A dash of reality

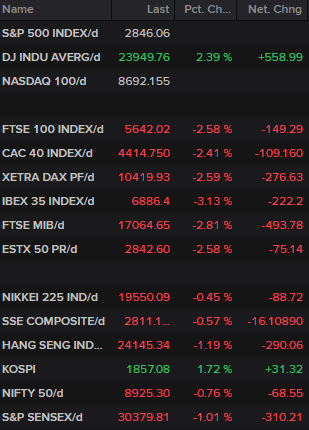

The last month has been much better than the one the preceded it for stock markets, but the rally may be running out of steam as earnings season brings us back down to earth.

Source – Thomson Reuters Eikon

Results from the banks this week will provide a much clearer picture of the economic consequences of the coronavirus and what lies ahead. JP Morgan and Wells Fargo’s numbers were sobering, to say the least, while others this week may bring investors back to earth with a bang, starting with Goldman Sachs, Bank of America, Citigroup and Delta Air Lines today.

There was no sugar coating from the IMF on Tuesday, either, as the organization forecast the worst contraction since the Great Depression. Meanwhile the OBR in the UK said it expected the economy to shrink by 35% this quarter. And this is while not knowing when economies will be fully up and running again, so it could be much worse, which should give investors something to think about before they get carried away.

Stocks have enjoyed a decent rebound over the last month so perhaps we’re seeing a little risk now being taken off the table as the economic reality of the situation starts to hit home. That said, if economies now start to ease lockdown measures and the cloud of uncertainty lifts, investors may see opportunity in these dips once again. The central banks have flooded the market with liquidity and we’ve seen what that has done before.

IMF warning does oil prices no favours

Efforts by oil producers around the world to address the global imbalance and price plunge that’s followed have been insufficient, it seems, as WTI dips back below $20. The move will be exacerbated by the latest forecasts from the IMF and more downbeat tone across the markets but unless we start to see some results on the supply side, prices will remain under severe pressure and more meetings will be necessary.

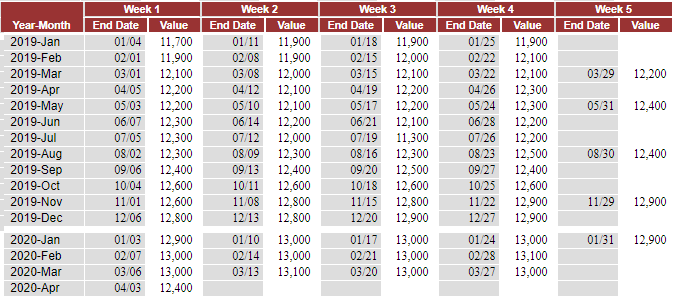

The US will be key to this, with output already down to 12.4 million last week from a peak of 13.1 million in March. Given what we’re seeing in rig numbers, I expect we’ll see further significant declines here which may eventually prop up the market.

Source – EIA

Stronger dollar pulls gold off its highs

The dollar is back in favour this morning, as stocks tumble on the various warnings, which is pulling gold off its newly established highs. The yellow metal is flourishing in this environment – record low interest rates, unprecedented bond buying, softer dollar – but these things don’t just move in a straight line. If we are due a pull back in risk markets then that could slow gold’s progress, if the dollar remains in favour, but longer term, this environment is very favourable and I think all-time highs may not be too far away.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Bitcoin trapped but rally reliant on risk appetite holding up

Bitcoin looks a little trapped at the moment, with $6,500 and $7,500 providing strong barriers to the downside and the upside. Bitcoin has rebounded nicely in the improved risk environment but could be vulnerable in the coming weeks if we see that pare back. It’s early days but if $6,500 falls, it could take the wind out of the sails of the rally and $6,000 may not put up much of a fight.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

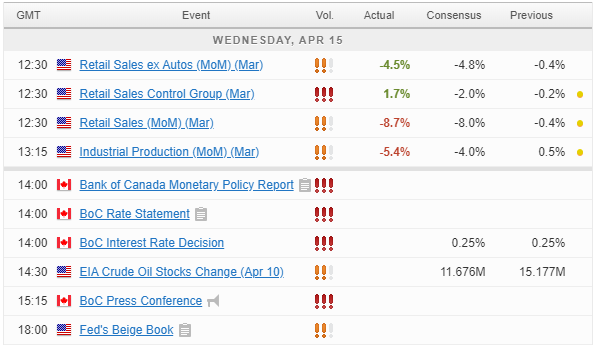

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.