The Trump and Clinton election is set to be one of the “ugliest” and “messiest” U.S. elections ever, astute gold analyst Frank Holmes warned this week. He believes this is a reason to own gold and will be one of the factors that will see a resumption of gold’s bull market after the summer doldrums which we explore below.

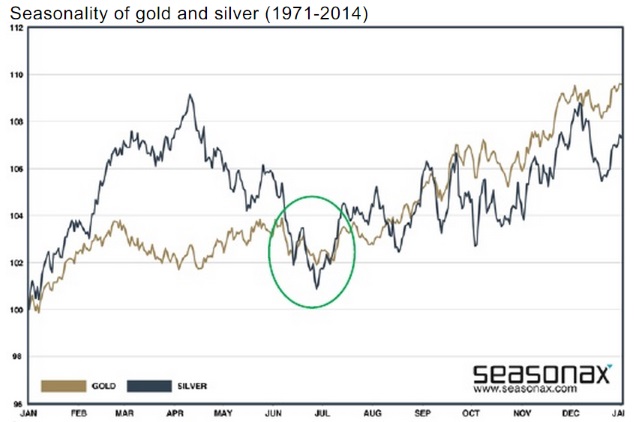

Gold is now in the “summer doldrums” prior to the seasonally stronger period of the Autumn when gold tends to perform best – especially in the month of September (see seasonal chart below). Holmes believes the bull market will resume soon due to the very strong fundamentals including “low-to-negative bond yields around the world. (Between $11 trillion and $13 trillion worth of global sovereign debt currently carries a negative yield.)” and of course heightened geopolitical risk including in the U.S.

He writes:

“Looking more Las Vegas casino than Oval Office, the stage Donald Trump delivered his nomination acceptance speech from Thursday was all gold, from the stairs to the podium, completely befitting of his showman-like style. Whether you support or oppose Trump, it’s time to face reality. This is really happening, and we should all brace ourselves for what will surely be one of America’s messiest, ugliest general election seasons.

Only time will tell which candidate will be triumphant in November, but in the meantime, one of the winners might very well be gold, which has traditionally attracted investors in times of political and economic uncertainty. In the United Kingdom, which voted one month ago to leave the European Union, gold dealers are seeing “unprecedented” demand, especially from first-time buyers. Some investors are reportedly even converting 40 to 50 percent of their net worth into bullion, though that’s not advisable. (I always suggest a 10 percent weighting, diversified in physical gold and gold mining stocks.) In Japan, where government bond yields have fallen below zero and faith in Abenomics is flagging, gold sales are soaring.

It’s not unreasonable to expect the same here in the U.S. between now and November (and beyond).”

GoldCore have long pointed out that the summer months frequently see seasonal weakness as has been the case in recent years and since gold became a traded market in 1971. Gold and silver often see periods of weakness in the summer doldrum months of May, June and July.

Gold’s traditional period of strength is from early August into the autumn and early winter. Thus, early August is generally a good time to buy after the seasonal dip.

Next week, we commence August trading and August along with September and November, are some of the best months to own gold.

Late summer, autumn and early New Year are the seasonally strong periods for the gold market due to robust physical demand internationally. This is the case especially in Asia for weddings and festivals and into year end and for Chinese New Year when voracious China stocks up on gold.

Gold’s weakest months since 1975 have been June and July. Buying gold in early August has been a good trade for most of the last 40 years and especially in the last eleven years, averaging a gain of nearly 11% in just six months after the summer low.

Thackray’s 2011 Investor’s Guide notes that the optimal period to own gold bullion is from July 12 to October 9.

Holmes is the CEO and chief investment officer of U.S. Global Investors and is one of the better gold analysts out there. He shares our view regarding the summer being an optimal time to buy gold. Read more here.

Discounted Bullion For Storage (Allocated and Segregated) In London, Zurich and Singapore

London

Gold Bars (1 oz) x 100

Zurich

Gold Bars (1 oz) x 50

Gold Krugerrands (1 oz) x 10

Silver Bar (1051.2 oz Engelhard) x 1

Platinum Eagle (1 oz) x 1

Singapore

Gold Bars (1 oz) x 50

Gold Eagles (1 oz) x 5

Silver Maples (1 oz) x 455

Silver Eagles (1 oz) x 455

Silver Bars (100 oz) x 15

Call for discounted prices +353 1 632 5010 (IRL) +44 (0) 203 086 9200 (UK) +1 302 635 1160 (US/ Canada)

Gold and Silver Bullion – News and Commentary

Gold up slightly in Asia ahead of BoJ policy review, rate decision (Investing.com)

Gold futures score a 2-week high as Fed inaction fuels bulls (Marketwatch)

Gold inches up, set for monthly rise as markets await BoJ decision (Reuters)

U.S. jobless claims rise; labor market still strong (Reuters)

TD’s $230 Billion Man Goes Maximum Gold as Volatility Mounts (Bloomberg)

World heading for shortage of physical gold – DRDGold (Mining Weekly)

‘Joe Weisenthal: How Donald Trump changed my mind about gold (Bloomberg)

IMF admits disastrous love affair with euro, apologizes for immolating Greece (Telegraph)

Monetary sledgehammer to nut of Britain’s post Brexit economy? (Telegraph)

Stockman Warns “2008 Was Just Spring-Training For What Comes Next”(Zerohedge)

Gold Prices (LBMA AM)

29 July: USD 1,332.50, EUR 1,200.18 & GBP 1,012.03 per ounce

28 July: USD 1,341.30, EUR 1,208.78 & GBP 1,017.64 per ounce

27 July: USD 1,320.80, EUR 1,200.21 & GBP 1,007.77 per ounce

26 July: USD 1,321.25, EUR 1,199.56 & GBP 1,006.40 per ounce

25 July: USD 1,315.00, EUR 1,196.91 & GBP 1,000.32 per ounce

22 July: USD 1,323.20, EUR 1,199.22 & GBP 1,005.10 per ounce

21 July: USD 1,322.00, EUR 1,199.32 & GBP 1,000.75 per ounce

Silver Prices (LBMA)

29 July: USD 20.04, EUR 18.03 & GBP 15.20 per ounce

28 July: USD 20.41, EUR 18.42 & GBP 15.52 per ounce

27 July: USD 19.58, EUR 17.81 & GBP 14.95 per ounce

26 July: USD 19.68, EUR 17.89 & GBP 15.00 per ounce

25 July: USD 19.41, EUR 17.66 & GBP 14.77 per ounce

22 July: USD 19.70, EUR 17.87 & GBP 15.03 per ounce

21 July: USD 19.34, EUR 17.55 & GBP 14.66 per ounce

20 July: USD 19.70, EUR 17.88 & GBP 14.95 per ounce

Recent Market Updates

– Gold Bullion Up 1.6%, Silver Surges 3.7% After Poor U.S. Data and Dovish Fed

– Marc Faber: Invest 25% Of Investment Portfolios In Gold Bullion

– “Could Not Invent A More Bullish Story For Gold Bullion”

– Gold In Bull Market – “Every Reason For It To Continue” – Frisby In Money

– Is Gold Set To Hit $1,500 Per Ounce?

– Why Italy’s bank crisis could be a ‘ticking time bomb’

– Gold Holds Near Two-Week Low as Risk Appetite Rises on U.S. Data

– IMF Scraps Forecast for Global-Growth Pickup on Brexit Fallout

– Gold, Trump and Rates: Bank That Foresaw Rally Flags $1,500

– Gold Lower After Central Bank’s Surprise Move

– “We Are On the Cusp of an Explosion in the Silver Price”

– Stocks Rally – Is Brexit Systemic Risks Contained?

– Britain has a new prime minister – here’s what that means for you

The post Trump, Clinton, “Ugliest” Election Coming – Gold’s “Summer Doldrums” Prior To Resumption of Bull Market appeared first on crude-oil.top.