By EconMatters

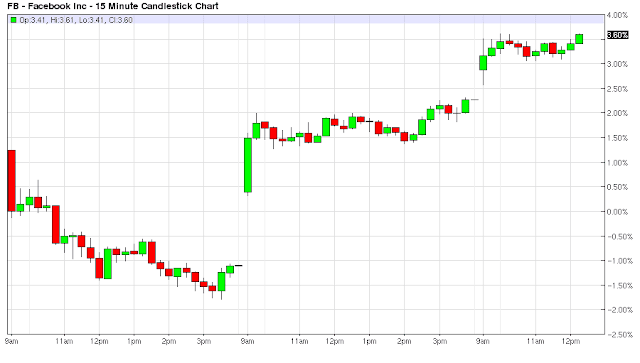

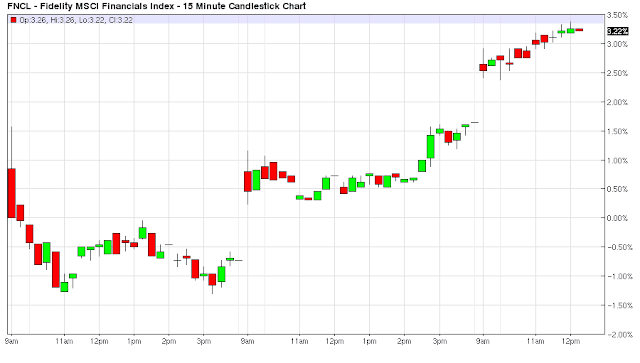

We delve into Portfolio Strategy and the lesson of not panicking right after an event that wasn`t priced into financial markets. Unfortunately, Karen Finerman of New York-based hedge fund Metropolitan Capital Advisors panicked in my opinion after the initial first blush reaction to the Brexit event.

It may very well work out for her in the long term, but it was definitely a portfolio mistake that cost her fund money in the short term. She could always rebalance her portfolio once the dust settled a bit, but she sold her assets at a bad price just on a weekly basis, and the market was more than happy to take advantage of her selling at the bottom on a weekly basis. In summation, make sure you don`t out think yourself, or get “Fancy Play Syndrome” which is a poker analogy of trying to get too cute with a strategic play.

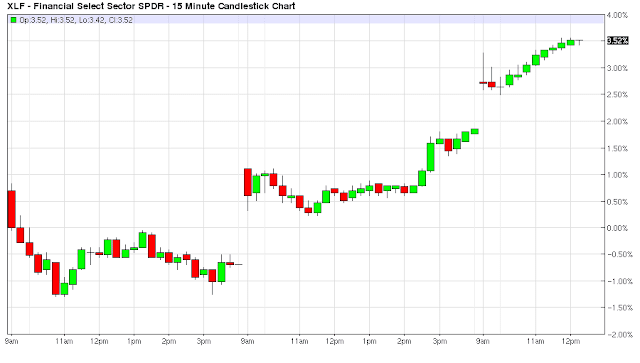

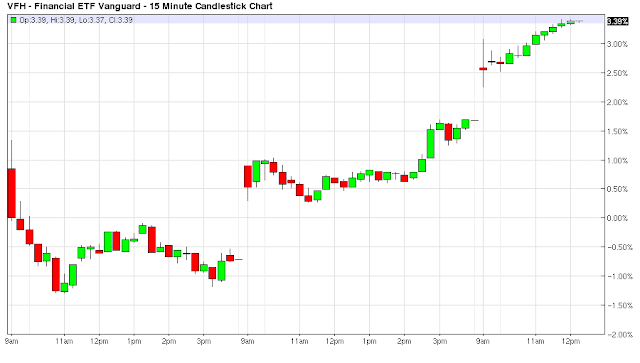

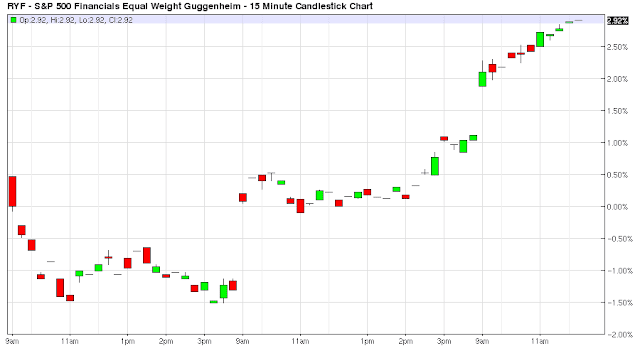

Furthermore, the ETF industry takes advantage of market incompetence by fund managers who lack the ability to properly stock pick assets in this portfolio class. All ETFs are complete garbage in my opinion, and Fund Mangers need to stop relying on them for passing the accountability buck, i.e., if you are not good enough to stock select, then go work in an industry other than portfolio management because you are costing clients returns with your laziness, lack of analytic ability, and overall negligence from a due diligence standpoint.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The post Brexit Portfolio Strategy Analysis & Why ETFs Suck (Video) appeared first on crude-oil.top.