Daily Markets Broadcast

2018-10-31

Wall Street ends a volatile day sharply higher

Wall Street closed strongly yesterday, bouncing from near-four month lows, amid gains in the tech and transport sectors. China’s manufacturing PMI slides to 50.2 in October, below estimates.

US30USD Daily Chart

-

The US30 index posted its biggest one-day gain in two weeks amid strong buying in the last hour of trading. Gains were led by the tech and transport sectors

-

The index has traded below the 200-day moving average, which is at 25,092 today, for the past five days

-

The run-up to Friday’s nonfarm payroll report starts today with the release of October’s ADP employment change, which is expected to show an add of 189,000 jobs.

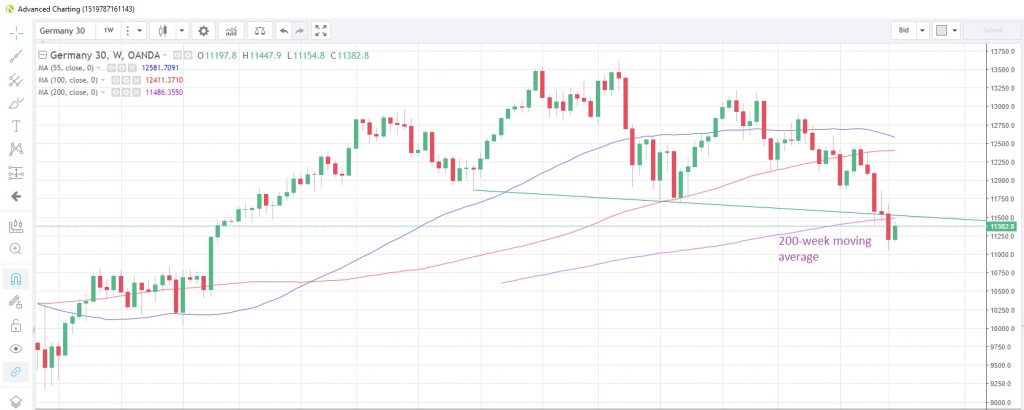

DE30EUR Daily Chart

-

The DE30 index rose for a second straight day yesterday, despite disappointing data, but is till on track to post its worst month since February

-

Support at the 55-month moving average at 11,187 remains intact, while the 200-week moving average caps at 11,487

-

Euro-zone Q3 GDP growth came in below forecast at +0.2% q/q vs +0.4%. Today we see October CPI data, which is expected to accelerate to +2.2% y/y from +2.1%. Slower growth and higher inflation is generally viewed as not a good combination for equities.

CN50USD Daily Chart

-

The China50 index rose for the first time in three days yesterday, still holding above the five-week low struck mid-month. However, it’s still facing its worst month since February

-

The 55-month moving average at 10,550 still lends support while the next resistance point is possibly at 11,252, the 55-day moving average

-

October manufacturing PMI came in below forecast with a 50.2 print, lowest since July 2016, which was the last time the index was below the 50 expansion/contraction threshold. The disappointing number could hamper sentiment.