We’re finally seeing a cooling in the post-US election moves in early trade on Tuesday which is offering some reprieve for emerging market currencies, as well as Gold and other safe haven assets that have come under considerable pressure since last Wednesday.

The US dollar has been a particular favourite since the election, with inflation expectations rising in tandem with Donald Trump’s infrastructure spending plans. The result of this is that markets now expect the pace of tightening to be faster than it would have otherwise been and the odds of a rate increase at the next meeting in December have risen considerably once again.

EUR/USD – Euro Climbs to 1.08 as German Economic Sentiment Jumps

The US dollar is paring gains today having rallied strongly off last Wednesday’s lows to trade near thirteen year highs. Given just how priced in a hike in December now is, it is possible that the move in the dollar is a little overextended and yet we’re not seeing a too much appetite for a correction. The move we’ve seen today more so resembles profit taking than anything more substantial. The correction in the dollar today is offering some reprieve for Gold though which has now come off its lows, around $1,211, but given the outlook, it’s difficult not to remain bearish on the yellow metal.

OANDA fxTrade Advanced Charting Platform

We could get more insight on the Fed’s plans today when we hear from four Fed officials, three of which will be voting at the December meeting and one of which will be an FOMC voter next year. Stanley Fischer, the vice Chair and a close ally of Chair Janet Yellen, claimed on Friday that the case for gradual hikes is quite strong and that the Fed is reasonably close to achieving its inflation and employment goals, which markets took to indicate that a December move is increasingly likely, particularly as this came following the election and the market volatility that followed.

Source – CME Group FedWatch Tool

Well also hear from Eric Rosengren, who recently has voted for a hike, as well as Daniel Tarullo and Robert Kaplan. With two permanent voters to speak, neither of which supported a hike at previous meetings, we could have an even better idea of whether the Fed will vote in line with market expectations next month.

We’ll also get retail sales data from the US today which should ensure the dollar and other US assets remain volatile. While I doubt the release will have a significant baring on the decision next month at this stage, a good reading, as it expected, can’t hurt it either. Especially as the numbers this year have been quite volatile and particularly earlier in the year, very disappointing. Another month of 0.6% growth would suggest the economy is going to perform much better in the final quarter, in line with expectations.

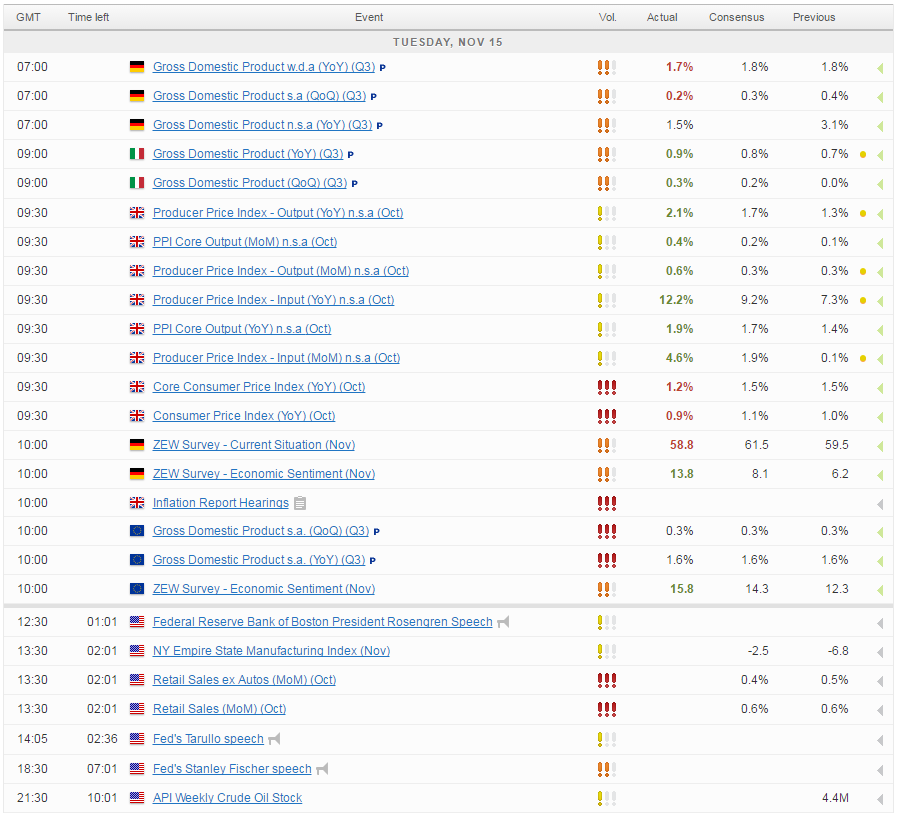

For a look at all of today’s economic events, check out our economic calendar.