The Common Problems Homeowner’s Insurance Does Not Cover

Most home buyers are prepared to sign up for homeowner’s insurance, but they often overestimate their coverage.

There are a number of unexpected events homeowner’s insurance does not cover, and in case of an emergency, you do not want to be caught off guard.

Below are some common events not included in the homeowner’s insurance policy, as follows:

Purchasing a home is a milestone that tops many people’s lifetime to-do lists, protecting that investment is Key.

Earthquakes and Floods

Depending on where you live, earthquakes and floods might not be common, but it is worth pointing out because a lot of people live in those zones.

Most natural disasters are covered by homeowner’s insurance, meaning things like tornadoes or lightning strikes or even volcanic eruptions.

Earthquakes and Floods are a different story, as the Insurance Information Institute points out.

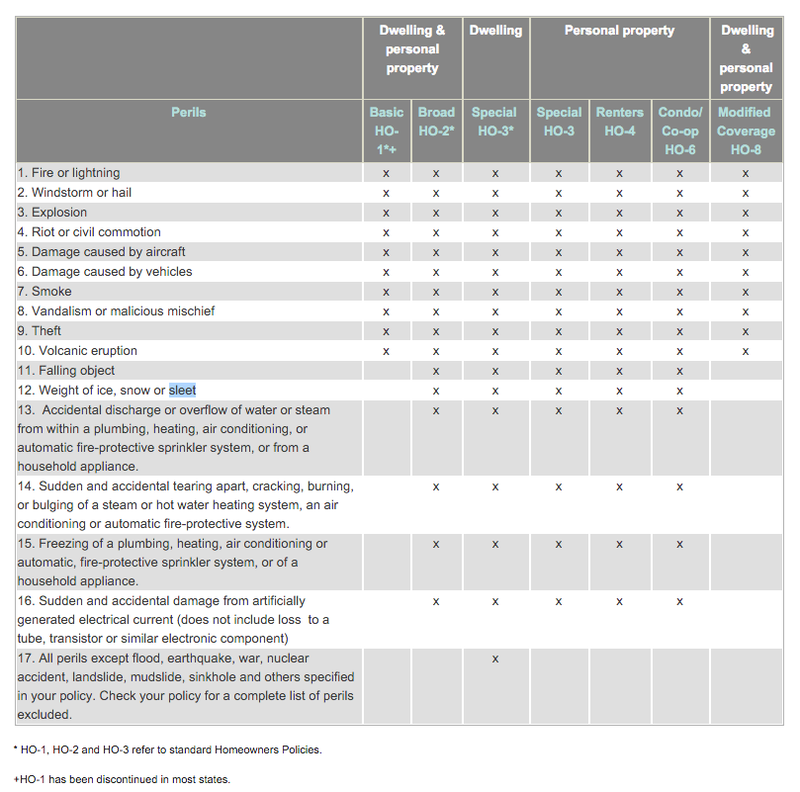

Below is a chart that provides some details on which disasters are covered:

You can buy separate flood insurance from private carriers or from theNational Flood Insurance Program.

If you live in a designated flood zone, flood insurance is usually a requirement.

You can find out if you’re in a flood zone using FEMA’s online flood map.

Most insurance policies include an addendum for earthquake insurance, unless you live in California. The California Earthquake Authority handles this type of insurance and it is offered under a separate policy.

Mold and Termites

Mold and Termites are common issues that virtually all homeowners face.

Both are typically excluded from the homeowners policy for the same reason, as they aree generally considered to be damage due to lack of maintenance. Most policies at least limit the coverage if they do not exclude it.

Homeowners should be extra vigilant about prevention and maintenance.

If you have any leaky pipes or flooding make sure to tend to them immediately, and clean up completely to prevent mold from growing in the home.

Renovating a home, then always use first rate mold-resistant materials.

To prevent termites, get your home inspected by a professional periodically.

Most experts suggest checking every 2 years. Once the termites spread, they can cause major structural damage to your home, and it is very expensive to treat and fix. Catch the pests early, and limit the damage.

The standard insurance policy probably does not cover sewer backups, but you can purchase it separately for about $50 extra a year. However, most standard policies will cover your expenses if you have to live somewhere else because your home is uninhabitable.

The Insurance Information Institute reports: For homes that have been severely damaged and are uninhabitable, homeowners policies may provide

Loss of Use coverage, which provides reimbursement for lodging, food and other living expenses you may incur as a result of having to live outside of your home. Loss of Use coverage also reimburses you for the lost rental income if you rent out part of the house.

Burst pipes, on the other hand, are often covered by your standard policy.

However, if the insurance company determines the damage was due to homeowner negligence, coverage may be voided out.

For example, if your home had a slow leak and you put off fixing it, the insurance company may consider that negligence. This is why it is also important to pipes from freezing in Winter, and protect them when traveling away from home. When pipes burst and the insurance company determines the homeowner did not take proper care of them, the adjuster will put that loss down to the homeowner and deny coverage.

So, it is always good practice to protect and maintain your home, as standard homeowner’s insurance does not cover everything.

Learn what is and is not included, and be better prepared in case of loss.

The post The Common Problems Homeowner’s Insurance Does Not Cover appeared first on Live Trading News.