Daily Markets Broadcast

2018-11-05

Wall Street drops despite strong jobs report

Wall Street fell Friday despite the US adding the most jobs in eight months. Fast wages growth pushed US yields higher while Apple suffered on slowing iPhone sales.

We will pause the Daily Market Broadcast tomorrow 6 Nov and 7 Nov 2018, resuming our service on 8 Nov 2018.

US30USD Daily Chart

-

The US30 index fell for the first time in four days after earlier touching a two-week high

-

The index failed to hold above the 100-day moving average at 25,462 on Friday. A weaker start is pressing the index toward the 200-day moving average at 25,077

-

Today we see the ISM non-manufacturing reading for October and, like its manufacturing counterpart, is seen sliding to 59.5 from 61.6. A lower number could be negative for the index.

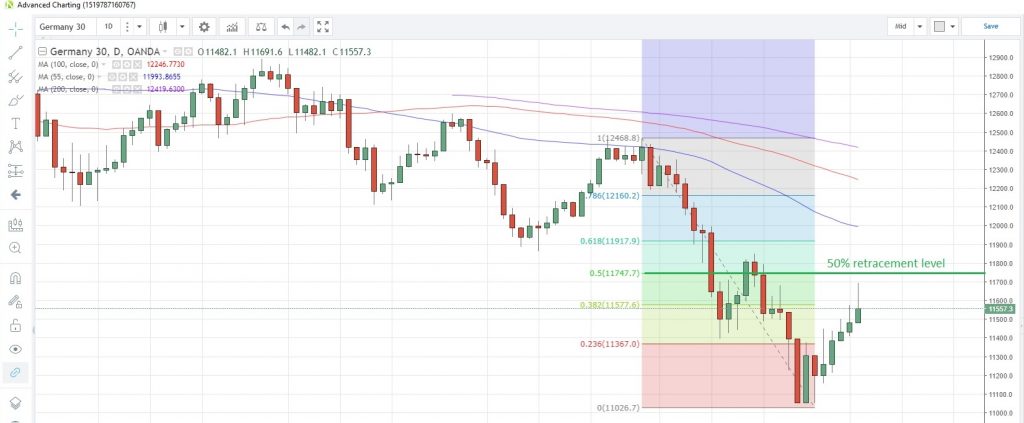

DE30EUR Daily Chart

-

The Germany30 index extended gains to a fifth straight day, the longest bullish streak since mid-July, reaching the highest level in two weeks

-

The index is rising toward the 50% retracement of the Sep27 to Oct 26 drop at 11,748. However, negative sentiment across global equity markets suggests a test of this level may be postponed

-

Euro-zone investor confidence probably slipped in November, data to be released today may show. The Sentix index is seen falling to 10.1 from 11.4.

WTICOUSD Weekly Chart

-

WTI slumped to a six month low on Friday after the US confirmed that eight importers had been exempted temporarily from the Iran sanctions

-

The commodity had its worst down-week since February last week, closing below the 55-week moving average for the first time since September 2017. The moving average is at $65.378 today

-

API weekly crude stocks data are due tomorrow. Last week saw inventories rise for a second week, with 5.7 million barrels added.