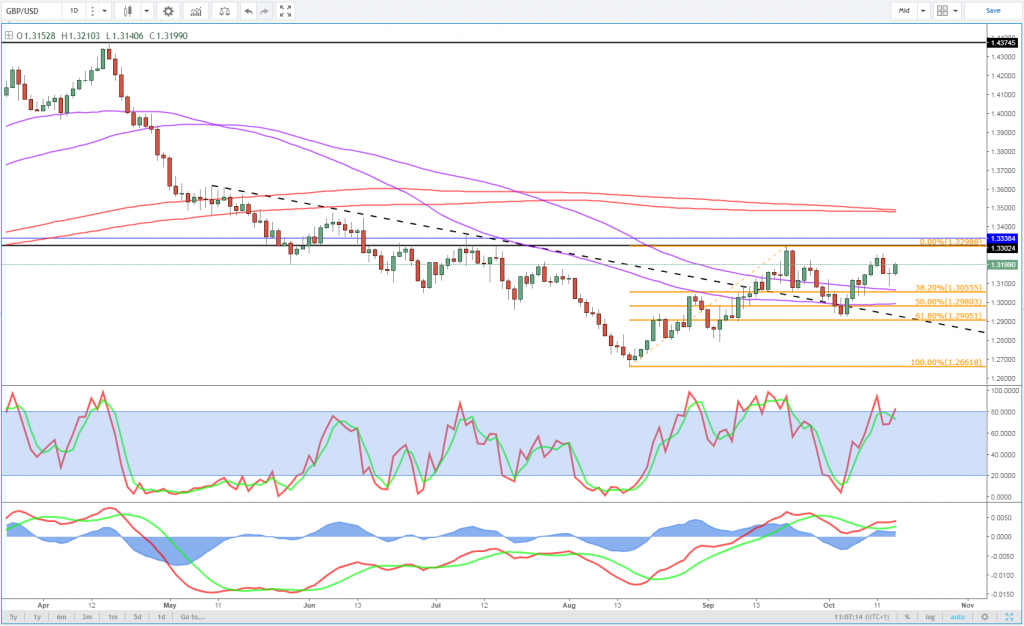

Real wage growth has been among the greatest casualties so far of the referendum result, having fallen in large part due to the currency impact on inflation. While we have edged back into positive territory this year, the increases are tiny which makes even a small beat today something to celebrate. The pound rallied following the data, breaking 1.32 against the dollar before paring gains.

GBPUSD Daily Chart

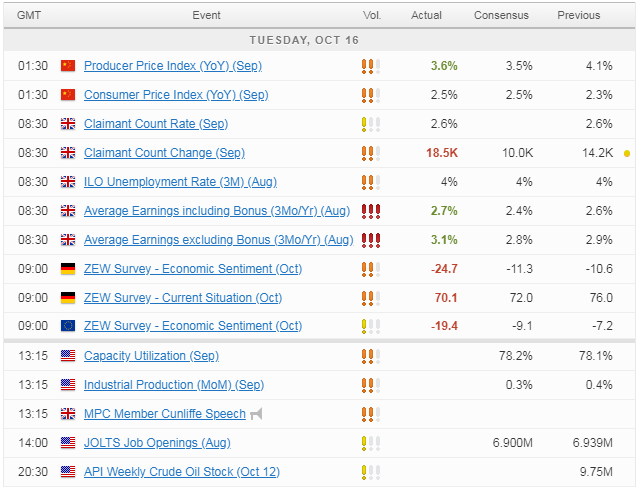

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.