Thursday August 2: Five things the markets are talking about

The Bank of England is more likely than not to hike interest rates +25 bps to +0.75% this morning (07:00 am EDT), but this has only recently become a closer call.

June’s BoE meeting minutes showed that three out of nine MPC members voted to raise rates, opening the door wide for a hike at today’s meet – futures are pricing a +91% odds.

Note: With those odds, the danger with today’s decision is if the BoE don’t go, then sterling (£1.3080) should plummet, otherwise the priced-in hike should have a limited impact.

However, for the ‘doves’ since then, June inflation has been lower than expected, earnings growth has slipped, and political and Brexit uncertainties are very much more heightened.

For the ‘hawks,’ the U.K economy continues to grow in line with, or slightly above, and employment is on the rise, two good reasons that should provide sufficient justification for a rate rise.

Elsewhere, global equities are a sea of ‘red’ ahead of the U.S open as President’s Trumps latest threats to free trade again has rattled markets – Trump is considering increasing proposed levies on +$200B in Chinese imports to +25% from +10%.

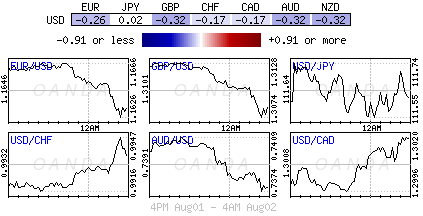

The ‘big’ dollar has found support, while sovereign bonds trade mixed as central banks policy decisions dominate proceedings. In commodities, oil prices touch a new two-week low on U.S crude inventories supply concerns, while gold prices remain choppy.

1. Stocks have little support

Global stocks are on the back foot amid heightened concerns over the escalating trade dispute between the U.S and China.

In Japan, equities again felt the impact from the slide in the broader Asian markets following Trump’s latest proposal on China imports. The Nikkei share average has pulled back from Wednesday’s two-week highs, as Chinese stocks fell sharply. The index ended the day down -1.03%, while the broader Topix fell -1%.

Down-under, Aussie shares slid overnight, pulled down by global miners – BHP and Rio Tinto. The S&P/ASX 200 index fell -0.6%. In S. Korea, the Kospi index also weakened on trade escalation worries. At the close, the index was down -1.6%, pressured mostly by major electronics and steel sector shares.

In China and Hong Kong, stocks extended their previous day’s losses as trade war fears, along with a Chinese vaccine scandal and signs of slowing domestic growth continue to undermine investor confidence.

At the close, the Shanghai Composite index was down -2% and the blue-chip CSI300 index fell -2.3%.

In Hong Kong, the Hang Seng index and the China Enterprises Index both ended down -2.2%.

In Europe, most regional bourses see red on geopolitical worries. Germany’s export-heavy DAX has already fallen -1.2% and this despite a declining EUR (€1.1617).

U.S stocks are set to open ‘deep’ down (-0.4%).

Indices: Stoxx50 -1.1% at 3,470, FTSE -0.8% at 7,588, DAX -1.8% at 12,516, CAC-40 -0.7% at 5,461; IBEX-35 -1.0% at 9,700, FTSE MIB -1.30% at 21,507, SMI -0.4% at 9,136, S&P 500 Futures -0.4%

2. Oil steadies to trade higher after losses, gold choppy

Ahead of the U.S open, crude oil prices have steadied after losses over the past two-days from a surprise increase in U.S crude inventories and renewed concerns over Sino-U.S trade friction.

Brent crude futures are up +16c, or +0.2%, at +$72.55 a barrel, after dropping -2.5% yesterday. U.S West Texas Intermediate (WTI) crude futures have rallied +6c, or +0.1%, to +$67.72 a barrel. They fell -1.6% yesterday.

Yesterday’s EIA report showed that U.S crude inventories rose +3.8M barrels last week as imports jumped. The market was expecting a drawdown of -2.8M barrels.

However, providing some support on pullbacks is ongoing tensions between the U.S and Iran.

Gold prices are small better bid, recovering from the yesterday’s session fall, supported by a weaker USD/JPY (¥111.44). Spot gold is up +0.2% at +$1,218.23 an ounce, after losing -0.65% Wednesday. U.S gold futures are little changed at +$1,226.70 an ounce.

3. Sovereign yields fall

Fears of an escalating trade dispute between the U.S and China is triggering a fall in some sovereign bonds yields.

In the Eurozone, German and French yields in particular have pulled back from their two-month highs as demand for safe-haven debt grows on trade fears.

In Germany, the 10-year Bund yield has eased -1 bps to +0.48%, while in the U.K, the 10-year Gilt yield has backed up +1 bps to +1.37%, the highest in seven-weeks.

Stateside, with the Fed leaving short-term interest rates unchanged yesterday, an upbeat assessment of the U.S economy’s performance would suggest another rate increase is likely at the next meeting in September. The market is pricing in an additional two rate rises by year-end.

4. Turkish lira at a new record low

With global risk appetite dwindling on global trade concerns is benefiting the U.S dollar. Also providing support for the greenback are rate differentials, aided by the Fed emphasizing yesterday, the U.S economy’s strength in a statement following its expected ‘no rate hike’ decision.

Overnight, the Turkish lira (TRY) has slid to a new record low outright of $5.0822 and is looking to go even lower. Year-to-date, brings its loss outright above -24% after the White House announced yesterday it would sanction the country over the detention of a U.S pastor.

Turkish inflation figures for July will be released tomorrow, and the market expects another acceleration. If so, this would be another negative factor for the TRY after the Central Bank of the Republic of Turkey (CBRT) recent decision not to hike their key interest rate.

GBP (£1.3071) is softer ahead of today’s anticipated “dovish” rate hike by the BoE.

In Japan, the BoJ demonstrated its flexibility in it policy performing an unplanned purchased in the 5-10-year JGB range during the Asian session that helped to cap rising JGB yields. Officials commented that it acted to meet target of keeping the 10-year JGB curve around 0.00% with the operation. USD/JPY (¥111.57) is a tad softer on ‘risk aversion’ trading.

Finally, the offshore yuan has hit its weakest level outright in more than 14-months ahead of the open after China said it would retaliate against the U.S on trade. The Chinese currency lost -0.6% to ¥6.8654.

5. Euro area industrial producer prices rise

Data this morning from Eurostat show that in June, industrial producer prices rose by +0.4% m/m in both the euro area (EA19) and the EU28. Year-over-year, prices rose by +3.6% in the euro area and by +4.4% in the EU28.

Digging deeper, the increase in the euro area is due to rises of +1.1% in the energy sector, of +0.4% for intermediate goods and of +0.1% for durable consumer goods, while prices remained stable for capital goods and for non-durable consumer goods. Prices in total industry ex-energy rose by +0.2%.

In the EU28, the increase is due to rises of +1.2% in the energy sector, of +0.4% for intermediate goods and of +0.1% for capital goods, durable and non-durable consumer goods. Prices in total industry ex-energy rose by +0.2%.