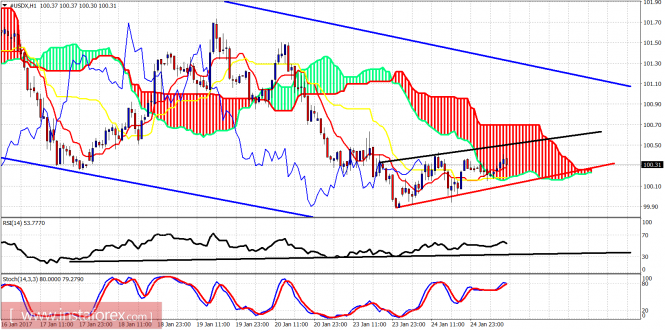

The Dollar index is showing signs of strength combined with a minor first bullish divergence. We might see another dip towards 99-99.40 but overall the Dollar is short-term oversold and ready for a strong bounce if not for a full reversal to new highs.

Black line – resistance

Red line – support

Blue lines – bearish channel

The Dollar index remains in a medium-term bearish trend since it topped at 103.70 and reversed. Short-term support is at 100.10 and resistance at 100.50. If we break support, then we should expect 99-99.40 to be reached. If resistance is broken, we should expect a move towards the upper channel boundary near 101.

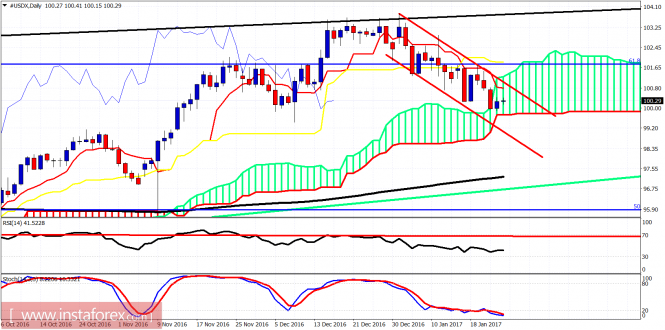

Red lines -bearish channel

On the daily chart the index has reached the Ichimoku cloud support. Price remains inside the bearish channel. There is minor divergence in the RSI and an oversold stochastic. Important for bulls to break above 101.20 as this entire decline could very well be a wave 4 correction and the final leg up towards 105-106 could start. 97.50 is critical support for the long-term bullish trend.

The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of USDX for January 25, 2017 appeared first on forex-analytics.press.