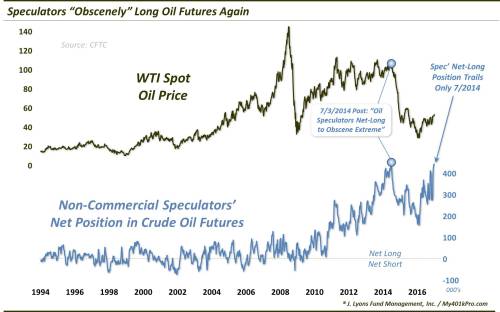

Speculators in crude oil futures are back near their “obscene” record net-long position set just prior to the 2014 collapse in oil prices.

When we started posting our charts on social media and writing this blog some three years ago, one of the most popular early posts dealt with trader positioning in crude oil futures. That was at the beginning of July 2014, and to this day it remains one of our most popular posts. The title of the post was “Large Speculators Net-Long To Obscene Extreme”. And to look at the chart was to instantly understand the impetus behind the title.

Chart from July 3, 2014 post:

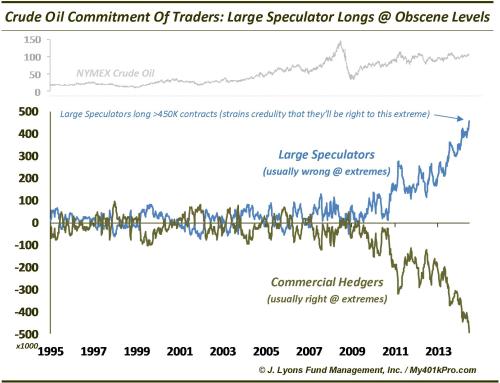

At the time, the trajectory of the record net-long position in crude oil futures by Non-Commercial Speculators (and by extension, the record net-short position by Commercial Hedgers) had gone fully parabolic. In the case of the Speculators, prior to 2013, their largest ever net-long position in crude oil futures was 276,000 contracts, and prior to 2011, the record was 176,000 contracts. At the end of June 2014, their net-long position was a record-smashing 459,000 contracts. On the flip side, Hedgers’ net-short position had grown to a record 492,000 contracts.

Why was that important? As we have explained on many occasions in these pages, this data from the CFTC’s Commitment Of Traders (COT) report provides a very useful look at the positioning of various groups of traders. The 2 biggest groups are Non-Commercial Speculators and Commercial Hedgers:

- Non-Commercial Speculators are by and large commodity pools and hedge funds that exist mainly to trade the market long and short. These funds are normally trend-following entities. And while they can be on the correct side of a long trend, at extremes they are considered “dumb money” as they are typically “off-sides”.

- Commercial Hedgers are typically financial firms and institutions involved directly in an industry reliant upon a particular commodity. Most of the time, they are truly “hedging” within the commodity market, primarily taking the other side of the Speculators’ trades. Therefore, at extremes and key turning points, they are most often correctly positioned. For that reason, and partly because they are more often intimately familiar with the commodity in question, they are considered the “smart money”,

Given the above primer, the Speculators’ record long position back in early July 2014 naturally had us concerned about a potentially significant drop in oil. Should oil prices begin to turn down, the record long Speculator position represented a massive amount of money at risk of exiting the market.

However, the fact that the positioning was so skewed, far beyond any levels previously seen, we wondered if there was something that had structurally changed in the market. This was a source of great debate at the time, even among our firm. From the 2014 post:

Is this extreme positioning a sign that oil prices are about to nosedive? We’re not so sure. Oil prices, while at the upper end of the range of the past few years, have not experienced a rise anywhere commensurate with the rise in Large Specs’ long positioning. Therefore, perhaps there is a structural change in the data that we are not aware of. We do know that long-only commodity funds and ETF’s may be distorting the COT figures a bit. Regardless, on a short-term momentum and rate-of-change basis, the data still appears relevant. And based on those metrics, Large Spec positions are elevated to an extreme.

The one catch regarding the structural change argument is that we don’t observe the same behavior in other futures’ COT data. If, for example, long-only funds were distorting the net-long positioning of Large Speculators, we would expect to see the same types of extreme COT readings across other futures contracts that we see in Crude. That is not the case. Therefore, it is possible that Large Specs, aside from some structural change, really are extremely off-sides to the long side of crude. That would be a foreboding sign for the price of oil. While it is close to breaking out above 3-year highs, we would be on the lookout for a failed breakout if a new high does materialize. Given their historical track record at extremes, Large Speculators are not likely to be big beneficiaries in the long-run from an impending rise in crude prices.

Thus, while we were open to the possibility of a structural shift in the data, our hunch was that Speculators were indeed overloaded to the bullish side of the boat. As we wrote on the chart, “it strains credulity that they will be right to that extreme”. As luck would have it, oil prices topped out that very week. They would go on to drop 50% by the end of the year, and 75% by early 2016.

We say “luck” because, in actuality, we could have posted a chart of record Speculator net-long positions at several points during the previous 3 years. It just wasn’t until June-July 2014 that it mattered. Thus, identifying an extreme is not difficult – identifying when it will make a difference is. So, it was certainly a bit of luck that we posted that chart when we did, “calling” the top in oil.

We bring up this episode and lesson now because of our present circumstances. Specifically, after a substantial unwinding of the Speculators’ long position during the July 2014-2016 rout in oil prices, the bounce in oil over the past 12 months has seen them rebuild their position. And as of last week, they were net-long over 440,000 contracts, 2nd only to June-July 2014.

Will this “obscene” net-long position result in the severe headwind for oil prices as it did last time? Again, we can see that the position is extreme, but we don’t know when that extreme will hit the tipping point. The Speculators’ net-long position could continue getting more extreme, indefinitely. However, we will say that these are not the conditions that oil bulls want to see when considering the prospects for another sustainable run higher.

We can’t predict for sure when the next shoe will drop in the oil market. These Speculators may continue to be correct in their bullish posture for awhile. However, given their obscene position, you can bet that eventually they’re going to get lit up again.

* * *

More from Dana Lyons, JLFMI and My401kPro.

The post Are Oil Speculators About To Get Lit Up Again? appeared first on crude-oil.top.