By EconMatters

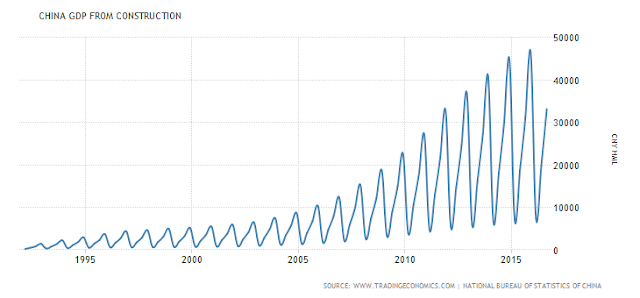

We discuss China`s Credit Bubble, Real Estate Bubble, and Non Performing Loans Bubble in relation to CAT; a stock up $30 on a substantial decline in Earning`s and Revenue Growth. We think ultimately CAT will cut their dividend like a lot of E&Ps will also be forced to come to terms with. Current Institutional owners of this stock should be dumping this over-valued stock, not to mention any Retail Holders, as we think CAT is going to retest the $60 a share level over the next two years. CAT could very easily be a $20 stock in five years as the ZIRP Free Money Party comes to an end, taking stocks with declining revenues where they would otherwise trade without Central Bank excesses.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The post Caterpillar is The PosterChild for OverValued Market (Video) appeared first on crude-oil.top.