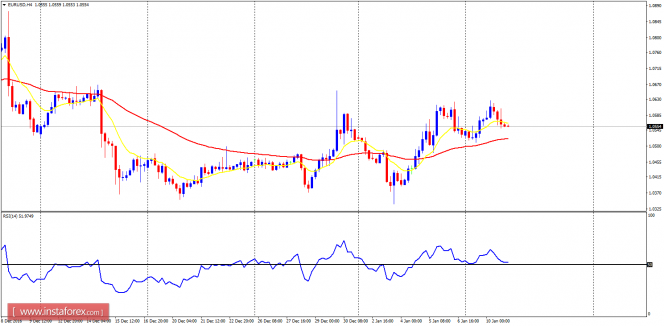

EUR/USD: The EUR/USD has

been making attempt to go upwards. Price is now above the support line at 1.0500,

and might eventually target the resistance lines at 1.0550, 1.0600 and 1.0650. Bulls have been making some effort to push

price upwards, and they may eventually succeed.

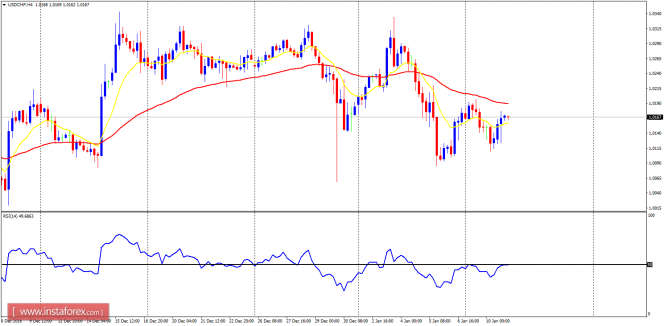

USD/CHF: This market has

become fairly choppy in recent times. However, the bias remains bearish because

the EMA 11 is below the EMA 56, and the RSI period 14 is somewhat below the

level 50. There could be more bearish effort, which would make price test the

support levels at 1.0050 and 1.0000. It would not be easy for the support level

at 1.0000 to be breached to the downside, unless there is a strong selling

pressure.

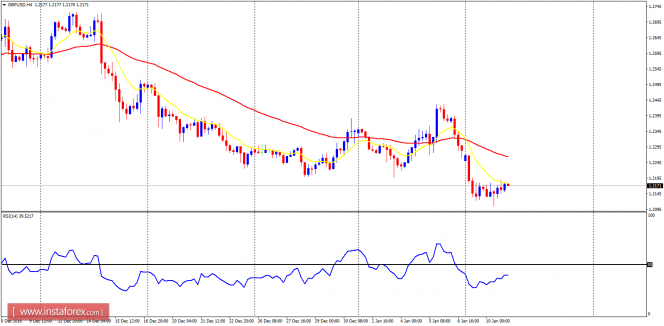

GBP/USD: The GBP/USD is

still in a bearish mode. Any rallies in this market could be seen as an

opportunity to go short, for the bias on 4-hour and daily charts is bearish. As

long as price is not able to go above the distribution territory at 1.2650, the

bearish bias would be valid.

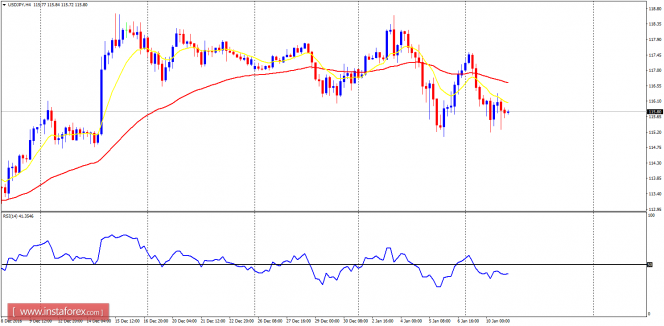

USD/JPY: There is a

‘sell’ signal on this pair – as USD becomes weak. There is a Bearish

Confirmation Pattern in the chart, and further southward journey may be

experienced, which may enable the demand levels at 115.50, 115.00 and 114.50 to

be tested this week or next week.

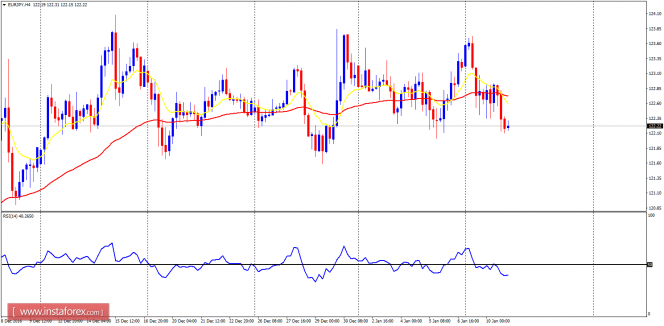

EUR/JPY: This currency

trading instrument has been consolidating for a few weeks. The market environment

is quite choppy, but a closer look at it shows some weakness in price, as it

goes below the EMA 11 (which has crossed the EMA 56 to the downside). The RSI

period 14 is also below the level 50. Unless EUR becomes very strong, this

instrument would possibly go southward.

The material has been provided by InstaForex Company – www.instaforex.com

The post Daily analysis of major pairs for January 11, 2017 appeared first on forex-analytics.press.