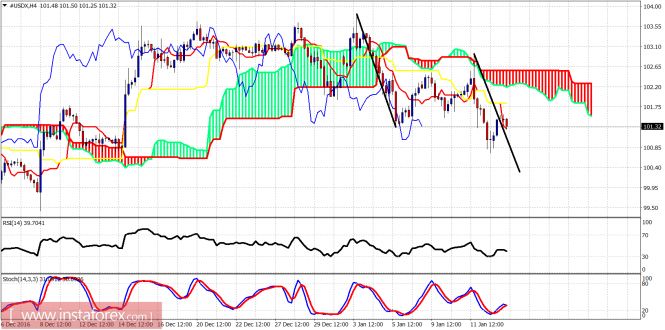

The Dollar index remains in a bearish short-term trend and our target of 100.40 remains intact and very possible to be achieved even today. Any bounce should be sold and as long as price is below 102.50 trend will remain bearish. However, the form of the decline implies that this downward move is corrective.

The Dollar index remains below the 4-hour Ichimoku cloud. Resistance is at 102.50. Support is at 100-100.40. Trend remains bearish in the short-term and a new lower low remains possible as there are no signs of a bullish divergence.

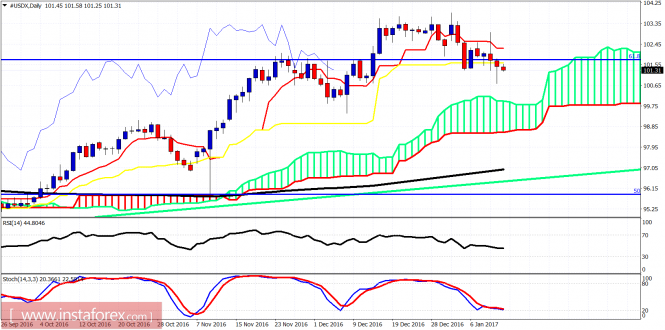

On a daily basis,trend is showing reversal signs but price remains above the Ichimoku cloud. Price has broken below the tenkan- and kijun-sen (the red and yellow line indicators) implying increased chances of approaching the Kumo (cloud) at 100. I remain short-term bearish but will look to cover short positions near 100 as a bounce will be justified from those levels.The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of USDX for January 13, 2017 appeared first on forex-analytics.press.