Part 1 here…, …Massive debts, no good jobs, faltering productivity, soaring entitlements, declining net investment and drastically shrinking household incomes add up to an unprecedented assault on America’s vaunted middle class. In fact, the middle class is shrinking markedly as an empirical matter and fading rapidly as an aspirational possibility.

In the sections ahead, we will attempt to document what elite opinion-makers fail to comprehend about all this. To wit, it is their own profoundly misguided Wall Street/Washington policy regime that has given rise to this massive economic failure.

For more than three decades they have sown the wind. Trump is the whirlwind they are now reaping.

The Essence of Donald Trump’s Appeal To The Flyover Zone: “We Are Not Winning Anymore”

We are here referring to Trump as the rallying figure for main street insurrection. That does not deny the fact that in posturing as an anti-politician outsider he has also proven himself to be a rank demagogue. His scurrilous attacks, inter alia, on Moslems, Mexicans, minorities, women, political opponents and countless more are frequently beyond the pale—–even by today’s rudely partisan standards of public discourse.

Indeed, there has rarely been a political figure in American life that has emitted as much baloney, bombast, brimstone and bile as Donald Trump. And none has ever matched his narcissism and egomaniacal personality.

But that’s not why he’s succeeding.

The Donald’s patented phrase that “we aren’t winning anymore” is what’s really striking a deep nerve on Main Street. His rhetoric about giant trade deficits, failed foreign military adventures and other shortcomings of America’s collective polity self-evidently touches that chord.

Indeed, Trump’s appeal is rooted at bottom in voter perceptions that they personally are no longer winning economically, either. And as we demonstrated above and shall further document in depth, the vast expanse of main street America has indeed been losing ground for the last 25 years.

What is winning is Washington, Wall Street and the bicoastal elites. They prosper from a toxic brew of finance, debt and politics.

We call this deformed system Bubble Finance. Its tentacles extend from the vast apparatus of Wall Street and the finance and asset management businesses it feeds to the venture capital hotbeds of Silicon Valley, Route 128, Research Triangle, New York, Seattle, Austin and Denver.

It also includes to the LA branch of entertainment (movies and TV) and the San Francisco branch of entertainment (social media). Most importantly of all, it encompasses the great rackets of the Imperial City.

Indeed, Washington’s unseemly prosperity arises from its sundry precincts of debt-financed Big Government. The latter has been enabled, in turn, by the massive bond-buying campaigns of the Fed and other central banks.

These flourishing domains of statist hegemony include the military/industrial/surveillance complex, the health and education cartels, the plaintiffs and patent bar, the tax loophole lobbies, the black and green energy subsidy mills and endless like and similar K-Street racketeers.

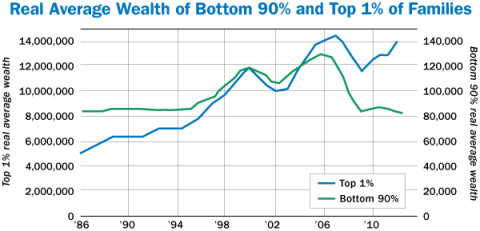

By contrast, most of America’s vast flyover zone has been left behind, and not simply because real wages and household incomes have been relentlessly shrinking, as shown above. Even more strikingly, the bottom 90% of families have no more real net worth today than they had in 1985.

The top 1% are an altogether different matter. Their average real net worth has grown from $5 million to $14 million and now stands at nearly 300% of its level three decades ago.

In large part this drastic dichotomy is owing to the fact that the stock market has been transformed into a gambling casino by the massive monetary intrusion of the Fed. As will be more fully explored later, virtually free overnight carry trade funding and stock market props and puts have generated vast ill-gotten gains from incessant leveraged speculation. These gains, of course, have not remotely trickled-down to Main Street.

Moreover, the wealth round trip of the bottom 90% depicted in the chart below was hardly real in the first place. The calculated levels of main street net worth temporarily soared owing to Greenspan’s 15-year housing bubble. But that eventually culminated in the great financial crisis, meaning that what is left is mainly the mortgage debt.

As we indicated, the persistent shrinkage of real wages and net worth in Flyover America is no accident or blemish of capitalism. It is a consequence of the Washington/Wall Street consensus in favor of printing press money, rock bottom interest rates and 2% inflation targeting. Together and at length, these misguided policies have buried main street households in inflation and debt.

Neither of these millstones is even acknowledged by the mainstream narrative because they have been essentially defined away. By the lights of the Fed and its Wall Street acolytes, in fact, debt has been christened a growth tonic while inflation is held to be a special form of monetary goodness that levitates economic output, incomes and jobs.

Alas, that’s just plain old tommyrot. There is no case for siding with more inflation as a matter of policy and there is much history to warn us of the dangers of rampant debt.

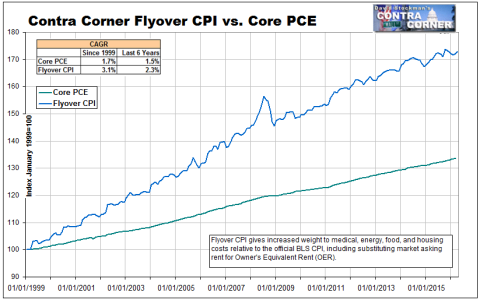

As to the scourge of the ever escalating cost of living, the chart below tracks a modified CPI which includes the aforementioned heavier weights than the regular CPI for the four horseman of inflation—food, energy, medical and housing. It also incorporates a more accurate measure of market based medical costs and housing/shelter costs.

This “Flyover CPI” is a far more honest indicator of the actual cost of living pressures faced by main street households, therefore, than the sawed-off measuring rod used by the Fed called the PCE deflator less food and energy.

Needless to say, during the 29 year span since Alan Greenspan’s arrival at the Fed in August 1987 most people have needed food, heating, transportation, shelter and medical care. The Flyover CPI based on an accurate measuring of those necessities has risen by 3.1% per year during that period.

That relentless rise in living costs has not slowed down since the turn of the century, as shown in the chart below. Yet compared to the 3.1% per annum gain in the actual cost of living in Flyover America since the year 2000, the Fed’s favorite measure has risen by just 1.7% annual.

The wedge between these two inflation measures is not just a statistical curiosity; it’s a big deal and a commentary on why the Washington Beltway and Flyover America are two ships passing in the dark.

In fact, just since the turn of the century the actual cost of living on main street has risen by 40% more than acknowledged by the nation’s purported guardians of price stability at the Federal Reserve. That the political class in Washington and the speculators on Wall Street, therefore, are clueless about the deep economic distress afflicting main street America is not at all surprising.

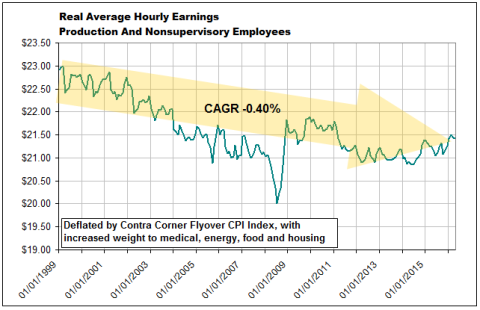

Indeed, this relentlessly increasingly cost of living explains the rise of Donald Trump more than anything else. The fact is, when the purchasing power of hourly wages is deflated by this honest measure of inflation——their buying power is 5% lower than it was 30 years ago. Wage earners are not winning anymore, not by a long-shot.

In this context, the elites who make and communicate national policy couldn’t be more wrong. Their spurious Keynesian model postulates a deficiency of inflation and the myth that nominal incomes among economic agents all march higher in lockstep as the central bank pursues its spurious 2.00% annual inflation targets.

In fact, there is no lockstep march or equitable inflation at all. The incomes and wealth of the bicoastal elites gain far more from financialization and asset inflation than they lose to the CPI, while stagnant nominal wages in the flyover zones are relentlessly squeezed by too much inflation in the cost of daily living.

Moreover, since the brief spurt in the late 1990s, the decline has been even more severe, and undoubtedly galling, too. That’s because Wall Street and the bicoastal elites have gone from one pinnacle of prosperity to the next, even as main street jobs and real wages have remained under intensive assault…

The post The Essence Of Trump’s Appeal To The Flyover Zone: “We Are Not Winning Anymore” appeared first on crude-oil.top.