Submitted by David Stockman via Contra Corner blog,

After a week in which all the big retailers—Macy’s, Kohl’s, Nordstrom’s, Gap, JC Penney, Dillard’s——reported exceedingly downbeat results for their April quarter, it is not surprising that the Census Bureau’s statistical fabrication mill reported robust April retail sales. Likewise, you could count on the financial press to trot out the superlatives, as in the case of the Reuters’ headline proclaiming, “U.S. retail sales rise strongly, boost economic outlook”:

U.S. retail sales in April recorded their biggest increase in a year as Americans stepped up purchases of automobiles and a range of other goods, suggesting the economy was regaining momentum after growth almost stalled in the first quarter…….”The retail sales report shows that recent claims of the demise of the U.S. consumer have been greatly exaggerated,” said Steve Murphy, a U.S. economist at Capital Economics in Toronto.

Not exactly. Retail sales of $450.89 billion in April were down 2% from $460.1 billion in March.

Yes, April has one fewer day than March so there is a matter of seasonal adjustment. But that’s where the shenanigans start.

The Census Bureau reported seasonally adjusted April sales of $453.44 billion, up by a headline catching 1.3% from March.

But then again, based on the seasonal adjustment factor used in 2011, the SA number would have been $450.35 billion, up only 0.6%; and had the 2014 seasonal adjustment factor been used, headline sales would have been $452.6 billion, representing an in-between gain of 1.0%.

Then we also have Easter falling in April during both of the latter two years versus March 27th this time; and in all years there were April showers, too, normal or not!

For crying out loud, seasonally-maladjusted, weather-whacked single month deltas from the rickety government statistical mills are only one step removed from noise. But they are seized upon by the financial press because the latter are exceedingly lazy and always on the prowl for anything that might be “good news” for the stock averages.

But that’s what Bubble Finance has come to. Namely, a cult of the daily stock market that is so myopic, superficial and sycophantic that it has practically reduced financial journalism to noise, as well.

To be sure, there is plenty of information in the Census Bureau on-line data base that shows in an instant that the vaunted American consumer is running out of steam. As will be documented further below, there is not a snowball’s chance that the debt besotted consumer can save the US economy from the demise that lies ahead.

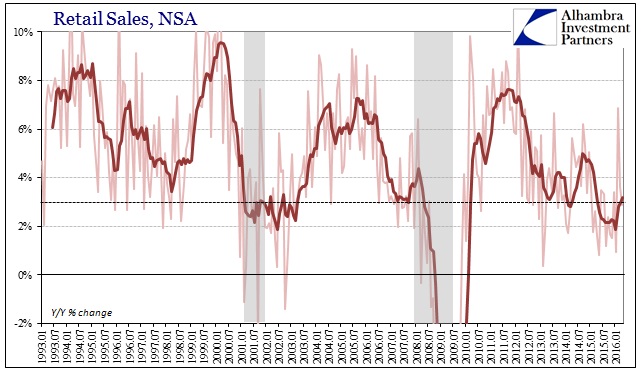

Even as to the near-term, in a nearby post Jeff Snider put the lie to the headline noise with charts that provide historical and cyclical context.The 2.9% year-over-year non-seasonally adjusted gain in April was obviously nothing to write home about and was among the lowest monthly gains outside of recession during this century.

In fact, the April retail sales report brought even more evidence of continued deceleration from the 4-6% annual gains recorded earlier in the recovery. It is reminiscent of the pre-recession patterns of the past, not a signal that the consumer has spung back to life.

Even these sharply weakening trends overstate the case. The above figures include auto sales, which have rebounded under the tailwind of soaring auto lease and loan finance. In fact, practically any consumer who can fog a rearview mirror has gotten a car loan, but that is not a good thing; it’s a booby-trap as explained below which will boomerang in the years ahead.

Meanwhile, yeaterday’s Census Bureau release provided unmistakable evidence of an exhausted consumer that the media cheerleaders missed altogether.

Thus, between April 2010 and April 2014 when households were recovering their sea legs after the trauma of the financial crash and Great Recession, ex-auto retail sales grew at a 4.1% rate in nominal terms, and 2.1% adjusted for the CPI.

By contrast, during the last 24 months, non-auto sales have barely crawled higher, rising from $343.3 billion in April 2014 to $355.0 billion in April 2016. That’s less than a 1.7% annual rate.

Moreover, even if you credit the BLS’ comically understated CPI, it is evident that inflation adjusted sales outside of autos are now rising at barely a 1.0% annual rate.

It would take less than five minutes to spot that dramatic slowdown by scrolling through the Census Bureau data. Apparently, the algos which scanned the April release and posted the stories didn’t have the milliseconds to spare.

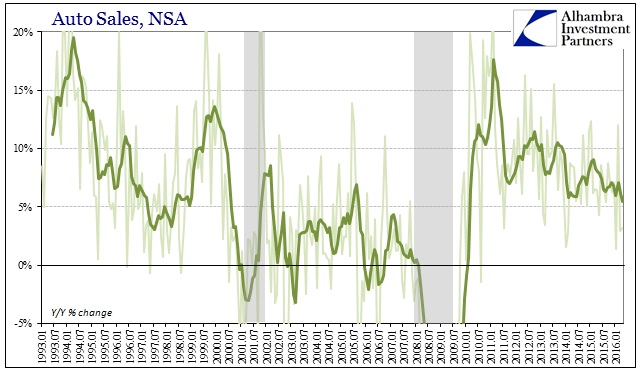

Likewise, it wouldn’t take long to see that even auto sales have shifted to a distinctly lower gear. April NSA auto sales were up just 3% on a y/y basis compared to annual gains of 10% to 15% early during the recovery, and from the exceedingly deep cyclical hole that accompanied the GM/Chrysler bankruptcies in 2008-2009.

Actually, the robust upturn of auto sales since 2010 has been a mixed blessing, to say the least. It has been induced by a spectacular explosion of auto loans and leases.

To wit, since July 2010 motor vehicle sales reported in the monthly retail sales data have risen at a $354 billion annualized rate. At the same time, auto loans outstanding have increased from $699 billion to $1.052 trillion. The arithmetic gain in auto debt thus happens to be $353 billion.

That’s right. Exactly 99.72% of the gain in sales was funded by more debt. And during the last year it has gone off the deep end; auto loans have grown by $54 billion while annualized sales have climbed by only $28 billion.

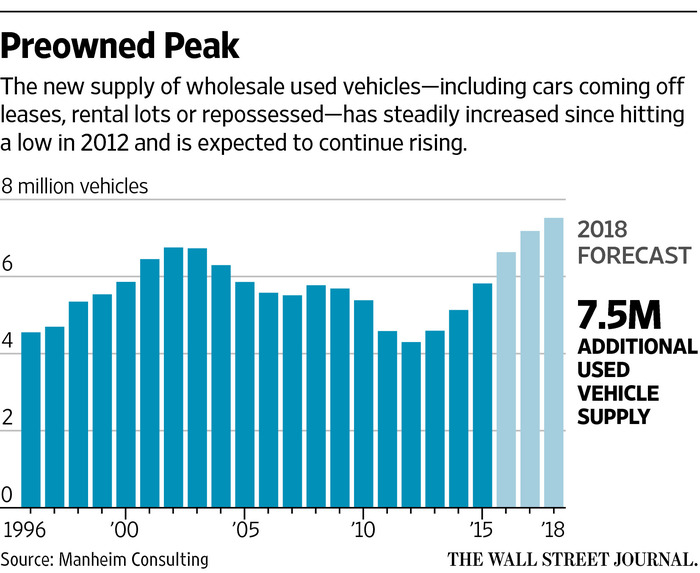

Needless to say, payback time is just around the corner. The virtuous cycle of declining used car generation and rising used car prices has exhausted itself. Yet that was crucial to the debt financed car-buying spree because it meant rising trade-in prices and therefore enhanced capacity to make down payments and loan terms.

Thus, in the run-up to the new auto sales crash in 2008-2009, used car prices plunged by 20% and new light vehicle sales fell from an 18 million annual rate to barely 10 million at the bottom of the cycle.

By contrast, during the first three years of the post-June 2009 recovery, used car prices soared by 24%, enabling the credit fueled recovery of new vehicle sales shown in the graph.

Here’s the thing, however. The worm is fixing to turn because the used car market is facing an unprecedented tsunami of used vehicles coming off loans, leases, rental fleets and repossessions. As shown above, used vehicle prices have been weakening for the last several years, but between 2016 and 2018 upwards of 21 million vehicles will hit the used car market compared to just 15 million during the last three years.

This means used car prices are likely to enter another swoon like 2006-2008, causing trade-in values to plummet and thereby draining the pool of qualified new car borrowers. When the cycle turns down, fogging a rearview mirror is never enough.

To be sure, there is nothing very profound about the certainty that an auto credit boom always creates a morning after hangover, and that the amplitudes of these cycles is getting increasingly violent owing to the underlying deterioration of auto credit. Currently, average new vehicle loans are at a record 70 months, loan-to-value ratios have hit 120% and upwards of 80% of new retail auto sales are loan or lease financed.

Moreover, the race to the bottom is happening once again in the lease market. That is, monthly lease rates have gotten so ridiculously cheap that the implied residual values are at all time highs. This means that when the used car pricing down-cycle sets in during the flood of vehicles ahead, massive losses will be generated, causing a sharp contraction of the leasing market, as well.

Stated differently, the auto sales piece of retail sales has virtually nothing to do with a rebounding consumer. Its a reflection of an artificially bloated and unstable credit cycle that is about ready to take the plunge.

And that gets to a larger issue brilliantly dissected in a nearby post by Thad Beversdorf. The entire mainstream meme about the consumer being the 70% backbone of the US economy, and that implicitly households can spend the America to prosperity ignores a crucial factor. Namely, that the PCE (personal consumption expenditure) component of GDP is not the same thing as household jobs and wage and salary income, at all.

More than 25% of PCE is accounted for by government income transfers led by social security and medicare—both if which are heading for insolvency in the years just ahead. On top of that, the surge in household leverage ratios in the two decades leading up to the 2008 crash and arrival of Peak Debt added a further layer of spending power derived from credit expansion, not production and wages.

As a result, as Beversdorf’s chart demonstrates, the share of PCE accounted for by transfer payments and consumer borrowings has soared from 24% in 1993 to nearly 36% today. This means that the prospective trend of consumption spending is as much a matter of fiscal policy and household credit health as it is wage and salary growth.

To wit, reported PCE has grown from $4.4 trillion in early 1993 to $12.3 trillion at present. That represents a 4.3% growth rate over the last 23 years.

Yet had the 1993 transfer payment/consumer debt share remained constant at 24% of PCE——today it would be only $10.2 trillion, if you assume that the growth of government transfer payments on the margin was financed with Federal borrowing.

At the end of the day, the seasonally maladjusted data for April retail sales amounts to no more than a swiggle in the larger trend. To wit, consumption spending financed by the growth of transfer payments and household borrowing is coming up hard against Peak Debt, while tepid growth in wage and salary income remains hostage to a domestic economy plagued with structural barriers to growth, an aging business cycle and a gathering global recession from which it is not remotely decoupled.

So contrary to Reuters and its Keynesian quote standbys, it is not true that “the demise of the U.S. consumer have been greatly exaggerated”.

Actually, it can be hardly exaggerated enough.

The post Another Headline Head Fake – The Consumer Can’t Save The U.S. Economy appeared first on crude-oil.top.