Oil is poised for a second weekly drop after a larger-than-expected gain in American crude stockpiles eclipsed tensions between the U.S. and Saudi Arabia over the disappearance of a prominent critic of the kingdom.

Futures in New York headed for a 3.4 percent loss this week as government data showed U.S. inventories grew by more than double what analysts had forecast. Prices were little changed on Friday after President Donald Trump said it “certainly looks” like missing journalist Jamal Khashoggi is dead and warned of “very severe” consequences for the killing.

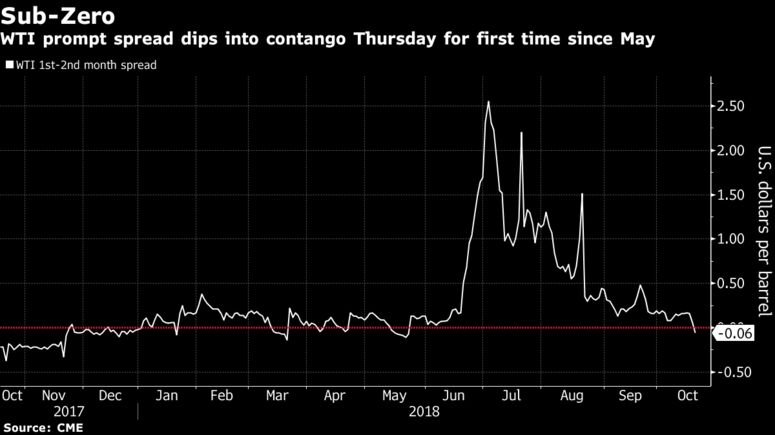

Also in oil markets, the front-month contract traded below the following month’s settlement in New York, flipping into negative territory this week in a condition known as contango. That signals oil traders are turning less optimistic on the near-term direction of the market.

The U.S. inventories data “was a complete shocker, sending oil markets spiralling lower,” said Stephen Innes, Singapore-based head of trading for the Asia Pacific at Oanda Corp. “Price action and discovery suggests traders are no longer concerned about how high prices will go but rather how quickly they will fall. As for today, at least, the bid on dip mentality has run for cover.”

Crude’s rally has staggered since hitting a four-year high earlier this month as the growth in U.S. inventories for a fourth week added to concerns over the lingering trade war between America and China. In the midst of mounting tensions surrounding Saudi Arabia, data showed the world’s largest oil exporter boosted crude output in August as it sticks to its OPEC pledge to pump more.