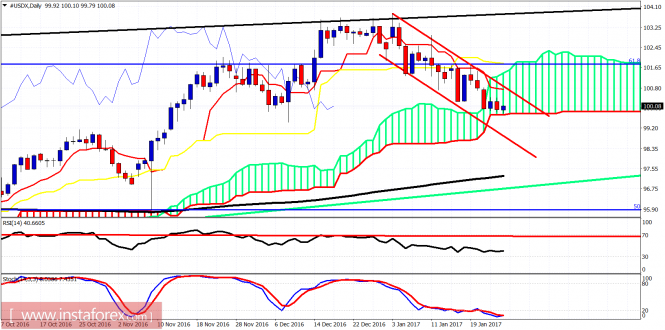

The Dollar index is near its lows and continues to provide bullish RSI divergence signs. The time when the index will confirm the bullish reversal is very close. I’m bullish about the Dollar index, so I expect at least a bounce towards 101.50-102.

Black lines -bullish divergence signs

Blue lines – bearish channel

The Dollar index is still inside the bearish channel. Price is still below the 4-hour Ichimoku cloud. But oscillators are oversold, diverging and turning upwards. This will soon provide a strong bounce for the Dollar index at least towards the cloud resistance at 101.35.

Red lines -bearish channel

On a daily basis the Dollar index reached the lower cloud boundary support and is showing signs of reversal. A bounce towards 101-101.50 is expected now. Bears should wait for a bounce to look for selling while bullish traders are close to important support. I favor short-term bullish positions today.

The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of USDX for January 26, 2017 appeared first on forex-analytics.press.