Industrial metals are attempting to break their relative downtrend versus precious metals; that has historically been good news for the economy and stocks.

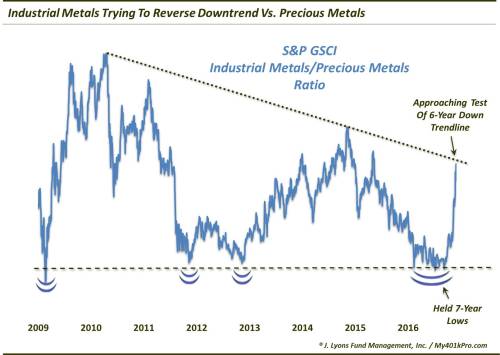

There are few better illustrations of the post-election trade, thus far, than the dichotomy between industrial metals and precious metals. The illustration is especially vivid when combining the performance of the 2 groups into a single price series. And while it seems that many folks on financial social media have taken to the practice of gratuitously lumping 2 seemingly disparate securities into a meaningless ratio chart, in this case there may be some merit. First, however, take a look at how the ratio between the S&P GSCI Industrial Metals Index and the S&P GSCI Precious Metals Index is hitting a potentially critical juncture right now.

Specifically, the ratio has essentially been in a descending triangle since 2009. That is, the Industrial Metals have been making lower highs and horizontal lows versus precious metals. In a conventional single issue chart, this pattern would carry negative connotations, i.e., it would suggest a likely eventual breakdown below the lows. If that same interpretation holds here, then Industrial Metals should continue their under-performance relative to precious metals so that the ratio moves to new lows.

Importantly, the ratio was able to hold a test of its 7-year lows, which we noted in a post back in May. However, in order to prevent the customary descending triangle breakdown, Industrial Metals need to break the top of the triangle. This top is marked by the Down trendline stemming from the 2010 peak and connecting the 2014 peak. The group has a chance to do that here as the post-election bounce has lifted the ratio up to the point where it is challenging the post-2010 downtrend.

So, assuming the ratio is relevant, you can see why its present proximity to the Down trendline is important. But is the ratio relevant? Why would anyone care how Industrial Metals are faring versus precious metals. As we wrote in that May post, there are a couple potential reasons arguing for its relevancy.

- The 2 two price series are from the same asset class and, thus, at least somewhat relatable.

- While not always the case, each asset contains an implied message regarding the state of the economy or markets at large. The industrial metals are said to be a barometer of economic demand. Meanwhile, precious metals are very often a safe haven during times of turmoil.

- The implied messages of the 2 assets are for the most part contrary in nature. Often times, the market forces that will prop one of them up will push the other one down. Thus, combining the 2 into a ratio can visually accentuate the message that markets are sending.

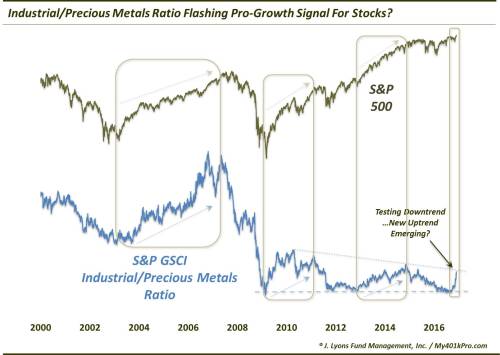

Graphic evidence of the validity of the message behind the Industrial Metals/Precious Metals Ratio can be seen in the next chart depicting the S&P 500 alongside the ratio.

As one can see, the slopes of the 2 series appear highly correlated. That is, when the ratio has been rising, stocks have also generally risen in lockstep. Conversely, when the ratio is declining, stocks have generally fallen as well. Witness the 2000-2002, 2007-2009, 2011 and 2015 declines. This is an important point given our present set of circumstances..

In sum, while they are widely overused and misused, ratio charts can be an instructive tool under the right circumstances. When the 2 assets are relatable, we can learn a lot about the assets themselves as well as perhaps the broader economic and market environment. In this case, if the Down trendline in the Industrial Metals/Precious Metals ratio puts a halt to the rally in Industrial Metals, it could possibly serve as a warning sign for the growth in stocks and the economy. If, on the other hand, the sharp rally in Industrial Metals over the past 6 weeks is for real and durable, then perhaps the ratio breaks out – and takes stocks and the economy along for the ride.

* * *

More from Dana Lyons, JLFMI and My401kPro.

The post Is The Industrial Metals Surge A Sign Of Growth In Economy, Market? appeared first on crude-oil.top.