BoE to Release New Economic Forecasts Alongside Rate Decision

The Bank of England holds its first monetary policy meeting of the year this week, after which it will release the quarterly inflation report alongside its monetary policy decision and hold a press conference with Governor Mark Carney.

The event – which is often referred to as “Super Thursday” – is one of the most hotly anticipated of the UK calendar as it offers significant insight into the thoughts of the Monetary Policy Committee, something that’s become increasingly sought after since it started raising interest rates in November.

BoE policy makers took the decision to raise interest rates after inflation surpassed 3% in November, a level deemed by many to be too high despite being driven by one-off currency moves in the aftermath of Brexit. This is led many economists to forecast another hike this year and two more over the three forecasting period, but have they and others been misled by the central bank?

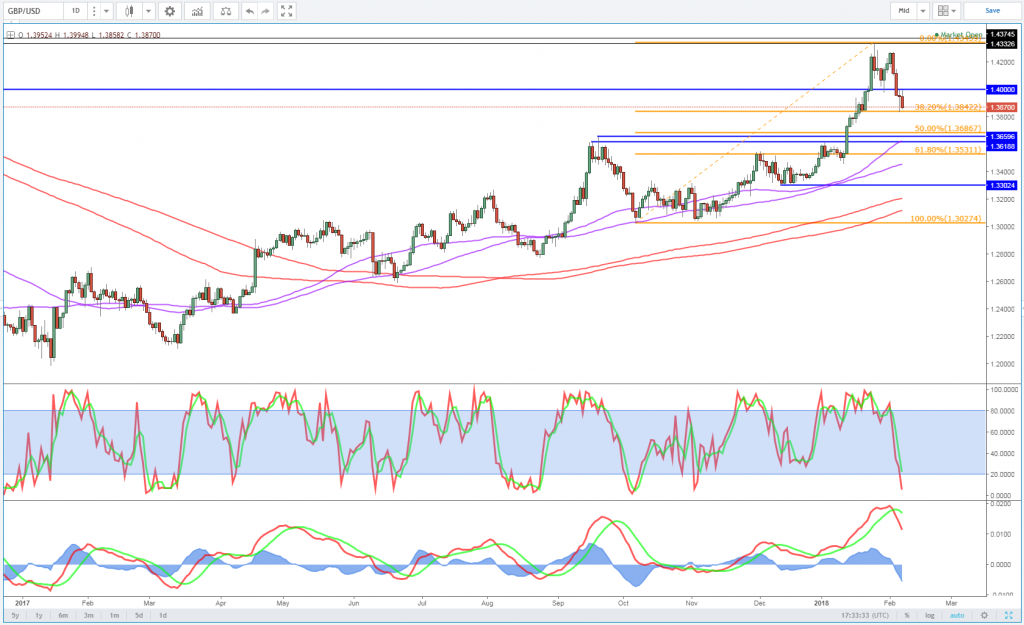

GBP/USD – Pound Under Pressure, BoE Rate Decision Next

In many ways, the dilemma facing the BoE is no different than that facing other central banks – the economy is growing, unemployment is very low, labour market slack appears low and yet inflation is stubbornly low – but one very important difference exists, Brexit.

The sheer amount of uncertainty that exists because of Brexit has resulted in low growth compared to its peers and its pre-referendum levels, businesses are reluctant to invest and the consumer squeeze is taking its toll. The economy may well have shown more resilience than many feared prior to the referendum but is this really the kind of environment that the central bank should be raising rates in? If not, why did they raise by 25 basis points in November?

The central bank will naturally point to the above target inflation as warranting a hike which would be fair, assuming they believed it would remain at those levels of exceed it, which is debatable. This would also indicate a willingness to raise more if inflation remains well above target. While it’s likely to have peaked, it’s not expected to fall very far for a while which is why people may be anticipating further hikes.

Another possibility could be that they wanted to reverse the emergency post-Brexit rate cut which many Brexiteers criticized at the time and some others have questioned the need for since. Especially when you consider that the central bank was reluctant to move below 0.5% throughout the aftermath of the global financial crisis and eurozone debt crisis. If lower rates were seen as risky or unnecessary then, can they possibly be warranted now? If not and this was behind November’s decision, are the markets wrong in anticipating another hike this year and more after?

Gold Slides to 4-Week Low as Stock Markets Settles Down

This could become a lot clearer in the coming meetings and Thursday should offer some early insight, particularly as the inflation report includes growth and inflation forecasts. Any indication that policy makers are in no rush to raise again could see markets pare back expectations resulting in lower yields on UK debt which could in turn weigh on the pound. We may not get this on Thursday though, assuming we do at all, as they may opt to gradually soften their stance over a number of meetings, particularly if Brexit negotiations aren’t progressing as planned. Ultimately, these will have a major bearing on how interest rates move over the three year forecast period.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The FTSE 100 may also be sensitive to the BoE event on Thursday, given its inverse relationship with the pound. A stronger pound has typically weighed on the index due to the external exposure of the companies that make up the index, while a weaker pound has been positive for it, as seen in the aftermath of the referendum. It’s been a rough couple of weeks for the FTSE, the last couple of days in particular as volatility has returned in force and equities have been sent into a tailspin lower. A strengthening pound – should the BoE release bullish forecasts and adopt a hawkish tone – may not help matters.

FTSE and GBP Trade Weighted Index Correlation

Source – Thomson Reuters Eikon