New tariffs already priced in

Investors have taken US President Donald Trump’s announcement of new tariffs against China in their stride on Tuesday, with indices across much of Asia and Europe in the green and US futures a little higher.

The tariffs have been talked about for some time now and it was only a matter of time until the announcement came so there was no reason to expect too much of a response, unless either the final number was higher or the list included unexpected items that investors deemed damaging. Not only did neither of these happen, but some expected items were not included on the list and the tariff will only be 10%, rising to 25% at the end of the year if negotiations don’t move forward, a minor positive.

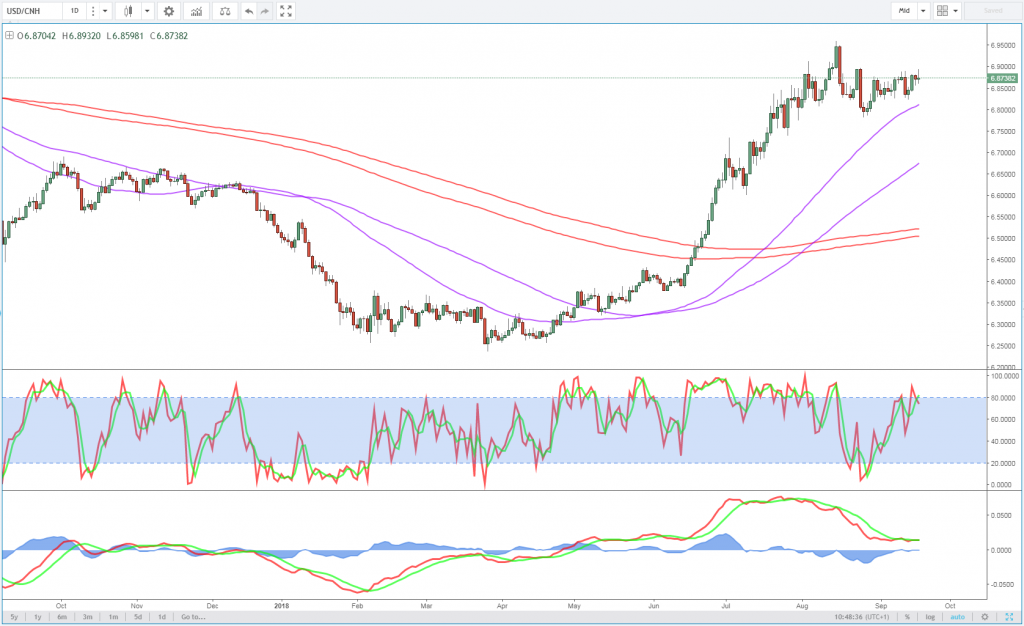

The ball is now in China’s court, how they respond will determine how big an escalation we can expect and what the economic and market price will be. So far, the economic impact has been minimal but we’ve only just entered into significant tariff territory. The greatest impact has come in the markets, with Chinese stocks having fallen into bear market territory and the yuan having fallen more than 10% against the dollar.

USDCNH Daily Chart

OANDA fxTrade Advanced Charting Platform

DAX higher despite new Trump tariffs

Will Trump follow through with more tariffs?

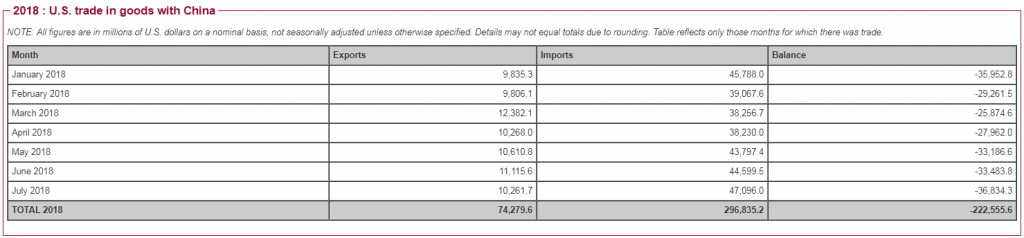

The interesting result of this is that the currency move has largely offset the impact of the tariffs on Chinese goods and the trade deficit has widened, I’m sure much to the frustration of the Trump administration. If we see a similar result from these tariffs and the impact on prices at home is more significant, I wonder whether Trump will revisit the strategy or just persisxt and attempt to inflict as much damage on China and its markets as possible.

US and China Trade Data (2018)

US Census Bureau

China obviously doesn’t have the tariff firepower that Trump has but appears to be adopting a different strategy for getting under the skin of the Trump administration. Aside from counter-tariffs, more of which will likely be announced very soon, China has shown a willingness to forge closer ties with others and reduce its reliance on the US, most notably Russia, something that will make lawmakers very uncomfortable and could hurt the US much more in the longer-term.

Ultimately, I’m sure investors would rather that common sense prevail and both sides return to the negotiating table and find a solution that removes tariffs and promotes free trade but it doesn’t feel like we’re any closer to that, especially if China follows through on reported threats to reject an invitation for talks if Trump follows imposes more tariffs.

Asia closing market notes : riding the risk rollercoaster

Politics likely to remain primary driver of markets

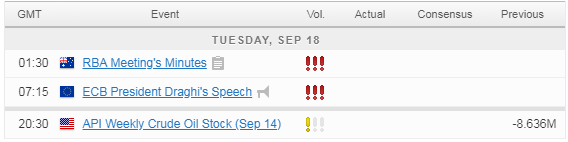

While there are a number of notable economic events that investors should pay attention to over the course of this week, politics has been dominant and I don’t see that changing, especially as Brexit negotiations continue with the deadline fast approaching. The pound has been extremely sensitive to Brexit reports recently, no matter how minor the comments appear to be and it’s likely that will continue until we start to see some significant progress.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.