Tokyo prices rise most in four months

This morning’s release of consumer prices in Tokyo saw the biggest rise in four months. Prices rose 0.9% y/y, beating economists’ estimates of a mere 0.5% increase by a large margin. Prices in June were 0.6% higher than a year earlier. This contrasts with the national reading for June which showed a below-forecast 0.7% gain. Excluding food and energy, the price rise was a more modest 0.5% y/y.

NOTE: Japan releases two sets of inflation data. A national one, which has a lag of one month, and one for just Tokyo, which is more current.

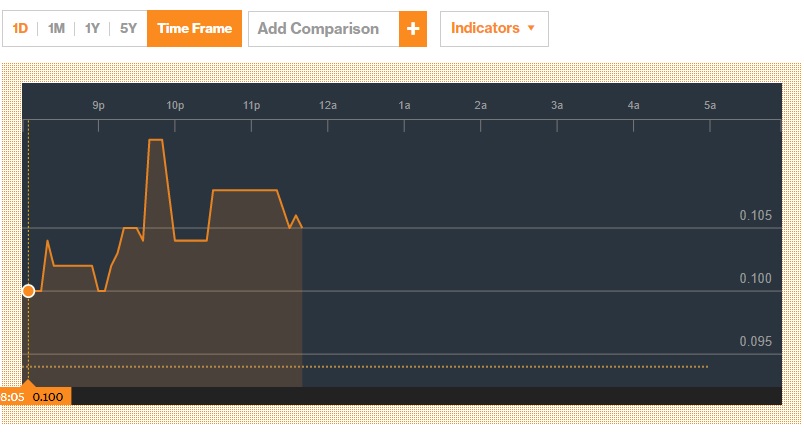

In the currency markets, the yen was given a little boost across the board post-data though there was perhaps more reaction in the bond markets. The 10-year JGB yield touched 0.1% for the second straight session. Last Monday, the Bank of Japan announced its first special fixed rate bond auction since February, offering to buy 10-year bonds at 0.11%. The Bank announced unchanged tenors and amounts at its last daily bond auction before the rate meeting on Monday/Tuesday next week.

USD/JPY Daily Chart

Bank of Japan to change QQE plan?

Also fueling the rise in Japan yields is speculation that the Bank will make changes to its bond yield targets at next week’s meeting. Observers suggest that quite often when it comes to the Bank of Japan, there is no smoke without fire. Some suspect that they may be testing the waters for such a move later in the year. Analysts reckon that any shift higher in yields, or a steepening of the yield curve, would be beneficial for Japanese banks and financial institutions.

10-Year JGB Yield Chart

ECB sticks to its plans

At yesterday’s rate meeting, the ECB maintained its stance to end bond purchases by the end of the year and pledged to keep interest rates static at least through the summer of 2019 before considering a tightening bias. The EUR did slide versus the dollar after the press conference, though this could also be attributed to gains in the US dollar ahead of today’s release of US Q2 GDP data.

Dollar Rebounds in Anticipation of Q2 GDP Release

US Q2 GDP data on tap

The main event on today’s data calendar will undoubtedly be the release of US Q2 GDP data. Estimates suggest growth accelerated to 2.3% q/q from +2.2% in Q1, while the annualized figure is seen jumping to 4.0% from 2.0%. Apparently, a top Trump official has been telling Republicans to expect a “blockbuster GDP number” while Trump himself has commented he’d be happy with a number 4 in front. Other data releases include German import prices and US personal consumption expenditure prices for Q2.

You can see the full MarketPulse data calendar at: https://www.marketpulse.com/economic-events/