Submitted by Chris Martenson via PeakProsperity.com,

By its actions, the Federal Reserve has selected a precious few winners and many, many losers. Sadly, you are highly likely to be one of the losers.

Sorry!

I'm one, too, if that helps soften the blow.

But we have a lot of company. Other losers include:

- Savers

- Anyone with money in a checking account

- Anyone with money in a savings account

- Anyone with money in a CD

- Anyone depending on bond income

- All pensions

- Endowments

- First time homebuyers

- Renters

- Those who invest based on fundamentals

- Everybody alive in the future, when the bills come due

Anyone on this list has been intentionally pre-selected by the Fed for losing. The Fed has done this deliberately, with full pre-knowledge that it was going to diminish the prospects of the majority in favor of the benefit of an elite few. And to make matters worse, it has no plans to — and no clue how to — reverse the damage it has wrought.

Everyone on the list above has been dinged by the Federal Reserve — on purpose and by design, I will repeat — in order to transfer wealth and purchasing power to:

- Big banks

- The government

- Entities with large stock (equity) holdings

- The wealthiest 0.1%

- Speculators

- Borrowers (the heavier the better)

- Well-connected insiders whom the Fed tipped off in advance

This has, of course, not been lost on the 99.9% relegated to the loser camp. They are angry and growing more pissed off by the day. We see this anger playing out politically, in street protests, and in growing tensions with the police. All of this is connected, of course.

Soon, more and more folks will figure out the source of the growing inequity causing this anger, and the hot new trend of the future will be Fed bashing. So you might as well get in on the ground floor…

Righteous Anger

As primates, we’re all hard-wired to expect fairness. It’s part of being a social creature. When we experience unfairness, we react the same way this Capuchin monkey does, although we might try to convince ourselves we do so in a more civilized manner:

But really, we're just as emotionally-driven as that poor, deprived monkey when confronted with our own circumstances of injustice.

While it's true that the world will never be completely fair, the conditions today are extremely ripe for provoking a lot of righteous populist anger.

Watching big banks commit huge felonies time and again, then get away with only paying fines that are mere blips on their earnings statements, has been difficult for me to swallow — as it was for a large number of other people. The recent movie The Big Short does a good job of making your blood boil on this point.

Or noting all the instances where the wealthy and powerful skate by without any real charges or penalties for their crimes, while 'regular people' have the book thrown at them by the legal system.

In fact, the rule of law in America today might as well be restated as the ‘sliding scale rule’, where the number and consequences of possible penalties that apply are inversely proportional to your net worth. Poor = more. Rich = less.

But of all the injustices being inflicted upon us, few are more pernicious than those being committed via the Federal Reserve's monetary policy.

The Fed is playing God, picking winners and losers. And as I outlined above, nearly all of us are losers.

Housing Losers

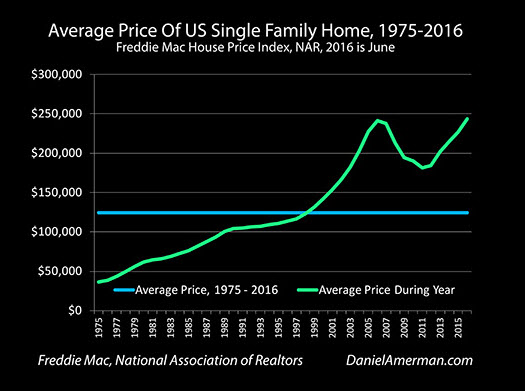

In the aftermath of the credit crisis, the Fed has been loudly telling us that if house prices go up then the owners of those houses will feel wealthier and spend more, boosting the economy. Or something like that.

In truth, the Fed has been acting to protect both the mortgage holders (banks, mortgage companies, Fannie, Freddie) and also its own portfolio of mortgage bonds. Few people realize this, but the Fed is the largest landlord in America. It owns more real estate, by far, than any other entity:

(Source)

Now, would you not agree that if a private entity had been entrusted with the capability of printing money out of thin air and then using it to purchase $1.78 trillion dollars’ worth of mortgage backed securities, thereby becoming the largest landlord in America, that there should have been a robust and spirited national conversation over whether or not this is a good idea? One that came with a truckload of debate, oversight and enforcement?

But there was no conversation. The Fed decided all on its own that driving up the cost of homes was the right thing to do, and they've succeeded wildly in that regard. Winners = current homeowners who sell at these current bubble prices and then downsize. Losers = everyone else.

Even many current homeowners who've benefited from recent price increases will lose over time. Why? Because of higher insurance and property tax costs.

The housing bubble that preceded 2007 has been restored by the Fed nation-wide, In dozens of cities., prices are now at or near all-time highs:

(Source)

The impact of these insanely-high house prices is that ordinary people are being priced out. Here's the extreme case of San Francisco:

The “Housing Crisis” in San Francisco Strangles Demand

Aug 16, 2016

In San Francisco, the median house price – half sell for more, half sell for less – is $1.37 million. According to Paragon Real Estate, if condos were included, the median price would drop to $1.2 million.

The median household income in San Francisco is $84,160, including households with more than one earner. So a household of two teachers with $130,000 in household income is doing pretty well, comparatively speaking.

The monthly mortgage payment for the median house in San Francisco, after a 20% down payment and at the prevailing rock-bottom mortgage rates, is $6,740 per month, or $80,900 per year!

So what kind of minimum qualifying household income would be required for the mortgage of a median house, plus taxes and insurance? For the US on average, $47,200 per year. In San Francisco, $269,600 per year. It would require a household of four teacher salaries!

Only the top-earning 13% of households in San Francisco can afford to buy that median house!

(Source)

To recap: if you put down a 20% down payment for a $250,000 house in San Francisco (good luck saving that up, ordinary people!) then the yearly mortgage cost alone is $80,900.

This affordability problem is so severe that regular people are moving out in droves. As a result, San Francisco is dealing with all sorts of worker shortages, including the lack of teachers mentioned in the above article.

These insanely high house prices are not some miracle of God, and it doesn't require a PhD in particle physics to understand what's causing them: the Fed specifically created the conditions to boost house prices to these levels, and has been printing up as much money as needed to accomplish this.

If you enjoy irony with your tragedy, consider the case of the planning commissioner for Palo Alto who had to move out of the area because she and her husband could no longer afford to live there:

Housing official in Silicon Valley resigns because she can't afford to live there

Aug 11, 2016

Once Kate Downing and her husband Steve did the math, it was obvious that if they wanted to raise a family, staying in Palo Alto, California, was not an option.

Although Steve, 33, works as a software engineer at a nearby Silicon Valley technology company and Kate, 31, is a product attorney at another tech firm, the cost of owning a home near their jobs has simply become too steep for them.

If they wanted to purchase their current house – which they rent with another couple for $6,200 a month total – it would cost $2.7m plus monthly mortgage and tax payments of $12,177, adding up to more than $146,000 a year.

The Downings’ housing struggle in the northern California region that is home to many of the world’s wealthiest tech companies carries a special irony due to Kate’s second job: up until this week, she served as a planning and transportation commissioner for Palo Alto – a position in which she pushed city officials to build more housing and pass pro-development policies that could help solve the growing affordability crisis.

(Source)

When two upper middle class successful professionals cannot even remotely begin to make ends meet, you have a raging housing bubble on your hands.

I’m going to keep repeating this point: this is no accident. It is not an act of God. This is the desired outcome of a specific and targeted Federal Reserve policy that is getting exactly what it intends: Higher home prices.

As a consequence of these high prices, home ownership rates in the US have plunged to levels not seen since 1965:

(Source)

Generations of homeownership have been undone in less than ten years by an activist Fed that has decided it knows who should be the winners and who should be the losers in the home buying game.

Of course, all of this is not real, long-lasting wealth. The Fed has merely blown another bubble; one that will eventually burst, creating far more pain on the downside than the pleasure enjoyed on the way up.

That’s just the nature of bubbles, as we laid out in detail in our recent report The Marginal Buyer Holds The Pin That Pops Every Asset Bubble (it's worth a read if you haven't done so yet)

It’s too bad the Fed did not learn from its prior recent bad mistakes that blew up in 2000 and 2008. I’ve taken the liberty of expressing this in chart form:

I hope that clears thing up.

There's no other way to put this, the Federal Reserve is a serial bubble blower. And sadly, the Fed is the alpha central bank in the world. It sets both the tone and the direction that the others follow. Which is why the bubbles in stocks, bonds and real estate span the globe today.

The Fed somehow lost the institutional memory that Paul Volker embodied back in the 1970’s and 1980’s. Volker's bitter medicine approach was replaced with a spiked punchbowl. Greenspan began the process, Bernanke cemented it, and now Yellen is busy keeping the party going long after the lights should have been turned off.

The Fed may never recover from the injustice it is creating. And good riddance. When institutions fail so horribly they need to be disbanded and discredited so that new ideas and practices can emerge.

And interestingly, we are (finally!) beginning to see some rotten tomatoes get thrown the Fed's way.

Is a ‘Fed discrediting cycle’ underway? Surprisingly, the answer may be: Yes.

The Worm Turns

The reason we need to track the ‘intangibles’ like Fed credibility is precisely because the entire system of fiat money is faith-based, when you get right down to it. We all know that on some level, but it becomes a conscious awareness once you understand how money is created in the fractional reserve banking system.

It's created when a loan is made at the bank level, as well as whenever the Fed ‘buys an asset’ which is really a fancy way of saying ‘created money out of thin air and exchanged it for debt.’

Well, if the Fed has the power to create money out of thin air, that’s really an extraordinary power, right? How can we have confidence it's putting that power to the right use?

Because all fiat currency (I hesitate to call it ‘money’ as it lacks the essential ‘store of value’ feature) is nothing more than an agreement between ourselves, it’s vital that trust and transparency be part of that arrangement.

But the current system goes out of its way to keep the public in the dark about how it works.

Even though money (er, currency) creation is a rather simple thing to explain, as I’ve done in the Crash course (Chapter 7: Money creation in Banks and Chapter 8: The Fed), it is not taught in schools. At any level.

In over 10 years of presenting this material publicly, I've not yet once run into a single person who has claimed to have learned about money creation in a public school or major college as part of the ordinary curriculum. Not one. Homeschoolers? Yes, all the time. Self-taught? Sure, them too.

Now ask yourself why something so important and yet simple to explain is not taught at practically any ‘place of learning’ throughout the land? The only reason I can think of is that it is considered too dangerous by those in charge.

After all, how can you keep a workforce chained to a paycheck model once they find out that the Fed simply prints up dollars by the trillions and hands them out to their closest friends, relatives, and revolving door colleagues?

Kinda makes me recall the bank scene from this old SNL skit with Eddie Murphy titled White Like Me:

Or perhaps we can understand why currency creation is not taught through this old quote from Henry Ford:

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

(Source)

I think old Henry also nailed it. The privilege and advantages enjoyed by those running our banking and monetary systems functions are deeply unfair. If those in charge of them want to keep their heads, its best to keep the public in the dark as much as possible.

Well, I think the cat’s out of the bag, and I base that on two exceptional recent events. The first was the ill-fated launching of a Fed Facebook page, by the Fed, and the second was a real turnabout article penned in the WSJ by none other than perennial Fed insider/toady John Hilsenrath.

In Part 2: This Is How Sentiment Shifts And Markets Crash, we look at how the previously-bulletproof faith in the Federal Reserve is quickly eroding. As with all belief systems, once sentiment shifts below a critical threshold, everything gets called into question. Suddenly, it's obvious to all the emperor was naked.

The demise of faith in the Fed is an essential milestone on the way to the long-overdue market correction. Once the markets no longer trust the Fed can keep the party going, the stampede for the exit will one for the history books.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

The post Sorry, Losers! How The Fed Has Screwed The Many To Protect The Few appeared first on crude-oil.top.