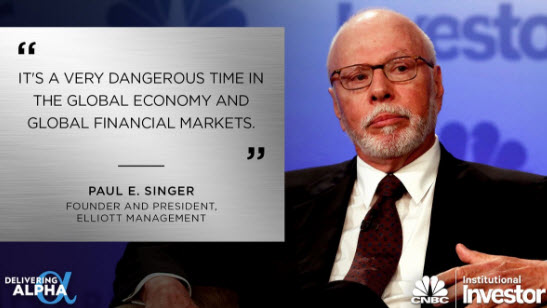

Buy gold as bonds are in the “biggest bubble in the world” and it is a “a very dangerous time in the global economy” according to billionaire investor, Paul Singer.

Speaking at the CNBC Delivering Alpha Conference, the respected hedge fund manager, Singer said he favours a diversification into gold right now.

He thinks that gold is “underrepresented in many portfolios as the only money and store of value that has stood the test of time.” He added that at current prices gold is “undervalued.”

For Singer, the founder of the $27 billion Elliott Management, owning gold is “opposite confidence in central banks” who have made the bond market “the biggest bubble in the world.”

Singer urged the room of investors to sell their bonds:

“I think owning medium to long-term G-7 fixed income is a really bad idea. By removing these things that are bad ideas, that’s a helpful thing. Sell your 30-year bonds. ”

The bond market is $60 trillion. Right now, nearly $10 trillion in fixed income is negative yielding. He added that these prices and yields contain a “tremendous, never-before seen asymmetry between potential further reward and risk.”

Singer is among a number of hedge fund managers who have become increasingly vocal against central bank policy. He said that central banks have created a “tremendous increase in hidden risk and “unusual dangers that are unique in the ‘5,000 years-ish’ history of finance.”

Transcript of Singer interview with CNBC here and video here

Gold and Silver Bullion – News and Commentary

Gold holds on to gains as steady as equities wobble (Reuters)

Gold holds mostly steady in Asia as investors await BoJ, Fed next week (Investing.com)

U.S. Stocks Fade as Jitters Persist Amid Oil Rout; Bonds Advance (Bloomberg)

Gold snaps a five-session slide as the dollar retreats (Marketwatch)

Greenspan Worries That ‘Crazies’ Will Undermine the U.S. System (Bloomberg)

No matter which way the bond bull market ends, it’s going to get ugly (Moneyweek)

Bridgewater’s Dalio: There’s a ‘dangerous situation’ in the debt market now (CNBC)

Welcome To Third World – Poor American Kids Become Prostitutes To Buy Food (Dollar Callapse)

Now Hundreds Of Paper Claims For Every Available Ounce Of Physical Gold & Silver (King World News)

15 Sep: USD 1,320.10, GBP 999.82 & EUR 1,174.23 per ounce

14 Sep: USD 1,323.20, GBP 1,001.40 & EUR 1,177.91 per ounce

13 Sep: USD 1,328.50, GBP 1,000.36 & EUR 1,183.69 per ounce

12 Sep: USD 1,327.50, GBP 1,000.80 & EUR 1,182.54 per ounce

09 Sep: USD 1,335.65, GBP 1,004.68 & EUR 1,184.86 per ounce

08 Sep: USD 1,348.00, GBP 1,009.11 & EUR 1,195.81 per ounce

07 Sep: USD 1,348.75, GBP 1,008.60 & EUR 1,199.85 per ounce

Silver Prices (LBMA)

15 Sep: USD 18.96, GBP 14.32 & EUR 16.87 per ounce

14 Sep: USD 19.04, GBP 14.42 & EUR 16.96 per ounce

13 Sep: USD 19.16, GBP 14.44 & EUR 17.06 per ounce

12 Sep: USD 18.72, GBP 14.11 & EUR 16.68 per ounce

09 Sep: USD 19.41, GBP 14.58 & EUR 17.23 per ounce

08 Sep: USD 19.93, GBP 14.90 & EUR 17.65 per ounce

07 Sep: USD 19.92, GBP 14.89 & EUR 17.71 per ounce

Recent Market Updates

– Silver Bullion Market – “Most Bullish Story Ever Told?”

– “Sorry, You Can’t Have Your Gold Bullion”

– Global Stocks, Bonds Fall Sharply – Gold Consolidates After Two Weeks Of Gains

– Gold, Silver, Blockchain and Fintech – Solutions To Negative Rates, Bail-ins, Cash Confiscations and Cashless Society

– Jan Skoyles Appointed Research Executive At GoldCore

– Silver Bullion Surges 3.5% To Over $20/oz

– Ireland “Especially Exposed” To “International Shocks” Warns Central Bank

– Deutsche Bank Tries To Explain Failure To Deliver Physical Gold

– Physical Gold Delivery Failure By German Banks

– Avoid Paper Gold – “Gold Delivery” Refused By Gold Exchange Traded Commodity

– Debt Bubble in Ireland and Globally Sees Wealthy Diversify Into Gold

– “Why Case Against Gold Is Wrong” – James Rickards

– Obama To Leave $20 Trillion Debt Crisis For Clinton Or Trump

The post Buy Gold As Bonds Are ‘Biggest Bubble In World’ – Warns Billionaire Singer appeared first on crude-oil.top.