With Donald Trump going after Jeff Bezos' "capture" of The Washington Post this week, along with Facebook's alleged liberalization of the mainstream's news feeds, the topic of press independence is once again back out of conspiracy theory back-rooms and near top of mind for many average indoctrinated joes. Almost thirty years ago, Edward Herman and Noam Chomsky claimed that media are “effective and powerful ideological institutions that carry out a system-supportive propaganda function," but as ProMarket's Luigi Zingales exposes, for Italy, there is some circumstantial evidence that Italian newspapers are captured by banks.

Economists would argeu that in a competitive market, media responds to the ideological preferences of their consumers, not of their owners (see).

This result is likely to be true when it comes to political ideology: consumers have strong preferences and in a competitive market media responds to these preferences. The same conclusion is less obvious when it comes to business interests. Most consumers do not have a strong ideological preference for the treatment of derivatives in bankruptcy or the proper accounting treatment of mergers. As a result, media can more easily cater to advertisers.

Yet, as long as there is sufficient diversification of interests on these issues across advertisers and media owners, on average the media can perform their function to inform in an unbiased manner, rather than to manufacture a particular consensus.

These conditions, however, are likely to fail when all of the media are in financial difficulty and the issue at stake directly concerns the banking system. When debtors are in economic or financial distress, creditors have great influence over their decisions. There is no reason why newspapers should be any different. Hence, financial institutions could–at least in principle–obtain a significant market power on the reporting of some news in the printed media, thanks to their lending. Is this just a mere academic possibility or does it have some empirical basis?

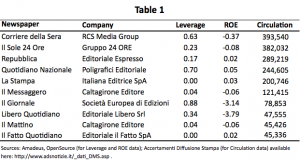

The current Italian environment represents a unique opportunity to test this hypothesis at least. Many Italian newspapers are losing money and/or are heavily indebted (see Table 1 below).

Even those that are not heavily indebted have reason to be influenced by the interests of banks. For example, Il Messaggero and Il Mattino are owned by Caltagirone, an industrialist who also owns a large stake in Unicredit, one of the two largest banks in Italy. Editoriale Espresso is controlled by the De Benedetti family, who during this period had to negotiate with the banks regarding another company they own (Sorgenia). The only newspaper that is not highly leveraged or highly dependent on banks for other reasons is Il Fatto Quotidiano.

To test how newspapers report about news that touches directly on banks’ interests, we need some events in which banks’ interests are at stake, and we need a benchmark. As a benchmark I will use the foreign media. For events, I will choose government actions, one against banks’ interests, and one in favor of them. The first, which occurred in January 2015, is the Government’s decision to force large cooperative banks (Banche Popolari) to become stock companies. The management of these banks violently opposed this decision for fear of losing control. The second event, which occurred in April 2016, regards the Government-sponsored creation of a superfund (not unlike that championed by Paulson in the fall of 2007) called Atlante, to mutualize bank losses across the entire financial system. The Government and the Bank of Italy used their moral suasion to coax banks, pension funds, and insurance companies to invest in a fund that will buy non-performing loans and new equity offerings by banks. In part, it was regulatory arbitrage. In part, it was a transfer of the banks’ losses onto the portfolio of pensioners and retirees. The major banks heavily supported the creation of this fund.

Thus, both of these decisions had strong government support, but they did not both have strong bank support: banks opposed the first, and supported the second.

I collected all the news that appeared in the top 10 Italian newspapers during the first 9 days for both events, having a research assistant classify the articles on the basis of their content. An article is considered positive (+1) if it contains explicit positive judgments about the decision. For example, on 4/11/16 Il Messaggero printed an article stating that the Atlante fund was “an amazing result.” “To the many voices in favor of “Atlante”, from Draghi to the IMF, from the G-20 to Minister Schaeuble, the authoritative Jean-Claude Trichet adds his,” writes La Repubblica on 4/20/16.

An article is considered neutral if it simply describes the fund, as for example Conti’s article in Il Giornale on 4/13/16. An article is considered critical if it raises doubts on whether the fund could actually work for the stated purpose. For example, an article on 4/12/16 in Il Fatto Quotidiano titled “Too many NPLs but too little money: the weight that crushes Atlante.” To establish what the “unbiased” view should be, I also collect the opinions published in the six top foreign newspapers.

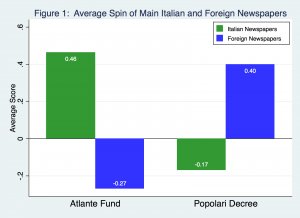

Figure 1 compares the average scores of the articles in Italian and foreign newspapers about the two events. Italian newspapers are strongly in favor of the Atlante fund, while the foreign newspapers are mostly against. The opposite is true for the transformation of Popolari: Italian newspapers are mildly against it, while foreign newspapers are strongly in favor of it.

Since there is no particular reason why foreign newspapers should be biased in one way or the other, we can take their reporting as unbiased reporting. Hence, on news where the Italian banks had an interest in positive reporting, Italian newspapers are much more positive than foreign ones. By contrast, on news where the Italian banks had an interest in negative reporting, Italian newspapers are much more negative than foreign ones.

It will take many more episodes like this to reach a reliable conclusion. However, there is prima facie evidence consistent with Italian banks pressuring Italian newspapers to write more favorably about topics they have a direct interest in.

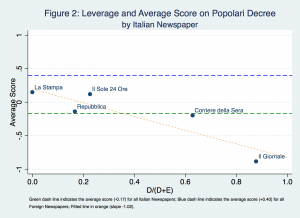

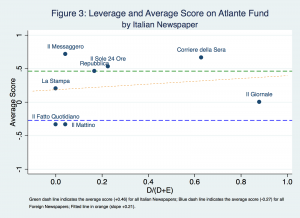

Figure 2 and 3 show how the variability across newspapers is related to the leverage of the newspaper. The blue line represents the average score of foreign newspapers and the green line the average of Italian ones.

In Figure 2 there is a very strong negative correlation between leverage and spin. The less indebted newspapers have a more positive opinion of the Popolari decree (like the international media), the more highly levered ones have a more negative opinion.

In Figure 3 there is a positive correlation between leverage and positive spin. The more indebted newspapers have a more positive opinion of the Atlante fund, while the less indebted one have a more negative view (in line with the international media).

Notice that because the two events have very different means, this bias is not a newspaper specific bias pro or against the government or pro or against a more favorable spin in general, but it moves exactly in line with the interest of banks: the more levered a newspaper is, the more it seems to agree with banks, whatever the interest of banks is.

How can this occur? While it is plausible that banks can put some pressure on newspapers’ editors, it is hard to imagine that any serious journalist would change her opinion according to what the editor says. Yet, capture can be obtained in much more subtle ways.

The most pervasive way is capture by sources. Often journalists are not experts on the topic they write about and thus they rely on the opinions of sources, whether they admit it explicitly or not. When the usual sources are all on one side of an issue, the newspapers will inevitably follow that bias. This possibility, however, cannot explain the difference between Italian newspapers and foreign ones. If anything, foreign correspondents have to rely more on sources, because they are less knowledgeable of the Italian situation. But they appear less biased.

The second possibility is that newspapers’ editors select the opinion to publish under explicit or implicit pressure from banks. To explore this possibility I look at the main Italian newspaper, which is also one of the more indebted ones: Il Corriere della Sera. I find that two regular economic commentators expressed negative opinions about the Atlante Fund elsewhere (in a foreign newspaper and in an online magazine) but did not publish any article in Il Corriere della Sera on the issue of the Atlante fund. This is consistent with the newspaper selecting commentators to write about an issue in order to project a pro-bank spin.

The data are clearly too limited to draw a strong conclusion. Yet, there is some circumstantial evidence that Italian newspapers are captured by banks, enough to call into question the Panglossian view of the media shared by most people in the economic profession, and enough to call for an investigation by the Italian antitrust authority.

The post Are Newspapers Captured By Banks? appeared first on crude-oil.top.