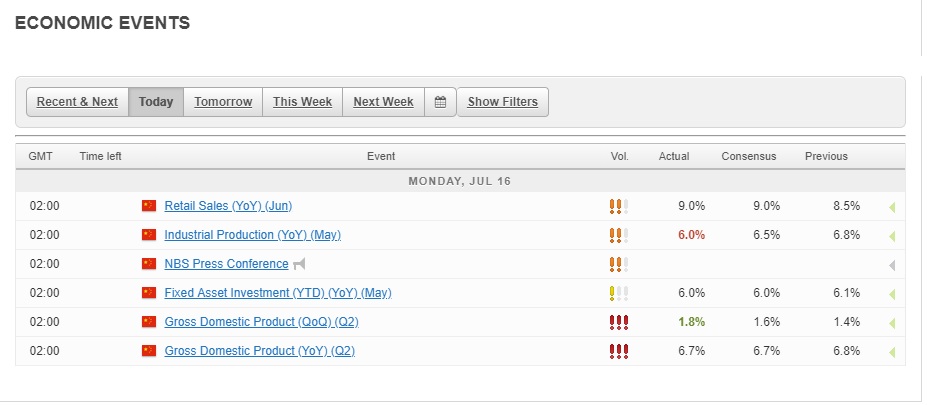

China Q2 GDP growth as expected, though lower than Q1

In this morning’s China data dump, Q2 GDP growth came in as expected but industrial production disappointed. The Chinese economy grew 6.7% y/y in Q2, a slower pace than in Q1 but was in line with economists’ forecasts. Industrial production for May on the other hand failed to match expectations, coming in at +6.0% y/y compared with estimates of 6.5% and a marked slowdown from April’s 6.8% increase.

In other data releases, June retail sales matched forecasts at +9.0% y/y, rising from +8.5% in May while fixed asset investment also equaled forecasts with a 6.0% y/y increase in May.

Equity markets fall; currencies stable

In a knee-jerk reaction, markets appeared to focus on the fact that Q2 growth was lower and industrial production missed. Given that the full impact of the first tariff implementations will not be truly felt until Q3, the growth outlook will become more cloudy going forward. AUD/USD slid to a low of 0.7408 though rebounded to near intra-day highs at 0.7434 in late trading.

In the equity space, China shares reacted negatively to the data with the China index sliding 1.72% as the specter of trade wars continues to dog local counters. The Australia and Singapore indices dropped 0.32% and 0.56% respectively. Japan equity markets were closed for a holiday.

AUD/USD Daily Chart

China says tariffs to have limited impact on inflation

In a press conference post-data, a China National Bureau of Statistics spokesperson Mao Sheng Yong said trade frictions are unlikely to have a significant impact on CPI and may see a subdued rise in prices in H2. On the outlook for the economy, Mao said the Bureau expects no change in China’s slow/steady growth path though acknowledged the trade sector faces challenges in H2.

Trade, earnings, teapots and the US dollar

In an apparent rebuff at the US and Trump’s trade aggression, Chinese Premier Li said, while meeting EU officials Juncker and Tusk, that China and the EU would uphold multilateralism and free trade as they exchanged offers on a bilateral investment treaty.

Euro-zone trade surplus to widen

The major events on the rest of today’s calendar feature Euro-zone trade balance for May, where the surplus is expected to widen to EUR19.7 billion from EUR18.1 billion, according to economists’ forecasts. US data includes retail sales for Jun, seen at +0.6% m/m which is lower than May’s +0.8% but with be the fourth consecutive month of positive month-on-month growth.

You can access the full data calendar on MarketPulse at https://www.marketpulse.com/economic-events/