Wednesday October 31: Five things the markets are talking about

October was the worst month in six-years for global equities, and despite a 48-hour reprieve on the final two-day’s of trading as investors balanced portfolios, November begins with regional bourses providing some mixed results.

The earnings season has carried on with pockets of weakness overseas on concerns surrounding trade; input costs, and while strong growth in the U.S, for now, largely offsets tariffs.

U.S Treasury prices are lower despite the ongoing heartache in equity markets pushing the U.S benchmark yield back above +3.15%.

Sterling has rallied aggressively overnight ahead of today’s Bank of England (BoE) monetary policy decision (08:00 am EDT) on reports that PM Theresa May and E.U negotiators have reached a tentative agreement that would give U.K. financial services companies continued access to European markets after Brexit.

Elsewhere, the Chinese yuan has rallied from his decade low outright; along with commodity currencies (CAD, AUD and NZD) as Chinese leadership signals that further stimulus measures are being planned.

Speaking of commodities, oil has extended its decline after its worst month in more than two-years.

On tap: U.S ISM manufacturing PMI (10:00 am EDT).

1. Stocks mixed results

In Japan, the Nikkei fell overnight, pressured by large cap mobile phone companies, who make up +80% of the index, said lower service fees will start hitting the bottom line in the next fiscal year. The Nikkei share average dropped -1.06%, while the broader Topix fell -0.85%.

Down-under, the Aussie benchmark index closed slightly higher overnight as shares in BHP rallied over +6.2% on the announcement of +$10.4B shareholder return. The S&P/ASX 200 index rose +0.18%. In S. Korea, the Kospi stock index dropped -0.26% overnight, snapping two-session gains, as concerns linger over a Sino-U.S trade row.

In China, shares rallied Thursday after a tough October that saw the country’s blue-chip index drop more than -8%, on news that leaders are to continue to take steps to support domestic markets. The Shanghai Composite index was up +0.1%, while the blue-chip CSI300 index was up +0.75%. In Hong Kong, the Hang Seng Index was up +1.75%.

In Europe, regional indices trade mixed with underperformance in the FTSE as Brexit optimism pushes the pound (£1.2905) higher, with the BoE rate decision along with the quarterly inflation report in focus.

U.S stocks are set to open in the ‘black (+0.3%).

Indices: Stoxx600 +0.48% at 363.32, FTSE -0.07% at 7,123.16, DAX +0.60% at 11,516.75, CAC-40 +0.20% at 5,103.61, IBEX-35 +0.79% at 8,964.00, FTSE MIB +0.81% at 19,204.50, SMI +0.44% at 9,041.50, S&P 500 Futures +0.33%

2. Oil prices fall on signs of rising supply, gold higher

Oil prices have extended their losses overnight, pressured by signs of rising supply and by growing concerns that demand may weaken on the prospect of a global economic slowdown.

Brent crude for January has dropped -37c, or -0.49%, to +$74.67 per barrel, while West Texas Intermediate (WTI) crude futures have declined -29c to +$65.02 a barrel.

Note: Both benchmarks posted their worst monthly performance in two-years yesterday – Brent was down -8.8% for the month and WTI lost -10.9%.

Crude prices are again under pressure from a trifecta of reasons.

Prices are pressured after data this week from the U.S EIA showed U.S crude inventories last week climbed for a sixth consecutive week.

Also weighing on prices is a Reuters OPEC poll showing that the organization increased oil production in October to its highest in two-years, as higher output led by the U.A.E and Libya more than offset a cut in Iranian shipments due to U.S sanctions, set to begin on Nov. 4.

And finally, growing concerns over the prospect of a global slowdown amid the ongoing Sino-U.S trade war are also weighing on prices.

Ahead of the U.S open, gold has recovered overnight from yesterday’s three-week low print as the recent drop in metal prices and an easing of the U.S dollar from multi-month highs encouraged buying. Spot gold is up +0.8% at +$1,222.41 per ounce, after falling for three consecutive sessions – the ‘yellow metal’ touched +$1,211.52 per ounce on Wednesday. U.S gold futures are up +0.9% at +$1,225.4 an ounce.

3. Yields looking for guidance

Government bond markets in the eurozone have been relatively calm given that month-end flows have now been completed and it is a holiday in parts of Europe (France & Italy) and one day before U.S payrolls. Nevertheless, some upbeat noises on Brexit are trying to dim the appeal of fixed income assets.

The 10-year Bund yield is trading at +0.39%, up +1.5 bps. Expect the market to take its cues from the BoE’s rate meeting (08:00 am EDT) that includes a quarterly inflation report and a press conference.

Elsewhere, the yield on 10-year Treasuries has backed up +1 bps to +3.15%. Down-under, the Aussie 10-year yield has rallied +2 bps to +2.65% on stronger trade balance numbers overnight. In Japan, the 10-year JGB yield has declined -1 bps to +0.12%.

Finally, the BoE announces its interest rate decision in a few hours, although it is not expected to raise the +0.75% rate, policy makers may strike a “hawkish” tone relative to current market pricing – many see U.K government Gilt yields as too “dovish” relative to the BoE’s policy plans for further gradual tightening of around one hike per year.

4. The pound breakouts on Brexit

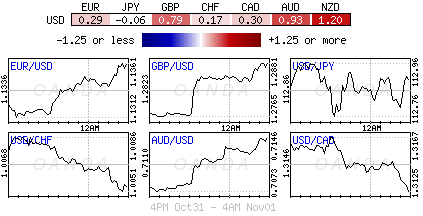

The ‘mighty’ USD has retraced some of its recent strength against G7 and a host of EM currency pairs overnight.

The pound (£1.2910, +1%) is higher on two apparent Brexit breakthroughs. A letter from U.K Brexit negotiator Dominic Raab to Parliament was published today that stated Nov. 21 as the possible date for an agreement with the E.U and overnight, the Times has reported that the U.K. has reached a post-Brexit deal for the financial services sector.

Note: Raab has since backtracked and admitted that there was no set date for the negotiations to conclude.

EUR/USD is higher by +0.5% to trade at €1.1385, while the Japanese yen has gained +0.1% to ¥112.85 outright. The offshore yuan has climbed +0.3% to ¥6.9532 per dollar.

5. U.K manufacturing PMI falls

Data this morning showed that conditions in the U.K manufacturing sector slowed sharply last month – output growth weakened, while new order inflows and employment both declined for the first-time in over two-years.

The seasonally adjusted IHS Markit PMI fell to a 27-month low of 51.1; down from September’s revised reading of 53.6 vs. 53.8.

Digging deeper, the weakness in total new orders was mainly centred on the consumer goods sector, as the intermediate and investment goods categories both posted mild expansions.

Foreign demand decreased for the second-time in the past three-months as Brexit uncertainties and global trade tensions had negatively impacted inflows of new work from within the E.U.