The last couple of weeks has seen a number of Fed officials warn about the prospect of at least one rate hike this year – including Chair Yellen and some of her closest allies – but with markets still not convinced, particularly by September, this Friday’s jobs report has become all the more important.

Two excellent jobs reports in June and July have put a rate hike this year well and truly back on the table but it would seem that investors want at least one more in order to be convinced. While December may now be marginally priced in for a hike, a weak jobs report could quickly change that. Equally, with September only 24% priced in, another strong report will be very difficult to ignore and we could see some serious repricing ahead of the meeting in three weeks’ time.

Rate Hike Fever Continues to Grip Markets

While we have to wait until Friday for the official numbers, the employment number from ADP today could offer some insight into which direction the NFP number will swing. The ADP number generally offers little in terms of an accurate estimate of the NFP data but one thing it can offer is an idea of whether it’s likely to far exceed or fall short of market expectations.

With that in mind, expectations for the ADP number is around 175,000, with NFP slightly higher at 180,000. Should we see a number above 250,000 today then the market implied probability of a September hike may well rise quite significantly having remained low for some time. This could see the dollar take off again as it did on Friday and yields on US Treasuries rally in tandem. A number below 100,000 will cast even more doubt on September and could see it priced out even more than it already is which could weigh on the dollar and yields. With the probability of a December hike only marginally above 50%, it could even see this pushed back to 2017.

Dollar Grinds Higher Looking For Fundamental Support

Also to come from the US we’ll get pending home sales and the Chicago PMI, as well as crude inventory data from EIA. Another inventory increase – the fifth in six weeks – is expected today of just short of one million barrels, which would be in line with Tuesday’s API number. A higher number here could see crude prices come under further pressure, with WTI and Brent potentially testing $44.25 and $46.50-46.70 support, respectively.

Source – OANDA fxTrade Platform

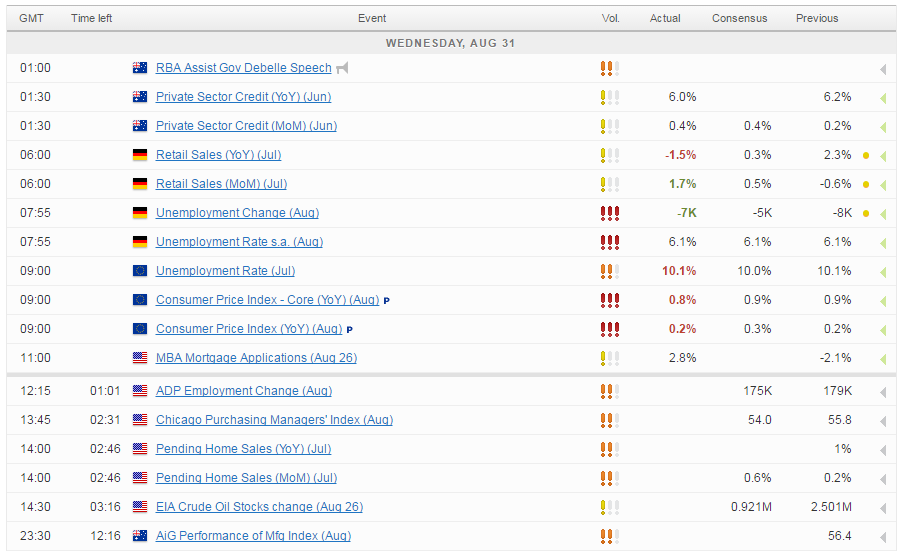

For a look at all of today’s economic events, check out our economic calendar.