May suffers setback as negotiations hit another apparent impasse

European markets are set to get the week off to a positive start despite Brexit and Italy risks seemingly rising as both enter into a crucial period.

Theresa May looks to have suffered numerous setbacks over the weekend that has reportedly forced her to abandon plans for an emergency Brexit cabinet meeting on Monday. May was hoping to get approval of a Brexit deal with the aim of securing an agreement with EU leaders this month but that now looks in serious jeopardy after the EU rejected her compromise for an independent mechanism that would enable the UK to exit the backstop customs arrangement.

The EU has insisted on ECJ oversight, which the UK can never agree to as it could leave it trapped in the backstop arrangement indefinitely which completely negates the point of the decision to leave in the first place. To make matters worse for May, four remain-backing ministers are apparently on the verge of quitting which would be yet another blow, albeit one she has survived in the past in more threatening circumstances.

None of this makes traders feel any more confident that we’re going to avoid a painful no deal scenario and we’re seeing that reflected in the currency at the start of the week. The pound is off against the euro, dollar and yen and looking quite vulnerable.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Brexit headlines are going to feed the volatility in sterling over the coming days and weeks as we get a better idea if the last 18 months of negotiations have been nothing more than a frustrating and tedious waste of time, or whether a fudge can be found for those last few – albeit major – remaining issues.

GBP weakens as Brexit advances stall

Italy draft budget expected Tuesday but government unwavering on deficit

It’s been a little quiet on Italy the last week or so but that will change at the start of the week as the government prepares to resubmit its draft budget. Ministers have been resolute about the need for an increased budget deficit of 2.4% for next year, insisting that this is not something it is willing to back down on. Recent reports though suggest that the Finance Minister will instead try to win over the European Commission by offering more realistic growth forecasts, while maintaining the deficit number, which you would imagine must therefore mean concessions somewhere on spending or taxes.

source: tradingeconomics.com

This will all come to a head on Tuesday and we may not have to wait long to know whether Italy is heading towards an Excessive Deficit Procedure which could ultimately lead to fines of up to 0.2% of GDP against the country. This may continue to weigh on the euro in the near-term as Italian yields remain elevated, lifting others with them and weighing on Italian stocks, and the spread over German Bunds sits at 2013 levels.

Oil rallies on JMMC report and Saudi December cut

Oil prices are up more than 1% at the start of the week following the meeting of the Joint Ministerial Monitoring Committee (JMMC) of OPEC+ nations over the weekend, at which the committee concluded that oversupply next year will warrant output cuts. The analysis doesn’t come as much of a surprise given the recent inventory data and the US decision to offer waivers to eight importers of Iranian oil, despite Saudi Arabia, Russia and itself pumping record levels of oil.

Oil (WTI and Brent) Daily Charts

It also doesn’t bind the countries to committing to such a move and there is likely to be some debate on the need for such a move in Vienna next month, with Russia expressing doubt. Saudi oil minister Khalid al-Falih confirmed that its output will fall by half a million barrels a day in December, regardless of an agreement, which is offering some support for oil prices today. More will need to be done though to persuade traders that the recent bear-market in WTI isn’t justified.

The oil market’s far reaching implications

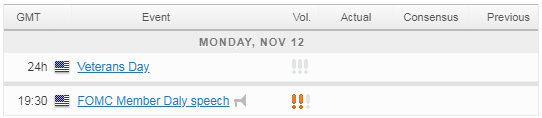

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.